Dmitry Balyasny did not become the leader of a $12 billion hedge fund without understanding the changes in the stock market trading game. Founder of the $12.6 billion Chicago-based hedge fund titan Balyasny Asset Management (BAM), Balyasny looks less confident on two chip giants to be money-makers. In the last quarter, the tycoon took a 95% whack to his position in Advanced Micro Devices (NASDAQ:AMD) and a 99% slash to his stake in Micron Technology, Inc. (NASDAQ:MU). Are growth prospects in these semiconductor leaders waning?

For context, the brilliant macro investor had written a letter to investors last year warning of a changing tide to passive investing and quant funds, with a boost in hedge fund assets rendering the stock market more dynamic; or in other words, less odds to realize profits. Balyasny is a master of strategic evolution, leaping toward the Street’s “misunderstood situations.” “A savvy trader who is aware that “the alpha is short-lived,” Balyasny knows how to pinpoint gains for the hedge funds who can trounce the rivalry in a market that is “just very competitive.” Business can be tricky in the short-term, but the hedge fund guru knows firsthand, “it is ultimately good for survivors.”

Three quarters of BAM’s alpha is driven from the long mindset of the long/short strategy. Keep in mind, this a rising, diversified hedge fund giant where 75% of alpha was garnered on back of the Atlas Strategy that stands as the bones that helped BAM first stand. That said, one-fifth of BAM’s returns last year were earned thanks to new portfolio managers. Balyasny is all about “good diversification,” from regions to frequencies. The hedge fund guru’s take: a hedge fund industry modeled after the likes of Amazon, an e-commerce king that has not only “crushed the competition” but prioritizes the “long game,” calling CEO Jeff Bezos’ strategy one with wisdom to glean. Notably, Balyasny is a success taken at his word, for leading his hedge fund firm to almost double from an August 205 market call that helped sidestep the collapse. The winning strategy: dishing out consistency on returns that do not rise and fall with the general stock market orbit.

Let’s explore BAM’s near-retreats in AMD and MU:

Advanced Micro Devices Gets Cut Down to Under $1 Million

Advanced Micro Devices is looking like a less favorable stock pick from the market-savvy eyes of Balyasny, who led BAM to sell off practically 1 million shares in the company- a sell-off of 996,688 shares. Now, Balyasny’s hedge fund firm owns just 57,624 shares left in AMD worth $579,000- only a bit over half a million dollars.

Stifel analyst Kevin Cassidy echoes from a different, bullish corner, anticipating the chip giant can hit its own guide of mid-single-digit server chip market share captured by the close of 2018 against the under 1% share exhibited by the close of last year.

On back of his review of the processor market, the analyst reiterates a Buy rating on AMD stock while bumping up the price target from $14 to $17, which implies a 16% upside from current levels.

Not only does Cassidy make an upbeat bet that the team will keep achieving its production introduction milestones, he wagers this is likewise lifting chip consumer enthusiasm in AMD processor adoption. This chip giant is tracking to outclass the processor market, as far as the analyst is concerned.

“Now we see end demand forecasts for PCs, servers and graphics add-in-cards as increasing. Consistent with our April 4th AMD upgrade thesis, we believe AMD’s EPYC server CPU is winning server designs and AMD’s broader PC CPU offering will allow AMD to outperform the market,” writes Cassidy.

As of Friday, the chip giant revealed its EPYC chip will fire up Cisco’s C4200 Rack Server Chassis as 2018 progresses. CSCO takes the alliance in stride, calling this its “highest density” server offered, boasting 128% chip cores per rack greater against the rest of its platforms.

“We believe other server OEMs have realized the benefits of EPYC and will be making similar announcements soon,” continues Cassidy, surmising: “In our view, the company has removed our concerns for execution risk. We believe the new products can expand gross margin and earnings.”

Worthy of note, though Balyasny is backtracking, AMD has been a robust performer in the market this year, vaulting 28% year-to-date in growth.

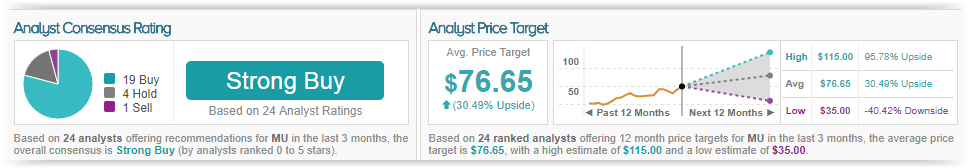

TipRanks suggests optimism largely circles AMD. Out of 18 analysts polled in the last 3 months, 10 are bullish on AMD stock, 6 remain sidelined, while 2 are bearish on the stock. With a return potential of nearly 9%, the stock’s consensus target price stands at $15.69.

