Andrew Spokes, managing partner at Farallon Capital Management stepped in for founder Thomas Steyer in 2013 and has been hedging big bets for the firm ever since. Spokes is now relinquishing quite a bit of Amarin (AMRN) stock and getting on the cannabis bandwagon by putting money into Tilray (TLRY).

Spokes joined the firm in 1997 and was responsible for opening the company’s London office just a year later in 1998, which he ran for 10 years before returning to home base in San Francisco, California. Spokes has both lived and worked in New York and Hong Kong. Before moving to Farallon, he spent 10 years at Goldman Sachs’ as an investment banker working in Europe and Asia before becoming executive director and head of corporate finance for the Asia division. It makes sense why the money-mover would be keeping eye on biotechs this month. He received a master’s degree in chemistry from none other than Oxford University. Now let’s take a look at the changes he made involving Amarin’s cardio-vascular medication Vascepa and Cannabis innovator, Tilray.

Amarin: Is There Something Fishy?

Spokes dumps around 27% of Amarin stock, or around 1,172,300 shares in the third quarter of this year worth around $53,898,000.

The fish oil drug maker recently revealed data for its drug Vascepa during an American Heart Association conference in November. The presentation was successful but followed by drama when some critics suggested the results were overexaggerated. Nevertheless, doctors responded to the data positively, with 87% saying they would prescribe the fish oil pills to patients.

Currently, AMRN’s drug Vascepa is under the scope as European regulators just banned all Omega-3 fatty acid products from promoting and labeling themselves as a healthful way to prevent cardiac events. Cantor analyst Louise Chen however, sees no reason for this listing off reasons why European regulations shouldn’t play a role in this American company’s fish oil drug.

Chen explains Vascepa is not commercially available in Europe (where the regulation is currently in effect) and Vascepa was not even a part of the European Medicines Agency (EMA) review. In addition, the analyst notes the EMA review called ASCEND studied Omega-3 mixtures only, which Vascepa is not. Furthermore, the analyst believes if the study leads to a complete removal of all omega-3 mixtures, Vascepa could have a unique opportunity. It will be interesting to see what’s up ahead for AMRN following Spokes’ removal of the biotech’s shares from his portfolio.

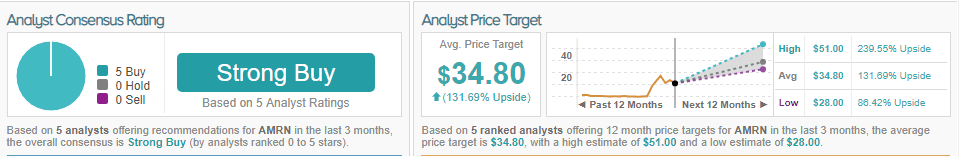

Wall Street likes the risk/reward factor at play here, as TipRanks showcases a strong buy consensus rooting for Amarin’s success. Out of 5 analysts polled in the last 3 months, all 5 are bullish on Amarin stock. With a whopping return potential of nearly 132%, the stock’s consensus target price stands at $34.80. (See AMRN’s price targets and analyst ratings on TipRanks)

Pushing the Pedale on Tilray

Spokes added a new name to his portfolio – Tilray. Spokes purchased 2,479,515 shares – worth a whopping $285,494,000 of the Canadian cannabis company.

The stock is currently rising nearly 7% following news that the company has set up a partnership with non-alcoholic beverages that contain components found in cannabis like tetrahydrocannabinol (THC) and cannabidiol (CBD). The partnership is exclusive to Canada and commercialization issues will be dealt with in the future. For now, it’s predicted CBD-infused drinks will become a $600 million market in the U.S. within the next four years according to Canaccord Genuity’s research.

The company considers itself a global leader in medical cannabis research and aspires to legitimize the industry. Cowen analyst Vivien Azer believes the partnership will help the company achieve its goal and even bring the business recognition internationally, which could help more nations legalize medical cannabis. Furthermore, she believes international sales will represent 15% of the company’s revenue in FY2020 and then 22% for FY2021. Azer says the partnership will help Tilray expand its reach.

However, not everyone out on Wall Street is quite as excited regarding this Canadian cannabis maker. Out of 5 analysts polled by TipRanks in the last 12 months, 2 are bullish on TLRY stock, while 3 remain sidelined. (See TLRY’s price targets and analyst ratings on TipRanks)