One of Wall Street’s loaded billionaires (and the richest man of Illinois) Ken Griffin continues to make waves among the investment world, a hedge fund guru now for close to three decades. This time, Griffin is biting into the technology sector, based on his first quarter moves. Not only did Griffin’s Chicago-based hedge fund Citadel decide Momo (NASDAQ:MOMO) is worth a bigger investment, but just yesterday, Helios and Matheson (NASDAQ:HMNY) investors were sent racing when Citadel Securities, a separate market making business also founded by Griffin, disclosed a position in the company.

Griffin has landed among Forbes’ 32 Annual World Billionaires List, and with a net worth roaring at $8.6 billion, Wall Street is going to take heed of the billionaire’s money moves. After all, Griffin knows just when to seize the day, even if it means picking up the pieces from hedge fund firms left in the dust. This is one of the strengths that has helped Citadel soar to manage $28 billion in assets. From hiring teams to taking on assets from funds of the likes of Sowood Capital Management, Griffin is fearless in grabbing market share from his competitors.

Worthy of note, Griffin had just released an open letter this year online to his firm’s investors warning of “dark clouds” overhead for this year’s economic backdrop. Amid a transitioning economic arena, and wariness paid to any hints of worldwide disruption, it is no wonder the Street is paying rapt attention to Citadel’s plays in technology.

Let’s explore:

Momo Draws a Bullish Play from the Billionaire

According to its most recent 13F filing, Citadel dialed up its position in MOMO 169%, to the tune of another 403,862 shares. Now, the hedge fund has a total of 644,250 shares worth $24,082,000 in the Chinese social media company that owns China’s spin on the Tinder app.

It appears word on the Street aligns with Griffin’s bullish play, with MOMO stock bouncing 15% yesterday on back of robust first quarter results for 2018. Momo’s revenue shot up 64% year-over-year in growth to $435.1 million, shooting far past the Street’s $396.3 million forecast. This points to $142.3 million in adjusted net income, or $0.69 per American depositary share (ADS), another beat against the Street’s expectations calling for $0.50 per ADS- and a noted rise from the $0.44 exhibited the same quarter last year.

Investors have reason to celebrate, and meanwhile, Momo Chairman and CEO Yan Tang is taking the results in stride as a “great start” to the year, thanks to “outstanding” growth on strategic goals set forth in the fourth quarter of 2017.

Tang cheers, “Our community continued to grow in size and engagements despite the negative seasonality, thanks to the product and marketing initiatives we have been taking in recent quarters,” adding: “The content ecosystem continues to improve, driving robust organic growth momentum for live streaming business.”

Keep in mind, the company had wrapped up its prior-revealed takeover of dating app Tantan this month, an almost $800 million cash and stock M&A move that Tang believes sets Momo to trailblaze “as a dominant player in China’s open social territory.”

Glancing ahead to the second quarter, the company guides revenue to range between $470 and $485 million, which would mark 51% to 55% in year-over-year growth- including roughly $4.5 million from Tantan for June. Notably, this marks a significant outclass against the $429.3 million the majority of investors had been anticipating. Naturally, the bulls went out stampeding yesterday.

Kenra Investors at Seeking Alpha chimes in sizing up the Tantan acquisition as a potential strong source of “growth optionality” for Momo. After all, even with solely $4.5 million from the app angled for the second quarter, the blogger notes, “the management has a plan to roll out new rounds of monetization efforts in the second half of this year, which should accelerate revenue growth.”

Ultimately, “Momo’s performance was excellent in purely financial terms but the main underlying ‘problems’ in the business remain. The growing ARPPU continues to be by far the main source of revenue growth, with a 64% Y/Y increase last quarter. Paying users continue to grow much less than total users, which means the ratio of users who are willing to pay is actually declining. In other words, Momo is still growing thanks to the fast-growth in revenue-per-user but a decreasing percentage of people is willing to pay for the premium services. Momo is a very solid business with no debt and excellent free cash flow generation, but investors should size their exposure to this name by taking into account two important sources of risk – high revenue concentration and lack of ‘organic’ growth,” contends Kenra Investors.

