If you’ve somehow avoided all the buzz surrounding Netflix, Inc.s (NASDAQ:NFLX) earnings, Stifel top analyst Scott Devitt is out today with a few insights and a price target hike.

Devitt noted, “Netflix continues to skillfully execute against its global, original content-driven growth strategy and the company delivered its first profitable quarter internationally in 1Q when many thought the company would never reach this threshold. Though Netflix’s increasingly front-loaded content investments will continue to weigh on profitability / free cash flow in the short term, it’s hard to argue with the company’s strategy given its momentum.”

The analyst increased his forecasts for domestic/international net adds to 599k/2.596mm from 246k/1.88mm previously as the pace of original content releases picks up in 2Q and benefits subscriber growth.

“As previously noted, Netflix expects greater net adds in 2Q:17 relative to the prior year, driven by a healthy content release schedule that includes the returns of several of Netflix’s most popular series and several notable feature films,” the analyst said.

As such, Devitt reiterated a Buy rating on Netflix shares, while raising the price target to $170 (from $155), which implies an upside of 12% from current levels.

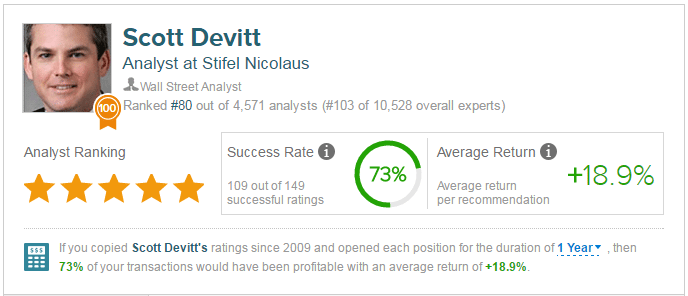

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, 5-star analyst Scott Devitt has a yearly average return of 18.9% and a 73% success rate. Devitt has a 57.1% average return when recommending NFLX, and is ranked #80 out of 4571 analysts.

Out of the 42 analysts polled in the past 12 months, 26 rate Netflix stock a Buy, 14 rate the stock a Hold and 2 recommend Sell. With a return potential of 3.3%, the stock’s consensus target price stands at $157.26.