Netflix, Inc. (NASDAQ:NFLX) stock looks poised to close several percentage points higher today, putting shares up about 19% year to date and a whopping 42% in the last six months. The bullish sentiment in the stock comes just ahead of the company’s first quarter results this evening. Can the online streaming platform live up to bullish expectations?

According to Rosenblatt analyst Alan Gould, expectations are lower than last year due to NFLX’s international expansion into an additional 130 countries last year and the slower domestic market expectation is due to the market maturing. It also had a strong original content offering the prior year with House of Cards fourth season, Daredevil’s second season, Fuller House, and benefitted from Making a Murderer.

However, given the company has beat in 11 of the past 13 quarters and that first quarter guidance assumed the strong 4Q-16 pulled forward some net adds from 1Q-17, the analyst would not be surprised with a first quarter beat.

Gould added, “The Street is looking for 2.45 million net adds for the second quarter, up from 1.68 million last year. The offsetting drivers will be an easier domestic comp due to the churn caused by the un-grandfathering/higher pricing last year offset by the big international expansion last year. Additionally, this should be a stronger content quarter this year highlighted by House of Cards fifth season pushed back to the June quarter in 2017. The second quarter has historically been the seasonally weakest for subscriber gains. The last big subscriber miss the company experienced was during the second quarter last year so we are expecting conservative guidance for the period.”

As such, Gould reiterates a Neutral rating on Netflix shares with a $150 price target, which represents a slight upside potential from current levels.

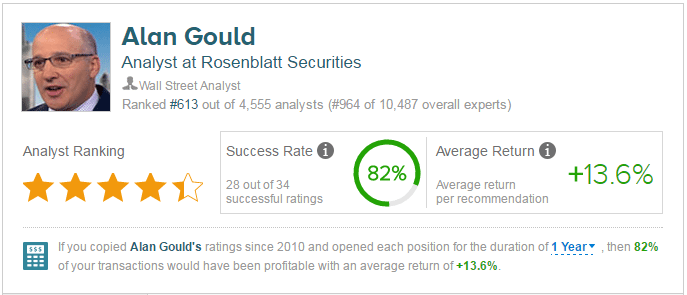

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Alan Gould has a yearly average return of 13.6% and a 82% success rate. Gould has a -17.3% average return when recommending NFLX, and is ranked #613 out of 4555 analysts.

Out of the 43 analysts polled in the past 12 months, 27 rate Netflix stock a Buy, 14 rate the stock a Hold and 2 recommend a Sell. With a return potential of 3%, the stock’s consensus target price stands at $151.75.