According to TipRanks, which measures the success of analysts and financial bloggers based on how their calls perform, five-star blogger Kenra Investors has an impressive ranking of #129 out of 6,494 bloggers and a 65% success rate. The blogger makes 12.0% in annual returns.

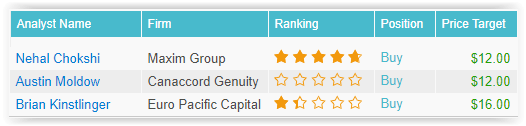

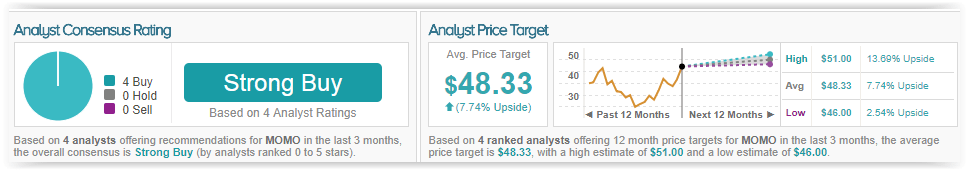

TipRanks highlights great enthusiasm among sell-side analysts when it comes to the Chinese social media company’s market opportunity at play. All 4 analysts polled in the last 3 months are unanimously bullish on MOMO stock. With a return potential of nearly 8%, the stock’s consensus target price stands at $48.33.

Leaping into Helios and Matheson

Helios and Matheson investors got enticed to buy when Illinois’ wealthiest man’s market maker Citadel Securities initiated a whopping 4,433,537 shares worth $1,817,750. Bear in mind that Citadel Securities is a notable market maker and providing liquidity in HMNY. As such, the transaction does not reflect a fundamental view on the stock.

Once the market caught word that the billionaire’s market maker just sprang to buy almost 4 and a half million shares in the challenged tech player, shares went on to rally back 15% yesterday.

The movie ticket platform at MoviePass is simple- making it affordable for subscribers to see a new movie each day for not even $10 a month. It is no wonder MoviePass surpassed 2 million in it subscriber base by the beginning of February, right after having hit 1.5 million. Rumor had it this platform was poised to be the future Netflix of the movie theater market. However, with the ghost of cash burn looming overhead, investors started to scramble when running the numbers. Even compelling potential can be dismissed when questionable finances come into the picture. Is this the golden opportunity it seems or are the bears right that all that glitters is not necessarily gold?

By the close of the first quarter, MoviePass was hit with a loss of $98.3 million, even though it gained over a million net subscribers. Considering HMNY reaps over 98% of its revenue from the movie-ticket subscription platform, Wall Street has grown cautious on whispers skeptical that the company is sustainable.

According to the Wall Street Journal’s recent article dissecting MoviePass and its opportunity, New York salesman Michael D’Ariano had enough conviction in the platform to shell out to buy 1,000 shares of stock in HMNY in the last four months. However, D’Ariano now complains that he is “saving $70 a month going to the movies and losing thousands investing in the company that’s letting me do that.”

Meanwhile, HMNY head Ted Farnsworth is unruffled by any of the latest bad buzz circling his company like a hawk, considering MoviePass remains primecd to achieve five to six million in its subscriber base by the close of 2018; with room to extend roots internationally. Farnsworth’s only complain to the Wall Street Journal: a fleeting play to allow new subscribers to simply see just four movies per month, which some mused to be a tactic to save on costs. “I let different people talk me into it,” explains Farnworth, who asserts: “Believe me, we’ll never run it again. I believe people in today’s world don’t want limits.”

Even with a much-need rally over the last 24 hours, the stock has dropped 81% in valuation. That said, Wall Street loves a good comeback narrative- and the surges in shares that follow suit. Is HMNY’s potential worth the risky bet? Regardless of market maker moves or not, Citadel Securities’ taking this position was just the sigh of relief bulls needed yesterday.

TipRanks suggests strong confidence on the Street on this tech player. All 3 analysts polled in the last 3 months rate a Buy on HMNY stock. With a monster return potential of 2620%, the stock’s consensus target price stands tall at $13.33.