Ray Dalio is a 68-year-old sitting on a throne of billions: $17.7 billion to be exact. For an investor and hedge fund guru who went from Queens all the way to guiding one of the leading hedge fund firms in the globe, Dalio has quite a bit of experience on his hands. Now, Bloomberg cheers the man as one of the world’s 100 richest people. At the age of 12, Dalio was already tripling his first ever investment. A financial whiz kid before even reaching his teenage years, Dalio has more years of trading now to back his choice to substantially lift his stake in Micron Technology, Inc. (NASDAQ:MU) and completely cut Intel Corporation (NASDAQ:INTC) from his list.

Notably, Dalio’s Bridgewater Associates first sprang onto the scene back in 1975, and in over four decades now boasts more than $160 billion in assets. This is a firm that managed to anticipate the global financial crisis of 2007- a crisis economist opinion deems the most harrowing financial crisis after the Great Depression. To put it bluntly, Dalio knows his Wall Street savvy, and knows it quite well to have achieved such massive success in his time investing. With financial savvy and Street knowhow, the guru is managing assets now preparing for the likelihood of a recession hitting by the time the next presidential election strikes in two years’ time. The reason Dalio credits for his achievements? Transcendental Meditation- the billionaire’s tactic in tackling a chaotic Wall Street like a real ninja of the Street.

Let’s dive into Dalio’s fourth quarter moves in the tech sector:

Micron Gains Bullish Attention

In an intriguing move, Dalio has dialed up his bullish confidence on the chip giant a meaningful notch, buying 384,901 more shares. Now, the hedge fund guru 385% of a lift in his MU holding later owns a stake of 484,884 shares worth $19,938,000.

Even BMO analyst Ambrish Srivastava, who opts to play it safe on the sidelines on MU has fired up his expectations on the chip giant ahead of its earnings showcase.

Notably, the analyst rates a Market Perform rating on MU shares and recently jumped up his price target from $43 to $63, which implies a close to 4% upside from current levels. (To watch Srivastava’s track record, click here)

The atmosphere for DRAM pricing is looking healthy from where Srivastava stands, who also pays attention to the fact Micron hiked up its guide just last month.

Not one to have “even hit a single” so far in his coverage of the chip giant, the analyst is certainly taking close note of “Memory industry fundamentals, [which] especially for DRAM, remain strong.” Srivastava has largely raised his 12-month target expectations on the chip giant especially with eye to pricing, which soars “stronger than what we had been modeling for.”

“Continued strength in DRAM” has the analyst positive on the chip giant ahead of tonight’s show and even going as far as to wager the Street is underestimating MU’s potential for the third fiscal quarter.

Yet, for the second fiscal quarter, the analyst mostly mirrors with the Street’s estimates, betting on a 7% quarterly surge to $7.275 billion in revenues along with EPS of $2.73.

Glancing to the third fiscal quarter, Srivastava anticipates revenues to hit $7.39 billion and EPS to reach $2.78- projections that leap above the Street’s expectations for $7.25 billion in revenues and $2.62 in EPS.

“We are raising our estimates primarily due to higher revenue and GM, driven by higher DRAM ASP, partly offset by higher opex and tax rate,” underscores the analyst, who kicks up his fiscal 2018 EPS from $9.51 to $10.71 and fiscal 2019 EPS from $7.13 to $8.24. For the calendar year of 2019, the analyst lifts his EPS estimate from $6.66 to $7.67.

These days, “tech is what’s working,” cheers CNBC “Mad Money” host Jim Cramer, who throws his bullish two cents into the ring praising the sector in general for being “on fire for a long time.” Keep in mind, Cramer says, “this is now the seventh straight week of gains for this group,” adding that this bodes well for the memory chip giant.

“Micron’s the backbone of everything from the personal computer, which has gotten a second wind, to the data center, which is the strongest part of the entire food chain,” argues Cramer.

For those who worry the DRAM market boon was ready to take a hit, the CNBC expert is none too concerned: “Micron’s been adamant that this time is different, that their chips are now more specialized and proprietary, harder to make.”

