Cliff Asness, at age 52, is worth around $3.6 million dollars and is the founder of AQR Capital Management. Asness’ founding partners — David Kabiller and John Liew are also worth at least $1 billion each. The trio built the firm up following the 2007/2008 financial crisis. AQR moved away from following the structure of a typical hedge fund to become a firm where investors pay lower fees, for stocks that are thought to have more long-term value and momentum. Asness’ theory worked – and the firm now has more than $185 billion dollars in assets under its belt. Unfortunately for Facebook’s (FB) and General Electric’s (GE) long-term investors, the firm has reduced a significant chunk of shares in both.

Asness was born in Queens, New York and grew up on Long Island before attending the University of Pennsylvania and then studying finance at the University of Chicago under the supervision of Nobel Prize winner Eugene Fama. Fama directs one of AQR’s biggest competitors, Dimensional Fund Advisors. Now, a respected investor, Asness has made some changes to his asset holdings, which has investors wondering what’s behind it.

Facebook Gets the Boot

AQR dumped 2,214,810 shares of Facebook stock, which accounts for around 26% of the firm’s position for the social media giant. While still holding 6,602,029 shares worth $1.86 billion, we have to ask what the thought behind this kind of move is. The truth is, you don’t have to search too far. FB has been under the spotlight after a year of bad press, including data breaches and the infamous Cambridge Analytica scandal, in which a handful of journalists reported the political consulting/data research company had been immorally harvesting data from millions of Facebook profiles for political purposes. This shook the faith for Facebook from users and investors alike.

To make matters worse, there’s been talk of how Facebook is managing the cleanup — and reports have not been good. A major concern over staffing has Wall Street feeling uncertain and the lack of stability has taken a toll on the stock. Stifel top analyst Scott Devitt did a bit of his own research, using Survey Monkey – and found only 52% of the staff were optimistic about the future of the company, whereas 84% were optimistic in 2017. Just under 10 members of the greater Facebook team have left this year – including Alex Stamos, the chief security officer, Elliot Schrage, head of communications and public policy and Alex Hardiman, head of news products. In addition, employees from acquired companies such as WhatsApp and Instagram have been taking off for other jobs in the Silicon Valley as well.

Additionally, many analysts suggest the U.S. government will turn to regulation of Facebook, due to a lack of trust in the company’s transparency. The list of reasons to lose faith in FB goes on, but for now, we have Asness to model after – and he just disposed of a big chunk of the stock.

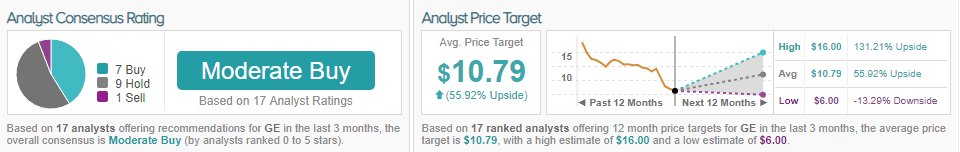

Regardless of the negative press, the stock is still doing well in the eyes of Wall Street analysts. TipRanks has found out of 39 analysts, 33 are bullish on the stock, with just 5 sidelined and 1 bullish. The consensus rating of “Strong Buy” gives way to a price target of $187.75 with a 51% potential upside. (See FB’s price targets and analyst ratings on TipRanks)

General Electric Gets the Other Boot

Asness lets go of a whopping $233,000 worth of shares for General Electric. That’s about an 84% drop in GE shares for the fund.

Some analysts and bloggers see GE’s recent announcement that its healthcare sector is going public as a gift to investors. Some have suggested it will add value for investors, but it seems Asness is having a bearish sentiment when it comes to this energy monster. The bears say the worst hasn’t yet come for GE, and that there’s no rush to buy the dip in the stock.

There are reasons to fret. The company has a debt of $115 billion dollars and negative cash flow to alleviate it. What’s more? GE cut its quarterly dividend from $.12 to $.1 per share, lowering the demand for investors quickly and immediately. As oil prices fall, GE’s Oil and Power companies will struggle even more than they already are. Maybe Asness is onto something.

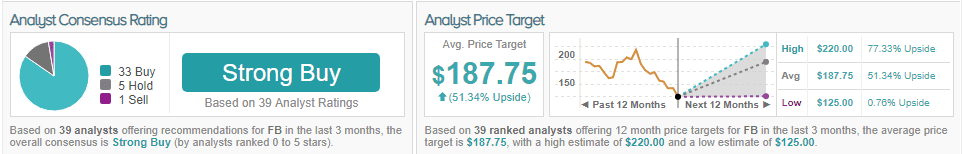

TipRanks analytics reviewed the ratings of 17 analysts who’ve been focused on GE. Out of the lot, 7 are bullish, 9 sidelined and 1 bearish. The consensus price target of $10.79 shows a major upside potential of nearly 56%. (See GE’s price targets and analyst ratings on TipRanks)