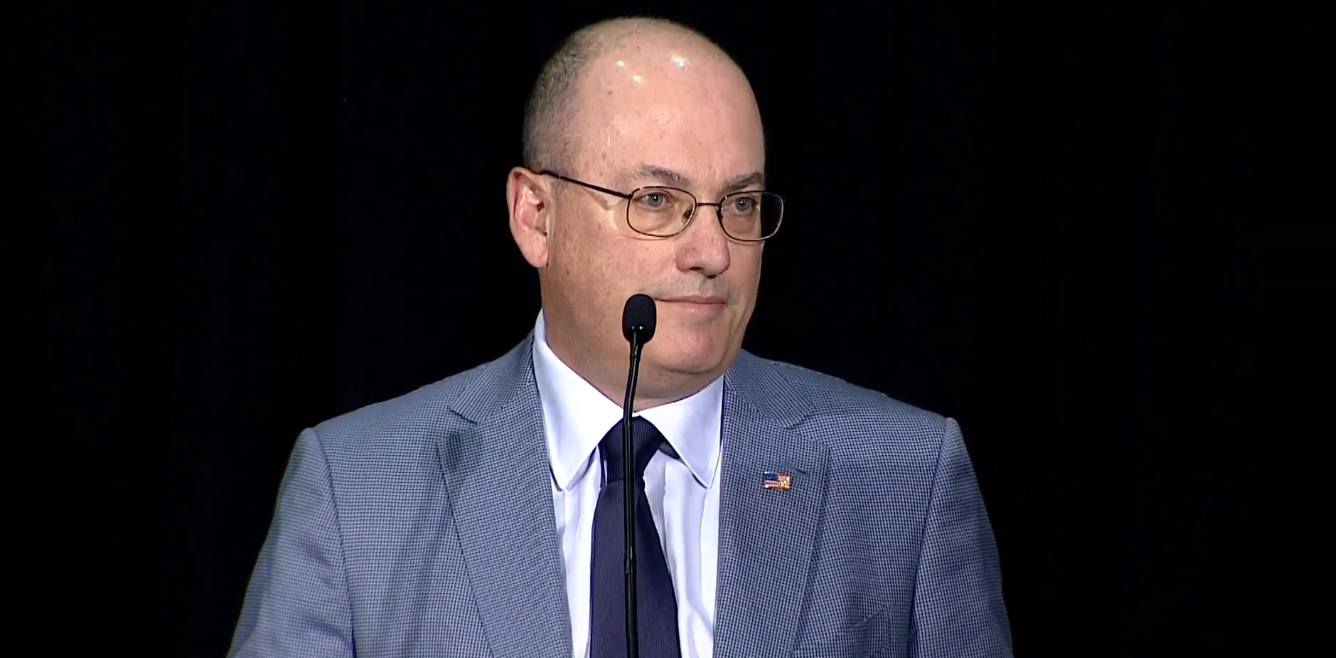

Global asset management firm Point72 knows how to play long/short equity strategies to reap investments. With billionaire founder Steven Cohen at the helm, Point72 has added over 1,250 employees worldwide in the last 26 years; and amassed a cool $12 billion in assets. Cohen himself boasts $14 billion to his name.

What’s on the horizon for Point72? It appears Cohen has his eyes on a strategic expansion in Asia. Not only has Point72 opened larger offices in Singapore and Tokyo, but the firm likewise expanded its Hong Kong office. Consider that three years ago, Point72’s office location in Hong Kong could hold roughly 60 employees. Present-day, mid-savvy Asia expansion, this capacity now soars over 160 employees.

Cohen is hard at work at a comeback. The mogul’s former firm SAC Capital Advisors fell to securities fraud scandal- and a ban from trading outside money for a rocky two years. Cohen had to fork over a $1.8 billion fine- but by January 1, the ban was over.

In the second quarter, Cohen’s Point72 appears to have taken a bearish turn on Chinese e-commerce king Alibaba (NYSE:BABA): Point72 cut its position here nearly in half. Yet, for Momo (NASDAQ:MOMO), it’s a far more bullish tale. The ‘Tinder of China’ (a free social search and instant messaging mobile app) has hooked Cohen’s attention, with Point72 boosting its stake a whopping 583%.

Let’s dive right into Cohen’s Q2 plays in China’s key stock giants:

Alibaba Gets Dumped

In the latest quarter, it appears Cohen sees reason to backtrack on BABA. Cohen shed 800,477 shares from his hedge fund firm’s stake in BABA- a sharp 48% chop. This now takes Point 72’s holding to 891,791 shares worth $165,454,000.

Alibaba posts earnings tomorrow for its first fiscal quarter of 2019 tomorrow morning, and all eyes are on this Chinese e-commerce king. One of Wall Street’s top analysts is sticking tight to the BABA bulls, angling for upside ahead.

RBC Capital’s Mark Mahaney reiterates an Outperform rating on BABA stock in a bullish earnings preview. Setting a $220 price target, the analyst spotlights nearly 24% in upside potential for Alibaba shares.

Notably, out of over 4,800 analysts we cover on TipRanks, Mahaney has an impressive ranking in the top 25. Mahaney’s track record of betting on BABA has paid off- he earns an average of 45% in profits on the stock. (To find Mahaney’s other stock recommendations, click here)

“Based on intra-quarter data points and our model sensitivity work, we believe BABA Street June quarter estimates are reasonable. We look forward to hearing more about the company’s future initiatives at BABA’s 2018 investor day and Cloud Conference in Hangzhou, China, September 17th – 22nd,” writes Mahaney.

