Math genius John Overdeck and computer scientist whiz David Siegel lead a global quant fund titan, New York-based Two Sigma Investments LP, towering with more than a monster $50 billion in assets under management. Notably, the firm that started in 2011 is now tied with Renaissance Technologies as the two largest global hedge fund kings of the industry. For two hedge fund gurus who assert they “never stop researching and developing,” it could be time for tech investors to take notice of two bearish Q1 moves: Sigma has majorly lessened stakes in two of tech’s standout titans, Micron Technology (NASDAQ:MU) and Apple Inc. (NASDAQ:AAPL).

Notably, Sigma has skyrocketed from a mere $6 billion just seven years ago. Moreover, Sigma’s colossal portfolio of $50 billion has vaulted from $35 billion seen in May of 2016- during a time period that saw non-quant fund managers of the likes of John Paulson and Paul Tudor Jones grit their teeth through harsh losses.

Built on computer-driven quant analysis, Overdeck and Siegel have transformed global business and spearheaded tech and investment management, coming out of hedge fund firm D. E. Shaw (and its over $45 billion in management) to one day outclass it in assets with Sigma. Rather than a firm cherry-picking the usual financial experts, Two Sigma has carved a reputation for selecting the majority of its work force, 1,200 employees with math and computer science-centric qualifications.

Let’s explore Overdeck’s and Siegel’s Q1 backtracks in MU and AAPL stocks:

Micron Dialed down 3 Million Shares

Two Sigma sliced almost half of its stake in chip giant Micron, selling off 2,899,929 shares. Now, Overdeck and Siegel’s firm owns 3,442,556 shares worth $179,495,000 in MU. The Q1 chop happened just in time before Morgan Stanley analyst Joseph Moore‘s downgrade on Micron shook the stock, which fell almost 8% yesterday.

An analyst who had been confident on the memory sector since 2016, valuation that is approaching Moore’s target expectations have him taking a step away to the sidelines on Micron. Even if DRAM is giving a powerhouse performance all the same, this seems to be valued into the stock, leaving MU shares “very close” to Moore’s target forecast. Meanwhile, the analyst warns bulls that had been seeking a NAND recovery in the back half of 2018 that this situation appears more and more “unlikely” to hit. Frankly, even with memory markets that boast improvement compared to historical context, this is all baked into shares, which allows “little room for upside,” wagers Moore.

Now, the analyst rates an Equal Weight rating on MU stock with a $65 price target, which implies an 11% upside from current levels. (To watch Moore’s track record, click here)

Moore is not getting that much “more cautious on pricing,” having been apprehensive on NAND for the past six months, and he continues to be quite encouraged on DRAM opportunities for 2018. That said, consider that the company has rallied in the month of May and this is a stock that has vaulted from a hint ahead of $10 per share two years prior to close to just shy of $60 today. May had been a good month for MU investors, with the stock jumping following the company’s analyst day, where the company boosted its third fiscal quarter guide and unleashed a $10 billion buyback plan.

It is hard to beat out expectations that are already anticipating a strong fiscal third quarter earnings show from the chip giant. The analyst warns, “we think that the stock prices in a very upbeat long-term scenario, and any erosion in fundamentals will be punished,” even if this is “a bit early” to downgrade the call. After all, the need to sell MU stock certainly is not “urgent.” Yet, “given the unpredictability of these businesses, and the 40% move in the stock in 3 weeks, we would rather err on the side of caution in an environment where we can see storm clouds on the horizon,” asserts the analyst.

Should Micron get any higher than $60, short-term conditions driving strong stock performance would need to keep blazing for the remainder of this year and even prospectively through the opening of the next year for Moore to recognize further upside opportunity. Lately, the confidence for “a seasonal rebound from our industry contacts” is not on part with the positive sentiment “we heard just a few weeks ago,” the analyst adds. Suggestions of positivity exhibited in the first half of 2017 on NAND is already trailing off. At the end of the day, Moore’s strategy hinges upon how he calculates the chip giant’s long-term valuation.

Yet, Seeking Alpha blogger Bill Maurer points out that Moore’s new neutral research note may not be as dissuading as investors took the call yesterday. Though yesterday proved to be a rocky day for the stock giant, Maurer suggests, “perhaps a pullback was needed before the next leg up.” After all, “The analyst note was not as bad as it seemed, and now the stock has decent upside to that firm’s target. In fact, the average analyst is calling for almost $20 of upside from here. With the stock’s major rally in May, the announced buyback would also be much less significant. While growth rates are slowing, Micron still is in a favorable DRAM environment, so this might just be a short-term decline in the stock,” continues Maurer.

When sizing up the new buyback plans, the blogger believes a big portion stands to shift back the latest share count surge while also leveraging stock-based compensation that is always being utilized. Lastly, the blogger contends, “Analysts may also not be fully pricing the buyback in, meaning earnings per share might actually rise next year if enough shares are bought back.”

According to TipRanks, which ranks analysts and financial bloggers based on how their calls perform, top five-star blogger Seeking Alpha’s Bill Maurer has an impressive ranking in the top 100: #78 out of 6,4898 bloggers. Mauer earns 8.2% in his annual returns and when recommending MU stock, he yields 18.8% in average profits.