Walking Out of Micron

Micron likewise is getting a bearish assessment as of the first quarter from Balyasny, who has shed a whopping 1,124,877 shares in the chip giant- a marked 99% stake slice. Now, BAM only owns 21,425 shares in MU worth $1,117,000; in other words, a position floating a bit over $1 million.

Morgan Stanley analyst Joseph Moore just last week sent the Street into a skittish sidestep, with MU shares falling 8% by Thursday’s close after the analyst once bullish on Micron – as well as the memory sector for the past two years – stepped over to the sidelines. Even if DRAM is remaining strong, is this already valued into the stock’s price? Moore believes yes, and as such, shares are suddenly quite “close” to his target expectations, making valuation look balanced. Likewise, the analyst adds he has rising doubts that the NAND recovery bulls hope to spot in the back half of 2018 will hit. Accordingly, the analyst now rates MU an Equal Weight rating with a $65 price target, which implies a close to 11% upside from current levels.

Compared to past memory markets, Moore presently spotlights a structural improvement. However, he continues to believe that present valuations “price that in,” which spells out barely any “room for upside.” The analyst’s perspective on pricing is merely a tad more apprehensive, especially considering he has already kept a wary eye on NAND from November and onward. Moreover, the analyst is “reasonably” positive on DRAM opportunities for 2018.

Keep in mind, however, MU stock has made quite the rally ever since its annual analyst and investor day on May 21st. After all, the conference saw the chip giant hike its third fiscal quarter EPS outlook from a range of $2.76 to $2.90 up to $3.12 to $3.16 and also unveil a $10 billion buyback plan. Before Moore’s downgrade on the chip stock, Micron shares had jumped almost 13% in 9 days’ time alone. It is a valuation hike that Moore does not ignore, as he anticipates shares value in a substantially confident long-term picture, one where “any erosion in fundamentals will be punished.”

Moore even believes he could be hitting the neutral stance a tad “early,” but notes his upgrade to the bulls was a call that also came before its time. Though there is no dire cause to dump shares, considering how wildly unpredictable the businesses can be, and a stock that vaulted 40% through the course of 3 weeks, the analyst believes it is smart to play to the cautious here. Moore adds, hedging bets is the right play especially in a backdrop where volatility could be storming just around the corner.

With shares circling close to $60, should MU climb any further, Moore proposes a picture in which standout short-term stock drivers would need to remain in motion for the remainder of the year and even prospectively through the start of next year to leave a window for upside gains. Moore likewise muses about a “pendulum” where he suddenly looks to the rest of Wall Street as a long-term bear. To the analyst, this points out a changing “pendulum” where half a year ago sentiment was too harsh on the stock- to current sentiment that rings too positive.

Regardless of how similar data points continue, Moore believes the upbeat clamors surrounding “a seasonal rebound” have immensely subdued considering what his industry contacts had been rumoring merely a few weeks prior.

If robust economics continue to be “exceptionally” impressive, DRAM pricing could seize the opportunity to keep lifting throughout the third quarter- and slip to hovering flat in the fourth quarter. Yet, with shortages in play and a gaping decline in the “urgency” factor of the equation, where a bullish chorus once sang in expectations for a third quarter show, this enthusiasm has since taken a dip from just two weeks prior- particularly with “cloud pushouts” at play.

When sizing up NAND, Moore underscores some traces of positive signs exhibited in the opening half of last year already getting obscured. While MU’s analyst day sent shares flying, Moore evaluates a chip stock that discounts operating margins more than 30% beyond a “peak” period which ranged between 50% and 55%. This, the analyst argues is just lofty “enough” to place bullish bets over to a neutral stance. In a nutshell, Moore’s downgrade comes from his strategy to put Micron’s longer-term valuation under the microscope.

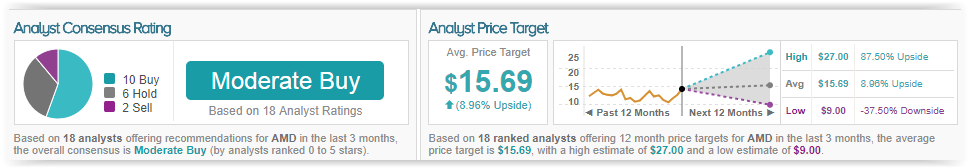

TipRanks indicates a strong bullish consensus backing MU stock. Out of 24 analysts polled in the last 3 months, 19 are bullish on the chip giant, 4 remain sidelined, while 1 is bearish on the stock. With a return potential of 30%, the stock’s consensus target price stands at $76.65.