Back in November, billionaire Steve Cohen predicted a bear market was approaching. The time frame he gave during an interview with the Financial Times (FT) was for it to come in 18 months. Did his prediction come early? Cohen’s remarks were spoken to the FT as his new hedge fund Point72 raised $5 billion since the firm opened its doors to outside investors.

Cohen is said to have had a return of 30% per year since opening his firm SAC Capital Advisors in 1992. However, a 2012 insider trading scandal rocked the house and Cohen closed shop in 2016. The savvy money-maker had already opened Point72at this point, which he ran as a family office while waiting to have a ban lifted that barred him from managing outside money as punishment for the insider trading that happened under his brim. In October the fund had losses of 2.8% and 4.3% in November.

The firm’s goal is to deliver superior risk-adjusted returns while adhering to the highest ethical standards. The fund recently moved the pieces on the chessboard – claiming shares of Facebook (FB) and knocking out shares of Roku (ROKU).

FB Still King

While Facebook has seen its share of negative press this year, the stock is still considered to be a survivor. Security breaches, leaked data, an unstable management staff, and the spreading of fake news has not deterred users from logging in. Most recently, the company had to issue an apology for exposing private photos of around 6.8 million users after a bug made drafts of photo posts and stories public. For a company that has not had a positive headline in 12 months, you wouldn’t quite be able to tell by its figures. Facebook has 2.2 billion users and the company’s other platforms like Instragram, Whatsapp and Messenger all get about 1 billion users per day. The hedge fund manager spent a total of $33,468,000 on Facebook stock, adding 52,950 shares to its Facebook holding.

The social media site doesn’t seem to be going anywhere. It plays a large role in the lives of ordinary people who use it to tell a large group of friends about life changes and 70% of adults are using the site in 2018, up from just 10% of the adult population 12 years ago. In addition, the company is working the News Feed to be more direct, showing users content most relevant to them, as it competes with Alphabet’s Google News algorithm. By using surveys, the company is able to identify which stories engaged users and which stories created the most amount of feedback and discussion.

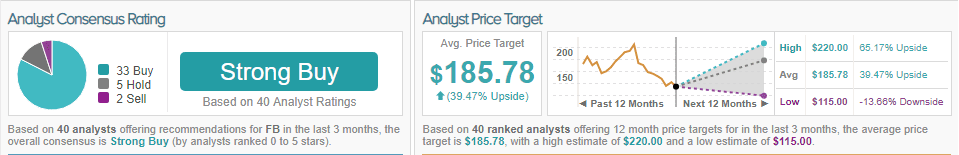

Though this stock, like all the others, was hit by market downturn this holiday season, most analysts and investors still feel bullish about the company in the long-term. TipRanks analytics has the data to support the claim. FB stock has a consensus rating of “Strong Buy” and consensus price target of $185.75, which shows a 38% potential upside. Out of 40 analysts, 33 are bullish, 5 are sidelined and 2 are bearish on Facebook stock.

Roku Out

Does Cohen know something that we don’t? Needham top analyst Laura Martin listed Roku as her “Top Pick for 2019” – but Cohen sold off 318,500 shares, or 83% of his holding in the company, totaling to $23,260,000. That’s a big selloff and a big contradiction. Martin says OTT market growth, strategic positioning, scale, demographic reach and brand advertising are all reasons to believe in a big rise for the stock. She maintains a Buy rating for ROKU with a price target of $45. (To watch Martin’s track record, click here)

The analyst says the TV community is now accepting Roku as part of the media ecosystem, as the technology commands around 3 hours per day of household user’s viewing. Additionally, the analyst believes the company has the potential to be acquired and provides very unique content on the Roku channel, which is organized in a compelling way for viewers in one place. This success is represented in the numbers. 2018 has been a solid year for the company in terms of operating momentum. In the third quarter, Roku reached 24 million unique active accounts, which shows a 43% year-over-year increase with a customer count of 23.8 million by the end of the third quarter. In the last 12 months, Roku took on 7 million new accounts.

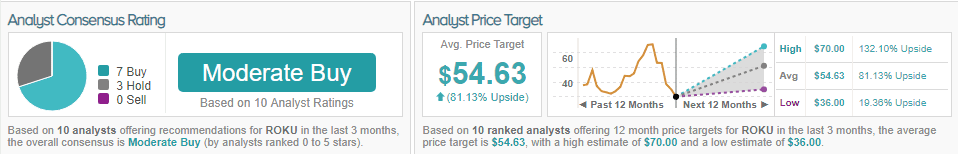

Wall Street analysts seem to have faith in the stock as well. According to TipRanks, out of 10 analysts, 7 are bullish and 3 are sidelined. With a consensus rating of “Moderate Buy” and a price target of $54.63, there’s an 81% chance for upside on Roku. (See ROKU’s price targets and analyst ratings on TipRanks)