TipRanks reveals strong enthusiasm roaring through the street on this semiconductor leader. Out of 24 analysts polled in the last 3 months, 19 are bullish on MU stock, 4 remain sidelined, while 1 is bearish on the stock. With a return potential of 33%, the stock’s consensus target price stands at $76.65.

Apple Gets Sliced Close to 3/4

Is Apple losing steam? Two Sigma opted to dump 73% of its stake in the big AAPL machine in the first quarter, ditching 24,194 shares. This leaves Two Sigma’s stake bleeding down to just 9,311 shares left in the tech titan, worth $1,562,000.

Maxim analyst Nehal Chokshi likewise just lost his bullish conviction in the empire, anticipating a fiscal 2019 lined up to rock the titan with daunting risk. Fleeing the bullish camp, the analyst now rates AAPL a Hold with a $200 price target, which implies a just under 7% upside from current levels. (To watch Chokshi’s track record, click here)

One big area of concern for Chokshi: a rapidly waning smartphone market, and to be blunt, the prospects down the line for subscription services are no longer compelling to offset this. Past survey data showcases attach rates for subscription services to “at best” reach 30%, which marks the ratio of sales of a primary product to a given corporation’s related secondary product. Notably, attach rates are a well-used metric in both marketing as well as sales used to evaluate strategies as well as performance.

In fact, the analyst wagers subscription services will sink to a “likely lower” attach rate, considering an “ecosystem centric approach, especially for services where entrenched incumbents exist.” Crunching the numbers on consensus expectations for Spotify, Dropbox, and Netflix, the analyst forecasts subscription services for Apple at maturity will realize at most a corporate 25% operating margin. Chokshi draws attention to fiscal 2019, which poses “high risk” to be a rough year with a smartphone market currently weakening.

Chokshi did calculations on a sweeping average revenue per user (ARPU) plus attach rate-spurred model for Apple’s multiple subscription services and subscription-like services: the app store, Apple Pay, Apple Music, iCloud, and soon-to-hit features from Apple News to Apple video in long-from. Presently, these subscription segments boast an approximately $12 billion annual run rate, but Chokshi sees potential for these to jump to $52 billion in fiscal 2022. Here is a case of a massively varying attach rate, with data points showing Apple News at a 10% attach rate scaling up to as high as the iCloud’s 50% attach rate. The analyst estimates U.S. based iPhone users take a 9% slice for Apple’s office productivity suite iWork, 32% for Maps, and 77% for Safari.

“We believe the widely varying attach rate is a result of: (1) how entrenched are competitive services and (2) higher AAPL attach rates correspond to lower differentiation for competing products. We note that our proprietary survey data on the free AAPL services should also be haircut when applied to the paid services,” writes Chokshi, who also spotlights a “services ecosystem centric” momentum that is chasing off iPhone users who likewise use Windows operating systems. Based on the survey data, the analyst projects 32% of iPhone users are also Mac users, or in other words, around 68% of iPhone users abound that have dangerous odds to snub the AAPL subscription services. Meanwhile, with it reasonable to assume a 30% attach for AAPL Music, the analyst cannot help noting the platform that has been out on the market for roughly 3 years has merely unlocked around 6% penetration to-date of the iPhone user installed base.

In the near to short-term, Chokshi advised he is not calling for the tech titan to magnetize share in a separate market that could be as monumental as the smartphone market- or capture significantly past what is already circling 17%. As such, Chokshi is not angling for “a halo effect” to keep the iPhone franchise running, smartphone user base growth at play or not.

Ultimately, the analyst warns Apple stands to even give up “modest” market share come fiscal 2019, which sends him lowering his iPhone estimates. The analyst projects a 7% year-over-year decline from 223 million to 208 million units. For fiscal 2019, the analyst cuts his revenue estimate by 3% to $258 billion, coming up 5% shy of the Street’s $272 billion, while also reducing EPS 5% to $12.62, also short of the Street’s $13.27 forecast.

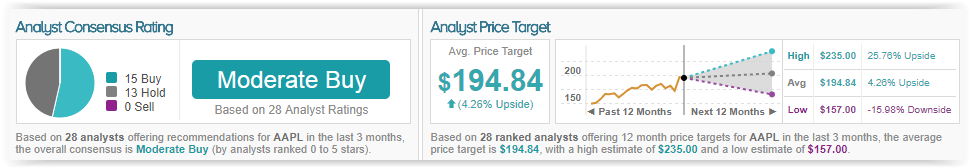

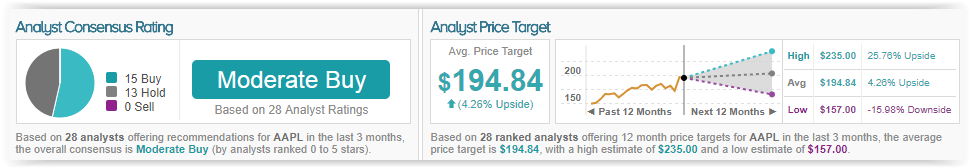

TipRanks suggests cautious word is catching up to bullish sentiment on the Street when it comes to the big AAPL machine’s opportunity ahead. Out of 28 analysts polled in the last 3 months, 15 are bullish on AAPL stock while 13 remain sidelined. With a return potential of 4%, the stock’s consensus target price stands at $194.84.