Christopher Lord is surely making his alma mater at Harvard Graduate School of Business proud, managing (and having co-founded) one of the leading hedge funds today on Wall Street: Criterion Capital. Founded 16 year prior, Criterion’s success thrives with a focus in tech, media, as well as telecommunications players. Lord likes to invest glancing to a longer-term scope with gains on the horizon. The theory rests on the anticipation of stock prices surging or dipping based on the skin-and-bones fundamentals of a company. However, two tech giants are no longer looking like ideal long-side investments to Lord, based on his latest quarterly moves: Advanced Micro Devices, Inc. (NASDAQ:AMD) and Apple Inc. (NASDAQ:AAPL).

According to TipRanks analytics, Lord is a nearly five star hedge fund manager, landing among the top 20: Lord’s fund Criterion is ranked #13 out of 203 hedge funds, with $1.66 billion in total assets under management. Lord has garnered a strong 28.04% in his annualized returns over the last three years, pulling off a portfolio gain of 167.8% since June 2013. With a stellar sharpe ratio of 3.64, where most hedge funds average less than half that with 1.22, this expert has proven his reputation as one that is trustworthy on the Street.

Let’s take a closer look as to Lord’s decision to throw in the towel on AMD and AAPL:

Advanced Micro Devices Gets Trashed

Advanced Micro Devices is getting the boot from Lord, who in the fourth quarter opted to toss out his stake in the chip giant- to the harsh tune of 1,685,240 shares worth a $17,324,267. No confidence left in this chip giant, Lord does not have a single dollar left backing AMD’s potential.

Recently, Tel Aviv-based security firm CTS Labs poked some holes in the bullish camp for AMD after revealing vulnerabilities uncovered in Ryzen and EPYC chips. However, AMD just had 24 hours of notice before CTS Labs rushed to dish to the public of 13 flaws circulating through these chipsets- hitting four classes of vulnerabilities.

This is far from the usual proceedings when it comes to disclosure, leaving the AMD team not even a moment to take a breath before Wall Street was buzzing with the latest hardware flaw affecting the tech-verse. Some were left crying out poor motives here, considering a financial analysis firm like Viceroy Research had access to the vulnerability report- and promptly posted a lengthy, scathing review of financial liabilities that could crop up an hour after word broke. Viceroy called bankruptcy for AMD in a 25-page negative report dismissing AMD stock as “worth $0.00.”

SearchSecurity is probing CTS Labs for its disclosure tactics, putting CTO of CTS Labs Yaron Luk-Zilberman on the defense: “it’s up to the vendor if it wants to alert the customers that there is a problem.”

Meanwhile, AMD is carving out a strategy for BIOS firmware patches to tackle three of the four flaw classes of vulnerabilities at play. The AMD team believes “that all the issues raised in the research require administrative access to the system, a type of access that effectively grants the user unrestricted access to the system.”

In a press statement, AMD CTO Mark Papermaster underscores, “Any attacker gaining unauthorized administrative access would have a wide range of attacks at their disposal well beyond the exploits identified in this research,” adding: “Further, all modern operating systems and enterprise-quality hypervisors today have many effective security controls, such as Microsoft Windows Credential Guard in the Windows environment, in place to prevent unauthorized administrative access that would need to be overcome in order to affect these security issues.”

Before this, AMD looked much better next to Intel, who suffered from a bug that hit most chips from 1995 on with vulnerabilities. Now, not even AMD chips are protected from the plague of hardware flaws hitting chip makers, from Meltdown to Spectre and onward. Lord may have backed out of the chip giant at just the right time- or will AMD rebound with its patches?

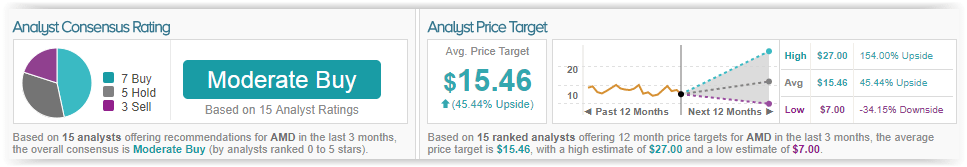

TipRanks indicates a cautious, yet optimistic Wall Street surveying the chip giant’s market opportunity. Out of 15 analysts polled in the last 3 months, 7 are bullish on AMD shares, 5 remain sidelined, while 3 are bearish. Notably, a great deal of optimism is baked into these analysts’ expectations, considering the 12-month average price target of $15.46 boasts a return potential of 45% from where the stock is currently trading.

