Marshall Wace first got its market legs 21 years ago, when founders Ian Wace and Paul Marshall leaned on risk management-minded thinking to bring this billions-making hedge fund machine to life. Now, this long/short equity firm is one of the biggest alternative asset management companies in the globe. If you’re following the recommendations of Wace and Marshall, whose firm landed first place among the yearly rating of Alpha’s leading hedge funds in 2016, Micron Technology, Inc. (NASDAQ:MU) and Facebook, Inc. (NASDAQ:FB) are two tech stocks worth the bet.

One reason Alpha gives kudos to Marshall Wace among the globe’s giant hedge funds is investor satisfaction, where investors in the firm were impressed with risk management along with transparency and infrastructure. However, this was in 2016- one year later followed a year that saw the $34 billion hedge fund lose over half of its profits from performance fees that experienced a sharp two-thirds plummet. For a firm that pulled off such a successful 2016, it is clear that Marshall Wace is ready to make sizable bets in tech to reap profits this year. With systematic-meets-quant strategies in tow, Wace and Marshall see fit to get bullish on the tech sector’s heavyweight players.

Let’s take a closer look at the firm’s upbeat quarterly plays in MU and FB:

Pouring Another 1 Million Plus into Micron

Micron is looking good to Wace and Marshall, who led the hedge fund firm to buy 1,209,366 shares in the semiconductor player. This bullish move notches an 87% jump in the billionaires’ enthusiasm on MU, with Marshall Wace now boasting a position of 2,613,367 shares in the chip giant worth $440,352,000.

For shares that have seen an approximate 50% rise in valuation from the beginning of last month, Susquehanna analyst Mehdi Hosseini likewise sees a tech player sitting pretty in a “sweet spot” in the Wall Street trading game.

All eyes are on Micron ahead of its big second fiscal quarter earnings exhibit this Thursday once the bell tolls. Though there were once apprehensions running like wildfire about NAND flash memory average selling prices (ASPs) sinking, the bulls have clearly won out here, with shares flying up since February.

Worthy of note, the analyst rates a Positive rating on MU stock and ahead of Thursday’s earnings show has lifted his price target from $60 to $80, which implies a just under 32% upside from current levels. (To watch Hosseini’s track record, click here)

Hosseini looks for rising focus on “normalized earnings,” which are forecasted to circle $8, and looks for the focus to take a shift to the long-term strategy, “specifics behind moving up the stack.”

Micron is ready to flex its NAND leadership momentum with a new SATA three-dimensional (3D) quadruple-level cell (QLC) 64L 3D NAND flash memory solid-state drive (SSD). This would mean MU gains advantage as the first big storage vendor to unleash QLC-based SSDs to the market- one with attractively low-priced NAND bit cost.

“Is MU becoming a cost leader?” the analyst asks, answering by making a bullish case for the giant: “We think they are in NAND, and as we noted in our Mar-7 report, MU’s newly introduced SATA (QLC 64L 3D NAND) SSD will be the first product to establish MU as the (NAND) cost leader. This would be a significant milestone, which has historically been a laggard particularly in NAND.”

“With Cloud becoming a bigger part of aggregate memory demand, and MU looking to capture a higher mix of economics, we see it as inevitable for MU to move up the stack. We anticipate Memory to be the fastest growth part of next-gen Data Center spending, and bits of memory cannot be “virtualized”! As such, we believe MU needs M&A to beef-up its portfolio of IP/System know-how,” continues the analyst, who finds expectations are soaring ahead of the company’s earnings.

Bottom line, the analyst urges investors to keep an eye on long-term trends at play, predicting next-gen DATA Centers will ramp up stronger gains for storage and memory. All the same, “execution is necessary to inspire confidence in L-T earnings power,” contends Hosseini.

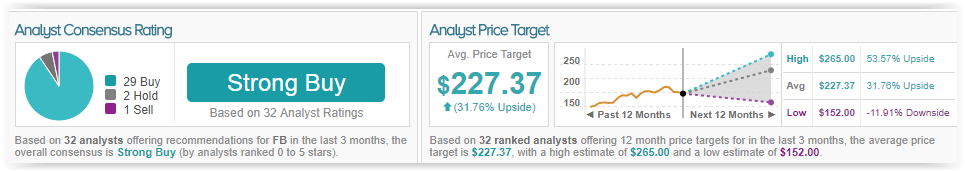

This chip giant has garnered one of the most impressive rankings on TipRanks, having amassed Street-wide popularity. All 15 analysts polled in the last 3 months unanimously rate a Buy on MU stock. With an encouraging return potential of nearly 16%, the stock’s consensus target price stands at $69.57.

Revving Up the Stake in Facebook

Marshall Wace is dialing up confidence in FB to the tune of 38% hike- an added 678,448 shares. The hedge fund now has a position of 2,495,476 shares in the social media empire worth $440,352,000.

Is now the time to get more bullish on FB? Consider that shares crashed almost 7% yesterday, with the social media titan dragged down by a data privacy skeleton in the closet.

The racket boils down to the grapevine’s reports of data analysis and mining firm Cambridge Analytica finding its hands with access to the personal information of more than 50 million Facebook user accounts. This hearkens back to the era of President Donald Trump’s campaign in 2016.

However, Oppenheimer analyst Jason Helfstein believes that one investor’s data privacy “concerns” are another savvier Wall Street trader’s “buying opportunity.”

In a nutshell, Helfstein says data “leveraged for political purposes or not,” he is simply not buying that FB did anything illegal- and in a world where people are often numb to data privacy scandalous news, it is hard to imagine a meaningful amount of users fleeing.

“Our working understanding is that a third party created an app leveraging Facebook’s universal login software tool, giving the third party access to those users’ information and information on their connections. This data was then shared with Cambridge Analytica and leveraged for political purposes. We believe this broke Facebook’s terms of service, but as of now, we have no reason to believe that any laws were broken. While this event will likely add to regulatory momentum around digital/ data privacy, we believe such regulatory solutions often take an inordinate amount of time (see Google Shopping saga over 7 years). From a user perspective, we believe consumers have largely become desensitized to data-privacy related issues after a large number of such breaches (Yahoo!, Equifax, etc.) and don’t see a significant risk of decreased usage. As such, we see the current selloff as a buying opportunity,” Helfstein concludes, unfazed by the latest public relations scandal buzzing through the Street.

As such, the analyst reiterates an Outperform rating on FB stock with a $225 price target, which implies a close to 32% upside from current levels. (To watch Helfstein’s track record, click here)

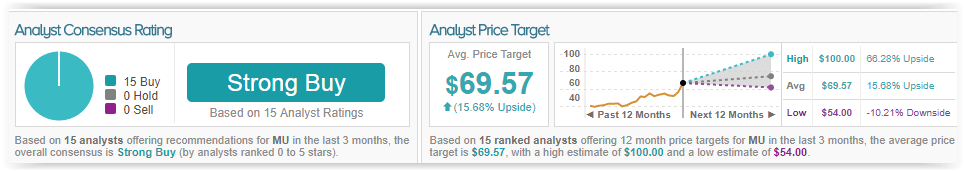

TipRanks showcases this social media titan has a strong bullish camp finding the stock worth the bet- which means there were a lot of disappointed bulls yesterday collecting their losses on the Street. Out of 31 analysts polled in the last 3 months, 28 rate a Buy on FB stock, 2 maintain a Hold, while 1 issues a Sell. The 12-month average price target stands at $227.79, marking a 32% upside from where the stock is currently trading.