JC Penney Company Inc (NYSE:JCP) shares are getting whacked today following weaker-than-expected earnings. Specifically, the struggling department store chain reported a 2Q net loss of $0.09 per share, higher than consensus estimates of $0.05 per share. In addition, same-store sales fell 1.3%, worse than Street expectations for a 1.2% drop. To the company’s credit, net sales in the second quarter climbed 1.5 percent, to $2.96 billion, slightly above forecasts.

Adding fuel to fire, Piper Jaffray analyst Erinn Murphy reiterated a Neutral rating on JC Penney shares, while lowering the price target to $4.00 (from $5.00). (To watch Murphy’s track record, click here)

Murphy stated, “We are lowering our PT from $5 to $4 on negatively revised estimates following JCP’s disappointing Q2 results. We, nor the Street, were expecting underpeformance near the magnitude delivered given frequent positive communication toward investors intra-quarter. After digesting results post the call, we are lowering our 2H and FY18 operational estimates. While management is approaching the 2H optimistically given July/ August improvement and the multitude of initiatives, we worry investors will increasingly question management’s credibility. We continue to believe the Street’s 2H (particularly Q4) department store estimates (at large) are too high and anticipate difficulty as JCP aims to drive positive or even flat comps guidance is contingent upon.”

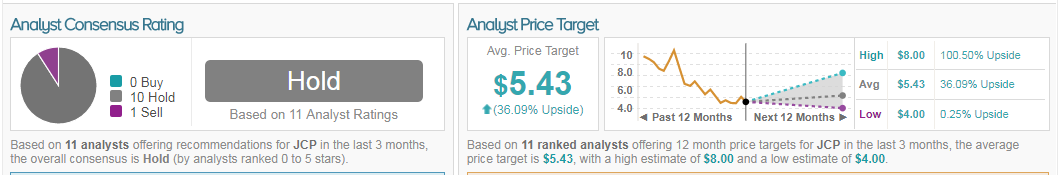

Most of the analysts covering JC Penney remain sidelined on the company’s stock. A total of 11 analysts provided ratings in the past 3 months; 10 suggest a Hold, while one recommends a Sell. The 12-month consensus mean price target for the stock is $5.43, reflecting a 36% upside from current levels.