No More Bites Left in Apple

Rumor has it the Apple iPhone X’s sales are underwhelming against expectations for a gains-making ‘supercycle’ that was set to storm the Street. Perhaps this is why a Harvard business man like Lord is heading out of Apple without looking back- shedding all 113,00 shares worth a whopping $19,045,020 in his latest quarterly move.

Morgan Stanley analyst Kathryn Huberty understands that the iPhone X has not been the all-star performer expected from the big AAPL machine- and yet, the bull argues that there is more to Apple than its iPhone X.

Wagering that the company’s Services potential is compelling, the analyst maintains an Overweight rating on AAPL with a $203 price target, which implies a 20% upside from current levels. (To watch Huberty’s track record, click here)

This tech titan is absolutely worth the bet, as Huberty asserts, “We see increasing value in the Apple platform, particularly through services monetization.”

True, “over the last five years, the vast majority (86%) of Apple’s 8% annual revenue growth was driven by iPhone sales,” acknowledges the analyst. Yet, Huberty likewise points out: “it is through monetization of Apple’s Services business that we see the company still generating mid single digit revenue growth.”

Worthy of note, the analyst calculates around 60% of revenue gains for Apple – over half of its revenue growth – are thanks to its strength in Services. Add in wearables to the equation and Huberty believes these segments “will drive almost all of Apple’s growth over the next five years.”

With services revenue hovering $30 for each device, a marked $25 boost from this time in 2016, “this metric under estimates the long-term revenue potential” for Apple’s Services business, Huberty writes. Noting that the majority of the tech titan’s users presently do not shell out dollars to be able to use the platform, this to the analyst indicates “that revenue per ‘active’ user is well above, and possibly double, the $30 level.”

Moreover, the analyst anticipates that in fact, this number could even hit “$100 or more;” especially taking under account Amazon Prime with around 106 million users paying roughly $99 annually and Netflix’s estimated 111 million subscribers ponying up around $120 each year for the service. With merely around 18% of Apple’s total device installed base standing as paid subscribers, this paves the way for “much room for improved recurring revenue,” contends Huberty.

Top analyst Amit Daryanani at RBC Capital echoes Huberty’s bullish stance on the tech machine, showing there are still optimists on the Street betting on Apple’s built-in legacy- even if Lord is fleeing the scene.

When diving into the company’s Services business and “its ability to lift gross margins, reduce cyclicality, and improve valuation,” Daryanani says to put it bluntly: “We think investors have been hyperfocused on the iPhone unit trends and less focused on AAPL’s ability to grow and monetize the install base.”

Worthy of note, the analyst has an Outperform rating on AAPL stock with a $205 price target, which implies a close to 22% upside from current levels. In other words, Darayani sees reassuring upside potential waiting in the wings for AAPL.

In fact, Daryanani explains that the company’s Services platform is a “critical part” of his case to be bullish on the stock, “particularly as the smartphone market matures.” The analyst calculates that roughly 20% of services growth rides a combo wave of rising monetization of install base, with average revenue per device circling $24, along with gains in the collective iOS install base with 1.3 billion devices.

“We believe AAPL stock should continue to outperform the market driven by strong FCF generation, ability for outsized capital allocation and a growing iOS install base that generates sustained and recurring FCF growth,” Daryanani expects, surmising that though services is in its “early” days, this company has the capacity to “grow into an important part of AAPL’s strategy driving investments, determining future product roadmap and perhaps M&A.”

One of Wall Street’s best performing analysts on the Street therefore is upbeat on the AAPL “Services snowball” down the line- just as a hedge fund whiz like Lord runs for the hills. Time will tell which Wall Street expert wins out in the name of the Wall Street trading game.

Amit Daryanani has a very good TipRanks score with an encouraging 82% success rate with an impressive ranking of #16 out of 4,757 analysts. Daryanani realizes 27.8% in his yearly returns. Investors following Daryanani’s recommendations on AAPL will earn an average of 26.3% in profits on the stock.

TipRanks showcases an analyst consensus leaning towards the bullish camp on this tech giant’s prospects. Out of 29 analysts polled in the last 3 months, 16 are bullish on AAPL stock while 13 remain sidelined. With a solid return potential of nearly 16%, the stock’s consensus target price stands at $191.30.