New York hedge fund Coatue founder Philippe Laffont reaped his billions thanks to smart bets on tech stocks, kickstarting the firm on the heels of walking out of Tiger Management almost two decades ago. In fact, Laffont sizes up tech as the trend of the future. So, what does a tech guru like Laffont see as a wise bet, as of the most recent SEC filing? Micron Technology, Inc. (NASDAQ:MU) suddenly has drawn Laffont’s intrigue with a fresh over 14 million stake in the company. Another chip giant could be faring with far less promise from Laffont’s perspective: the hedge fund manager is taking a significant step out of NVIDIA Corporation (NASDAQ:NVDA), leaving only over 1 million shares left in the semiconductor company.

What once dominated the “obscure,” as Laffont mentioned at February’s Forbes and Shook Research Top Advisors Summit, has suddenly taken a shift to the ubiquitous. Technology has a universal pull to it, suddenly a part of the world to come with cars, transportation, and each sector in the market, wagers Laffont. This is the billionaire’s key: knowing which sector matters most in the financial universe to turn his prosperous firm into one with $16 billion under its belt.

Keep in mind, not every guru in the biz has pulled off a hedge fund empire hinging on tech bets the way Laffont has done so with flying colors. Coatue garnered a monster 443% in returns between January 2001 and March 2016. Let’s take a closer look into Laffont’s big plays in two of the chip sector’s leading giants:

Walking into Micron with an Upbeat 14 and a Half Million Shares

Micron has ignited the tech billionaire’s attention, with Laffont initiating a big bullish stake in the last quarter: to the tune of 14,479,032 shares worth a whopping $754,937,000.

Laffant is far from the only bull rooting for Micron’s opportunity ahead. Morgan Stanley analyst Joseph Moore is perceptive to the company’s volatile waves in earnings power, a tricky balancing act between ebbs and tides in demand to supply. Yet, not even volatility that complicates calculating just what lies in Micron’s price holds Moore back from a bullish case that this stock is primed to reach $65 within the upcoming year.

As such, especially confident on short-term momentum more than valuation, the analyst notably has an Overweight rating on MU stock with a $65 price target, which implies a just under 19% upside from current levels. (To watch Moore’s track record, click here)

Though Moore is encouraged on the chip giant’s prospects, he acknowledges risk with a stock so volatile and is willing to scale back risk should he anticipate margins on the brink of eroding. Reward positively outbalances risk, as far as the analyst is concerned, as he wagers: “In a world polarized by the view that the stock can go to $100, or that the stock has downside to $35, we have maintained a middle road that the stock can get to $65, and have let the stock price dictate our enthusiasm.”

Beyond the upcoming year, Moore calculates an annuity matching average cash flow margin in the period of a business cycle. Estimating that Micron’s management has guided to a tax rate of 12% down the line coupled with depreciation to jump from current levels points to around 7-year depreciation terms coming to play- particularly on back of steep levels of capital expenses for both 2018 as well as 2019. Moreover, Moore expects a rising gap in capital expenses as well as depreciation in circumstances where towering sales sustain.

As for positive in the near-term, Moore sizes up a relationship with the second fiscal quarter print memory market worries to what came to play amid the first fiscal quarter’s earnings show. Though the Apple quarter stirred up fears in the market, the analyst points out that that in a lot of angles, the concern is not as stark as under 3 months prior. With checks pointing out non-excessive absolute raw materials inventory levels over at the big AAPL machine, inventories on an upturn for Apple, and non trade receivables “down much more,” Moore spots reason to be confident. Particularly in the cloud arena, the status quo beyond the smartphone playing field looks more powerful than expected “across the board.”

Meanwhile, DRAM price stability is a standout point, with Moore seeing reason for investors to dial up enthusiasm circling more robust seasonality. What if NAND pricing gets strained? The analyst argues that even so, Micron will simply cut costs to basically match any price plunges. In a nutshell, the company’s near-term picture is not just good, but “in fact exceptional,” leading the analyst to angle for this kind of positive steam ahead with cloud spending- the very factor that has charged conditions that look stellar and have favorability to continue forward.

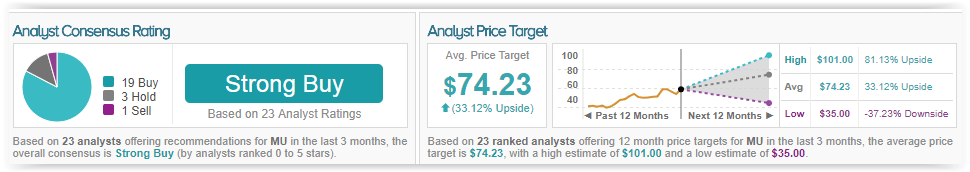

TipRanks indicates this semiconductor giant is a strong favorite on Wall Street. Out of 22 analysts polled in the last 3 months, 18 are bullish on MU stock, 3 remain sidelined, while 1 is bearish on the stock. With a solid return potential of nearly 37%, the stock’s consensus target price stands at $73.95.

Nvidia Gets Whacked Almost 3 Million Shares Lower

Nvidia has Laffont backtracking his once far more encouraged stance on the stock, as he shed 2,688,572 shares in his stake, or a 66% majority slice. This leaves Coatue holding tight to a position of 1,405,373 shares left in Nvidia valued at $325,471,000.

Yet, Wall Street’s #1 top performing analyst Craig Ellis at FBR seems to disagree. Not only is Ellis coming out with a bullish research note cheering Nvidia on back of a strong first fiscal 2019 earnings show last Thursday, he has also charged up his target expectations, more confident than ever. Though Ellis is celebrating Nvidia’s strength, the market keyed into a negative of the print: dipping graphics cards sales for crypto miners, primed for a two-thirds plunge in the second fiscal quarter.

Worthy of note, the analyst is not scared off by any share weakness, even as the stock has slipped almost 6% since earnings were dished out to the market. In fact, Ellis recommends pinpointing this as an enticing chance for entry, eyeing a slew of catalysts poised to hit this year; drivers that the analyst predicts could “fuel a further rise in SS estimates.” Ellis rates NVDA a Buy with a newly boosted price target of $300, marking a close to 23% upside from current levels.

“To start, 1Q’s sales were 1,860 bps above T3-year seasonality and while 2Q was 920 bps below, that’s still ~900+ bps of F1H outperformance. While we believe many presume NVDA’s channel has ‘filled,’ our pricing analysis suggests improvement but significant un-satiated demand,” underscores Ellis, who projecting Gaming is geared for a whirlwind of new products as early as June’s Computext. Meanwhile, the analyst likewise recognizes enthusiasm to Fortnight and PUBG as well as usual releases in the back half of the year, also spotting prospects for continuous gains in Gaming in the back half of fiscal 2019.

Ultimately, Ellis concludes: “Auto is progressing toward longer-term autopilot ramps, so looks spring-loaded for growth. Lastly, stellar financial execution with record 64.7% GM and 44.5% seems sustainable even as we model a modest and in-guidance retreat,” believing NVDA is an “attractive” pick for large-cap growth investors.

Craig Ellis has a very good TipRanks score with an 82% success rate and the strongest ranking on the Street, towering at #1 out of 4,800 analysts. Ellis yields 38.2% in his annual returns. When recommending NVDA, Ellis garners a mammoth 122.0% in average profits on the stock.

TipRanks exhibits Nvidia is a positive stock pick based on sell-side analyst’s majority opinion. After all, 18 out of 26 analysts polled in the last 3 months rate a Buy on the chip giant with 8 hedging their bets on the sidelines. With a healthy return potential of nearly 16%, the stock’s consensus target price stands at $284.48.