Back in 1987, Philip Hempleman founded his asset management firm Ardsley Partners to tap the best returns longer-term; all through clever stock picks and long-short equity portfolio management. The hedge fund guru guides portfolio managers to see through the eyes of a bottom-up strategy. Ardsley’s portfolio managers build portfolios by leaping towards companies that boast superior growth momentum and reasonable valuation. Overseeing every investment activity at Ardsley, Hempeleman’s most recent moves suggest risk not worth the gamble in Helios and Matheson (NASDAQ:HMNY), but a compelling bet in Celgene Corporation (NASDAQ:CELG) stock.

Back in 1987, Philip Hempleman founded his asset management firm Ardsley Partners to tap the best returns longer-term; all through clever stock picks and long-short equity portfolio management. The hedge fund guru guides portfolio managers to see through the eyes of a bottom-up strategy. Ardsley’s portfolio managers build portfolios by leaping towards companies that boast superior growth momentum and reasonable valuation. Overseeing every investment activity at Ardsley, Hempeleman’s most recent moves suggest risk not worth the gamble in Helios and Matheson (NASDAQ:HMNY), but a compelling bet in Celgene Corporation (NASDAQ:CELG) stock.

To offer some history behind the guru, Hempleman once managed portfolios for the Oppenheimer Target and Special Strategies, where the firm’s Target Fund became the strongest performing mutual fund from 1981 to 1982. Present-day, Ardsley’s strategies function on the following four pillars: a long-biased long-short equity strategy; a renewable energy/clean tech long-short equity strategy; a global technology long-short equity strategy; and a healthcare long-short equity strategy.

Does the word on the Street back Hempleman’s exit in HMNY and new play in CELG? Let’s take a closer look:

Helios and Matheson Analytics Gets Dumped

Philip Hempleman is not the only one starting to turn his back on Helios and Matheson Analytics. In the first quarter, Hempleman steered Ardsley right out of HMNY, selling off all 450,000 shares worth $1,273,500 ($193,500 based on today’s share price). For a stock that has crashed close to 79% since the start of May, Wall Street has quickly gotten antsy on the tech player and its majority holding in MoviePass. The culprit: SEC filing broke the news of cash on deck of $15.5 million overshadowed by monster cash burn hovering around $21.7 million in cash each month. Suddenly, investors were confronted with a dangerous question: is the Netflix-like business sustainable?

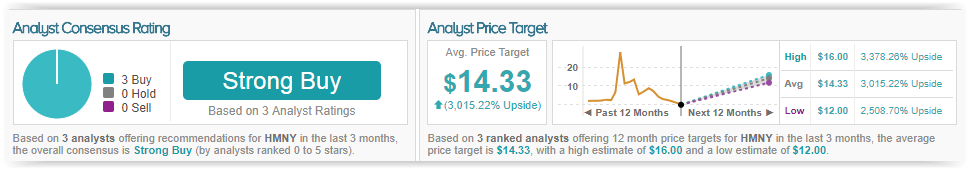

Maxim analyst Nehal Chokshi makes a bullish defense, rating HMNY stock a Buy with a $12 price target, which implies a 2,453% upside from current levels. (To watch Chokshi’s track record, click here)

Last Tuesday night’s 10Q filing has left Chokshi encouraged, thanks to a slew of “positives” that could be HMNY’s saving grace. However, even this bull acknowledges questions linger that demand answers before Chokshi adjusts his valuation on the tech stock accordingly.

Chokshi underscores statements from the filing that suggest the company has a cohort data presentation on the horizon; data that stands to reveal the picture on how MoviePass will drive its subscriber business to reach breakeven down the line. Additionally, the analyst commends $1.4 million earned from studio marketing and other outclassing his expectations looking for just $0.6 million. The analyst forecasts a long-term steady state run rate to circle $32 million per quarter. Third, Chokshi points to survey data polled by NRG from 1,500 moviegoers hinting: “MoviePass is creating value for studios and exhibitors that ultimately should lead to MoviePass creating a sustainable business.”

Page 33 of the 10Q filing stands out especially to the analyst, with HMNY commenting: “At the same time, our offering of a four-movies-per-month capped plan as part of a special, limited time offer with one of our strategic partners; and our current offering alongside our unlimited offering of a 3-movies-per-month capped plan allows us to obtain statistically large sample sizes to create short- and long-term analyses about consumption and usage and ticket spend for each of the various cohorts, which enables the Company to continue to make data-driven decisions.”

Therefore, Chokshi looks for cohort data to be presented with either HMNY’s second or third quarter audited results, a movie that would offer key data to prove MoviePass’ subscription business truly is exhibiting qualities of a “breakeven business without potentially needing to implement a hard cap.”

If recent big trading volume proves to be consistent in the next few weeks, the analyst believes HMNY can achieve a raise of around $100 million through the current At-The-Market facility set with Canaccord. Bottom line, “Such a raise should then give HMNY the runway needed to show data that demonstrates the subscriber business is indeed exhibiting breakeven characteristics, that should then take pressure off of shares,” contends Chokshi.

TipRanks highlights strong confidence on Wall Street backing the tech player. All 3 analysts polled in the last 3 months rate a Buy on HMNY stock. With a substantial return potential of 3,015%, the stock’s consensus target price stands at $14.33.

Celgene Draws a Bullish Bite

Celgene in turn looks far more compelling to Hempleman, who led Ardsley to initiate a fresh stake of 224,500 shares worth $20,028,000 in the biotech giant, as of the most recent SEC filing. When measuring up Hempleman’s bullish play against sentiment on the Street, RBC Capital analyst Brian Abrahams echoes confidence in Celgene’s market opportunity.

Notably, the analyst rates CELG an Outperform without listing a price target, entirely dismissing dismiss share weakness following former head of Business Development (BD) George Golumbeski. (To watch Abrahams’ track record, click here)

Corporate shakeup tends to stir up investor anxiety, and when CELG investors caught word that Golumbeski had left the biotech giant, shares followed suit on a roughly 5% dip. The retirement went unseen last month, and a surprise that has caught Wall Street a bit off guard is “weakness” Abrahams believes is “unfounded.”

After all, Rob Hershberg has led Celgene’s BD department since April 2017, and Golumbeski’s role toward his last days with Celgene had shifted to become more “strategic.” The key latest alliances established with Juno and Impact Biomedicines is all thanks to Hershberg, notes Abrahams, who explains: “Given that this has a been a transition in the works for sometime, we do not see any relation between reports about this emerging today and proximity to upcoming readouts, such as at ASCO or otherwise, like XLRN, BLUE, and JUNO.”

Abrahams shakes off the CELG stock sell-off as even “somewhat ironic,” considering Golumbeski is the very head of BD who was “responsible” for a lot of the agreements in the past years that drew wildfire criticism from the Street. Either Golumbeski-pioneered deals ran “into stumbling blocks” or they did not “sufficiently” generate “for post-Revlimid revenue sustainability.”

“However, we do believe it illustrates the sharply negative sentiment pervasive in the name, which we continue to believe will require a turnaround in catalysts to improve upon. Still, at current levels, with potential for improved CAR-T narrative at ASCO, ph.III luspatercept data, and ultimate Revlimid IP settlement, we see some potential for upside drivers, though we believe execution will be key,” surmises the analyst.

TipRanks exhibits enthusiasm circling CELG shares. Out of 23 analysts polled in the last 3 months, 14 rate a Buy on the biotech giant while 9 maintain a Hold. The 12-month average price target stands at $116.13, marking 46% in upside potential from where the stock is currently trading.