Lions Gate Entertainment Corporation (NYSE: LGF) is a global entertainment company most notable for its Hunger Games and Divergent young adult movie franchises. The company is excepting strong revenue from the third installment of its Hunger Games franchise, Mockingjay Part 1. In addition, Lions Gate recently acquired the distribution rights to all of CBS Films’ releases starting with teen comedy THE DUFF, scheduled to come out in 2015.

Investors of Lions Gate have high hopes that ‘Mokingjay’ will help push the stock even further than the two previous Hunger Games films already have. Since the Hunger Games franchise debuted in 2012, Lions Gate shares have nearly quadrupled in price. In the past month alone, Lions Gate stock has increased 8.8% due to the upcoming theatrical release of the film on November 21st. Boxoffice.com has predicted that Mockingjay Part 1 could potentially pull in $152 million in domestic theaters on its opening weekend. Mokingjay Part 2 is scheduled to be released in November 2015.

In other Lions Gate news, the entertainment company acquired the distribution rights to CBS films last week, a move that proves beneficial for both parties. Lions Gate will now gain access to a greater amount of quality content whereas for CBS Films’ it will gain access to Lions Gate powerful distribution network.

“CBS Films has emerged as a creative force that will serve as a commercially exciting and reliable source of quality mainstream theatrical releases for years to come,” said Lionsgate Co-Chief Operating Officer and Motion Picture Group President Steve Beeks. “Our partnership unites two companies with powerful brands, complementary strengths and similar entrepreneurial cultures in a distribution agreement that extends the terrific Lionsgate/CBS relationship.”

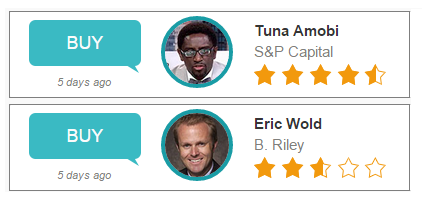

On November 18th, S&P Capital analyst Tuna Amobi recommended to Buy Lions Gate saying he would be surprised if the first ‘Mockingjay didn’t reach $1 billion in global receipts. He noted, “We expect Mockingjay Part 1 to reinforce the vitality of the ‘Hunger Games’ franchise.” Out of 35 total ratings, Amobi currently has a 71% success rate making recommendations and a +19.2% average return per recommendation.

In addition, B. Riley analyst Eric Wold also rated Lions Gate with a Buy on November 18th, estimating that the film will produce $425 million in ticket sales in its complete U.S. and Canadian theater run, and as much as $850 million internationally. He went on to say, “The ‘Hunger Games’ franchise will continue to be extremely important for Lions Gate for at least the next 18 months.” Wold has made 52 total ratings, earning a 52% success rate making recommendations and a +1.7% average return per recommendation.

On average, the top analyst consensus for Lions Gate is Strong Buy.