While “the graybeards simply refuse to believe that anything can ever be different,” Cramer cheekily surmises: “In the case of Micron, it turns out that this time it is different,”

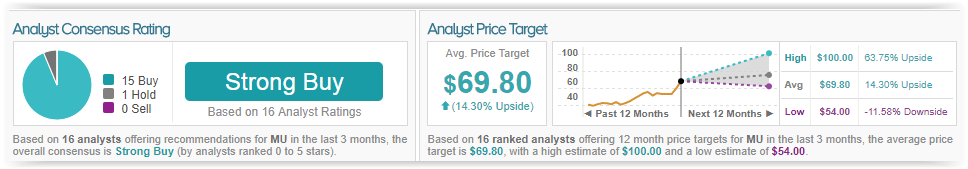

According to TipRanks, Micron has magnetized a strong bullish backing among Street-wide experts. Out of 16 analysts polled in the last 3 months, 15 rate a Buy on MU stock with only 1 maintaining a Hold. The 12-month price target stands tall at $69.80, marking 14% in return potential for the stock.

Intel Shares Get Totally Dissolved

In a big bearish quarterly play, Dalio has wiped out his entire holding of Intel, dumping all 351,286 shares worth $16,106,463. How does Dalio’s backing out of this chip giant balance with Wall Street speculation circling INTC shares?

Notably, the Wall Street Journal buzzed in unofficial news believing that the chip giant is looking at both Broadcom as well as other smaller companies for M&A deal possibilities.

Top analyst Amit Daryanani at RBC Capital chimes in from the sidelines, but tilting closer to the bears in his 12-month target expectations than the bulls, which largely echoes Dalio’s exit.

“There is accretion but also telenovela like drama,” responds Daryanani to the M&A grapevine, rating a Sector Perform rating on INTC with a $46 price target, which implies a 10% downside from current levels.

If the valuation dished out is “reasonable,” the analyst certainly sees AVGO as an “attractive” acquisition target for the chip giant. The accretion Daryanani forecasts lies between 85 to 90 cents, or over 20% accretive for INTC should AVGO’s rumored QCOM acquisition “fall through.”

There is more than one positive hanging in the balance should INTC go for AVGO: “1) A leading position in filtering and connectivity, given AVGO’s best-in-class FBAR and wifi/bluetooth combo assets, 2) Ability to build an ecosystem around cloud and enterprise, given AVGO’s assets in switching, routing (Tomahawk, Jericho, Trident) and storage, 3) Bigger AI opportunities, as we note AVGO is doing ASICs for machine learning workload, and 4) Material accretion potential over the coming years. In our analysis, we assume INTC funds the deal with debt and equity; this would potentially increase leverage to a manageable ~4x Net-Debt/EBITDA.”

Yet, Daryanani has reason to be cautious here, highlighting a slew of “uncertainties” considering regulator apprehensions of national security as well as AVGO’s intent to make the U.S. “the leader of 5G.”

“It will at least take 30 days before CFIUS can conclude the investigation,” contends Daryanani, asserting that in addition: “we have observed a higher scrutiny among regulators regarding high-profile deals, which could further complicate INTC’s reported consideration of M&A.”

Amit Daryanani has a very good TipRanks score with an impressive 89% success rate and one of the highest rankings on Wall Street- landing at #9 out of 4,779 analysts. In other words, Daryanani is one of the top ten best performing analysts on the Street, earnings 30.4% in his annual returns. When recommending INTC, Daryanani averages 0.0% in profits on the stock.

CNBC “Mad Money” host Jim Cramer weighs in on this chip giant as well, but absolutely dismisses the rumors of INTC buying out AVGO “for lack of a better word [as] total poppycock.” After all, “You’re getting a chance to buy one of the best companies in the world at an unjustified discount,” explains Cramer.

Meanwhile, “It’s foolhardy to wager that this deal will come to fruition, which leads me to the one Micron-related stock that’s at a discount that I would buy tomorrow, and that’s Intel,” continues the CNBC expert of the Street.

Ultimately, “Everything else in that group is up except Intel. This time is different. Intel’s a buy,” Cramer concludes, far more positive on this semiconductor player than Dalio or Daryanani.

In the grander scheme, TipRanks indicates Intel has the Street cautiously optimistic on its market prospects. Out of 26 analysts polled in the last 3 months, 17 are bullish on the chip giant, 6 remain sidelined, while 3 are bearish on the stock. With a return potential of nearly 2%, the stock’s consensus target price stands at $52.36.