The most moneyed man of Illinois, founder and CEO of hedge fund firm Citadel Ken Griffin likes his odds in the tech sector these days. Considering the Wall Street-made hedge fund whiz has somewhere in the ballpark of a massive $8.5 billion to his name, Griffin has carved a reputation of a billionaire to trust when it comes to betting on the right stocks. In a fourth quarter play, Griffin has laid his hands on new opportunity in Square Inc (NYSE:SQ) while dialing up his stake in Amazon.com, Inc. (NASDAQ:AMZN).

For a man who just shared an online open letter to Citadel’s investors of fears of “dark clouds” lingering for this year’s economic backdrop, Griffin cares about protecting the $27 billion in assets under his hedge fund’s management. The rich Illinois guru knows how to keep up with the changing times, having brought his hedge fund into money-making reality back in 1987- from Harvard University dorm and humble $265,000 beginnings to a machine that has carved Griffin a sweet multi-billion-dollar fortune.

Yet, even Griffin is not here for robots controlling the market a decade from now, insisting that there is zero room for cyborgs and bionic automatons to be taking on a role of billions at stake. For this Street-wise expert, these billions have purpose- a philanthropist at heart, who has supported everything from the arts to bike and pedestrian trails in Chicago.

Griffin is also a wise man who knows when to scoop up the remains of another’s wrecked opportunity, having just hired 10 quant members from Neil Chriss’ Hutchin Hill Capital hedge fund. Notably, Griffin is taking on this team not even three months following Chriss’ reveal that his fund was in its final days. In a hedge-fund-eat-hedge-fund world, Griffin intends to come out on top. The company just outclassed his rivals, with Citadel’s key funds bringing in 3% in returns to January’s table.

Just how bullish did Griffin get on Square and Amazon? Let’s take a closer look:

Griffin Steps into Square

Square has enticed the wealthiest man of Illinois to buy into the tech player, with Griffin charging Citadel to buy a stake of 1,994,215 shares worth $69,139,000. Yet, does Wall Street agree?

BTIG analyst Mark Palmer for one continues his bearish stance on the stock, maintaining a Sell rating on SQ with a $30 price target, which implies a close to 36% downside from current levels. (To watch Palmer’s track record, click here)

Sure, SQ has taken advantage with a rally from recent cryptomania- but Palmer questions, is this a good thing?

“The trajectory of Square shares appears to have been a muted version of Bitcoin’s wild ride during the past few weeks,” Palmer explains, adding: “While that connection seems to have worked to Square’s benefit during the latter portion of that ride given that Bitcoin has been rallying, it served as confirmation that Square’s stock has become tethered to the movements of a volatile cryptocurrency — a live-with-it, die-with-it relationship that we do not believe is conducive to the sustenance of a lofty multiple.”

RBC Capital analyst Daniel Perlin bats for the bulls, backing Griffin’s initiation with an even more bullish perspective ahead of tonight’s expected fourth quarter print.

Not only does the analyst reiterate an Outperform rating on shares of SQ, he also lifts the price target from $41 to $53 in upbeat anticipation of earnings, which implies a just under 14% upside from current levels. (To watch Perlin’s track record, click here)

Is SQ poised to serve up a beat? Perlin wagers yes, believing the tech player can outclass both his and the Street’s expectations angling for $38 million in adjusted EBITDA and $267 million in adjusted revenue.

“We believe upside will be driven by slightly stronger GPV, strength in subscription & services, and continued operating leverage. We are expecting momentum to continue into FY18 guidance,” underscores the analyst, who likewise anticipates a “conservative fiscal 2018 guide.”

“One of the attributes that SQ’s business model has been able to maintain is the sustainability of the transaction margin (transaction revenue gross profit/GPV), which over the last 11 quarters has averaged 1.05% […] We note that this spread should continue to widen, as the rate of change in subscription growth should continue to outpace the growth in transaction revenues. Here again we believe our Q4/17 estimates could prove slightly conservative.”

Perlin calls it a real tight-wire act for SQ to boost its EBITDA margins while investing once more into fresh product initiatives- an ever-hanging “question” for the company. To date, the narrative circling margin expansion “has been significant,” notes the analyst.

“The question remains as to the level of reinvestment required to support all the new product initiatives Square is bringing to the market, while at the same time expanding geographically,” surmises Perlin.

TipRanks highlights a large pool of confidence floating around this tech player on the Street- which shows that Griffin is not the only one seizing bullish advantage here. Out of 14 analysts polled in the last 3 months, 10 are bullish on SQ stock, 3 are sidelined, while 1 is bearish on the stock. However, is the stock overvalued or undervalued when taking under account these analysts’ expectations? Consider that the 12-month average price target sits at $45.64, marking a nearly 2% downside from where the stock is currently trading.

Amazon Gets a 216% Rev Up from the Multi-Billionaire

Amazon just drew a huge hike from Citadel, with Griffin investing in 458,994 new shares, taking his holding up 216% to 672,155 shares worth $786,065,000.

A popular stock giant, Griffin is certainly not the only one on the Street who sizes up compelling value in the AMZN empire.

MKM analyst Rob Sanderson sings the praises of the company as “the best growth story of all the megacaps over the very long term.”

As such, the analyst reiterates a Buy rating on AMZN stock while bumping up the price target from $1,350 to $1,750, which implies a just under 15% upside from current levels. (To watch Sanderson’s track record, click here)

Making an enthusiastic case, Sanderson boils down his bullish argument to the following reasons: “mostly driven by: 1) lower long-term tax-rate assumptions, 2) a higher outlook for revenue growth, and 3) a lower discount rate in our valuation methodology. We are also using lower e-commerce margin assumptions in our 2022 earnings power framework, partially offset by higher Amazon Web Services, or AWS, margin assumptions.”

Meanwhile, “Investors remain highly supportive of Amazon’s ongoing investments. This is, in our view, because the sustainability of the company’s moat and its ability to take advantage of appropriate opportunities (most recently in advertising) are becoming more obvious to investors,” adds the analyst.

Ultimately, the analyst concludes sizing up powerhouse earnings in the future for Amazon: “We continue to value the shares based on 2022 estimated earnings. We now see potential for about $78 of earnings per share by 2022, up from our previous estimate of $66. Lower tax assumptions represent $8 of the $12 revision, with higher revenue driving another $8, and with lower margin and mix assumptions a $4 per share drag.”

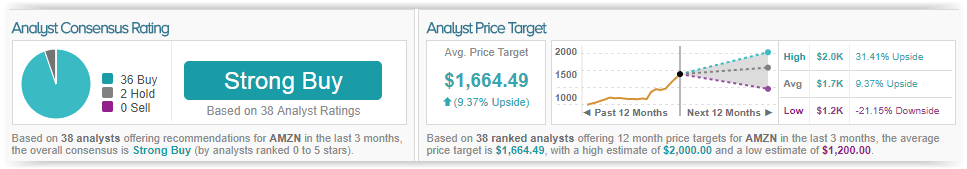

TipRanks shows that the king of e-commerce has earned one of the best analyst consensus ratings on Wall Street: a Strong Buy. Out of 38 analysts polled in the last 3 months, a whopping 36 analysts are bulls on AMZN stock, leaving only 2 hedging their bets on the sidelines. With a return potential of 9%, the stock’s consensus target price stands at $1,664.49.