The analyst expects BABA can bring in 81.6 billion RMB in revenue, making Mahaney more bullish than the Street’s forecast of 81.5 billion RMB. Additionally, against the Street’s 24.6 billion RMB estimate for adjusted EBITDA, Mahaney calls for a confident 28.5 billion RMB and 35% margin. Mahaney expects Alibaba to hit 8.38 RMB in adjusted EPS for the quarter against the Street’s 8.42 RMB.

Look for cloud computing revenue to rise 106% year-over-year, says the top analyst, who calls for 5.0 RMB in revenue. Additionally, Mahaney projects digital media and entertainment revenue to jump 24% year-over-year to 5.8 billion RMB- a lift from his previous forecast of 4.4 billion RMB. In other words, this segment would capture a 6% slice of BABA’s revenue. Mahaney believes the agreement to stream and market the World Cup will fire up this revenue.

“…we believe China Retail Revenue growth will be more back-weighted as the company laps large comps in the June and September quarters in this segment (China Retail represents 70% of Total Revenues),” continues the analyst.

Additionally, Mahaney anticipates: “We believe the streaming agreement with CCTV benefited many aspects of BABA’s business, including new subs for Youku, higher Advertising Revenue, and increased delivery on Ele.me. We believe that the mark-up in valuation for Ant Financial (from $60B to $150B USD) will likely trigger a ~$10B onetime step up in SBC expense.”

Bottom line, “We believe the company’s focus in Cloud remains growing customers and market share and not profitability,” contends Mahaney.

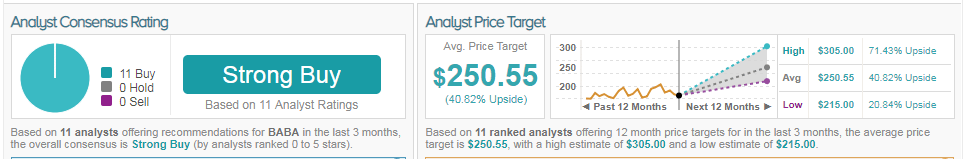

According to TipRanks, Alibaba is a Wall Street favorite. The ‘Strong Buy’ stock has racked up 11 bullish recommendations from best-performing analysts over the last three months. Consider that the 12-month average price target of $250.55 reflects high confidence. The Street is calling for another almost 42% in room for BABA shares to run.

Dialing Up Momo

Momo saw Cohen’s Point72 getting upbeat in the second quarter. The hedge fund firm added 404,200 shares to its stake in the ‘Tinder of China;’ quite a bullish play. Now, Cohen’s firm holds 473,600 shares worth $20,602,000- meaning the bulk of Poin72’s holding in Momo was purchased in the latest quarter.

Cohen must be racking up the gains today. Momo shares are on an almost 7% tear this morning after the Chinese tech player unleashed a solid second quarter print.

UBS analyst Jerry Liu cheekily poses a question in his bullish post-2Q research note: “Can dating become a significant growth driver?”

On back of the print, the analyst rates a Buy on MOMO stock with a $60 price target. This suggests Liu spots nearly 38% in upside potential from current levels. (See Liu’s other stock recommendations)

The analyst sees a “significant long-term opportunity in China for dating apps targeted at millennials and younger users.” Momo’s recent acquisition of China’s top dating application Tantan could stand to yield 13% of revenue dollar growth in two years, wagers Liu. This translates to a $132 million yearly revenue opportunity for Tantan from 49 million monthly active users- and is “achievable between the next 2-3 years.”

Liu crunches the numbers based on: “Tinder’s growth and penetration of the single and unmarried population in the US, and layering in China’s more favorable market dynamics, including higher uptake of Internet services and the lack of a bar/restaurant scene for dating.”

In fact, the analyst believes Momo could generate even higher dating revenue upside to $456 to $539 million. One, the Chinese tech giant stands to bolster a portfolio of apps to reach out to varying demographics- and provide “different user experiences.”

Next, Momo’s acquisition of Tantan could hike average revenue per subscriber along with paying user conversion. After all, Tinder’s average revenue per subscriber rocketed 60% between 2016 and 2018. With certain dating apps in China exhibiting stronger conversion than rival Tinder, this indicates to Liu a “higher propensity to pay.”

Liu’s recommendation on MOMO valuation: “Buy on long-term growth in Tantan and overall ARPU.”

Ultimately, “While some investors are focused on the near-term product cycle and relative value to YY, we see a more long-term story in Tantan supported by live streaming and VAS ARPU upside… Both are close to the high-end of Momo’s recent range, which we believe is warranted given the long-term upside. Our estimates are 12% and 15% above consensus for 2019 and 2020,” concludes the analyst.

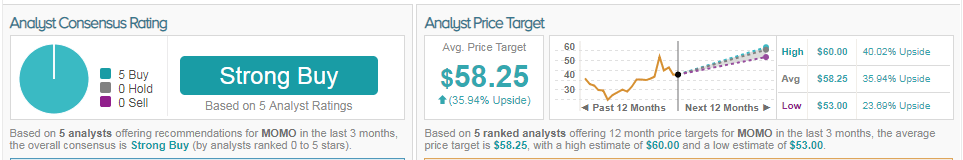

Street-wide sentiment circling MOMO stock shines positive. TipRanks market data reveals the stock is a ‘Strong Buy’ name among best-performing analysts: 6 buys over the last three months. With a robust return potential of 42%, the stock’s consensus price target reaches $58.25.