The Coca-Cola Company (NYSE:KO) is caught in a squeeze between the need for more advertising and incentives to increase customer demand and a decline in profit margins. Please consider two charts:

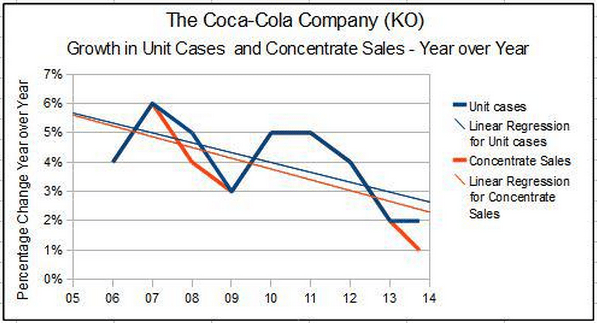

The information is presented in the 10-K, under the heading of “Beverage Volume.” These are total sales of cases and concentrate, whether by the company or distributors, and are an accurate reflection of consumer demand. The trend is down.

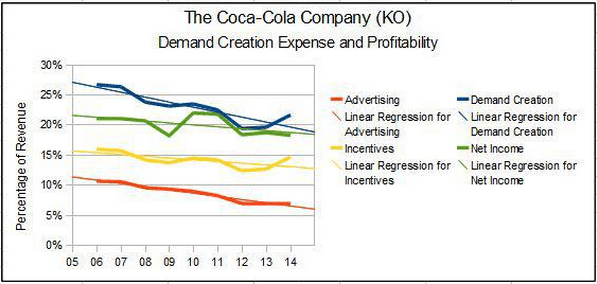

The data presented is not available from the usual sources, and it was necessary to go into the 10-K and 10-Q filings to develop it. Advertising is straight forward, but incentives are handled as “Deductions from Revenue.” The information is furnished in Note 1 to the financial statements. I have combined the two items under the heading of demand creation.

Looking at 2005 to 2014, both advertising and incentives, as a percentage of revenue, have decreased markedly. However, this didn’t flow through to the bottom line, where margins are shrinking. The net income for 2010 was adjusted for a gain of $4,978 million on the acquisition of CCE. They had a partial interest, which was written up to reflect the cost of buying out the other owners.

It appears that management has skimped on demand creation, which is now manifesting in lower volume growth. As such, the company is not as profitable as past results would suggest, since its long term intangible asset of brand loyalty is deteriorating.

At the same time, profitability in terms of net income as a percentage of revenue has been declining. This creates a squeeze, between the need for increased demand creation expense and declining margins.

Management is Addressing the Problem

On the 4Q 2014 earnings conference call, CEO Muhtar Kent acknowledged the problems and discussed a plan to resolve the issues:

Our five strategic system priorities to restore momentum are; firstly, accelerate sparkling growth led by Coca-Cola; secondly, strategically expanding our profitable still portfolio; third, increasing media investments by maximizing productivity; fourth, winning at the point of sale by unlocking the power of our system; and five, investing in our next generation of leaders.

The 3rd item presents the basic strategy: the company needs to increase advertising (media) expense, and plans to fund it by reducing costs.

Checking capex and depreciation, capex has exceeded depreciation by a comfortable margin for each of the past three years. Under the circumstances, the investor has some assurance that increasing productivity will not involve trying to extract more work out of fewer employees using outdated equipment. The assumption is that all equipment is up to date and optimal for its purpose.

On the Q3 14 conference call, Kent answered a question on the conflict between increased marketing expense and profit margins as follows:

Yes. I think we’re talking about is a balance approach bring us back to our long-term growth trajectory in terms of our financial performance. That is a combination of both growth more realistic and better sustainable growth on the top-line as well as margin enhancements. So as we said before, this additional program of productivity will yield, will generate two things, we believe clearly better growth as well as better margin enhancement.

It’s worth reading the transcript in full, or at least browsing it with a search on “margin.” What I see is a transition process that will take at least three years to complete. As a practical matter, it took many years to get off track and it will take a while to implement corrective action.

The Obesity Issue

Coke is getting bad press due to the increasing trend toward obesity in the US. Item 1 of the plan says the company will press forward behind its lead brand – Coca-Cola. That brand is now tarnished by association with the obesity epidemic. The 2013 10-K outlines the company’s response.

Obesity, Poor Diets and Inactive Lifestyles

The rates of obesity affecting communities, cultures and countries worldwide continue to be too high. There is growing concern among consumers, public health professionals and government agencies about the health problems associated with obesity, which results from poor diets that are too high in calories combined with inactive lifestyles. This concern represents a significant challenge to our industry. We understand and recognize that obesity is a complex public health challenge and are committed to being a part of the solution.

We recognize the uniqueness of consumers’ lifestyles and dietary choices. All of our products can be part of an active, healthy lifestyle that includes a sensible and balanced diet, proper hydration and regular physical activity. However, when it comes to weight management, all calories count, whatever food or beverage they come from, including calories from our beverages.

The following four global initiatives will guide our efforts to address obesity and bring people together to pursue solutions:

- Offer low- or no-calorie beverage options

- Provide transparent nutrition information, featuring calories on the front of all of our packages

- Help get people moving by supporting physical activity programs

- Market responsibly, including no advertising to children under 12

We recognize the health of our business is interwoven with the well-being of our consumers, our employees and the communities we serve, and we are working in cooperation with governments, educators and consumers.

As a factual matter, the obesity epidemic can be blamed on the prevailing sedentary lifestyle. Very possibly an ad campaign that featured attractive young people engaged in popular athletic pass-times, then consuming Coke instead of beer, would make the point without sinking to the level of attempting to defend the brand by discussing the science. That would be incremental media expense.

Given that network television may not be effective in reaching the target audiences, it may be expensive to find out how and where to get the message across. The current approach is sensible, but doesn’t seem to involve much action or expense.

The Stock-Based Compensation Issue

David Winters of Wintergreen Capital successfully challenged the company’s plans to award stock options to employees. The “burn rate,” or dilution, will be held to 0.8% annually for the current plan.

It should be noted that the plan extends to some 6,400 employees, and not just to top management. Further, those who create value should share in the benefits, for the sake of long-term motivation and retention.

However, the GAAP accounting doesn’t present the true costs in the years they are incurred. The company’s disclosures are good, and include the intrinsic value of options exercised and outstanding on an annual basis. After comparing the intrinsic value information to the cost of stock based compensation as reported, I see about 10 cents per year that I would subtract from the company’s reported earnings to reflect the timing differential.

Brand Proliferation

The 10-K reveals that the company owns or licenses over 500 non-alcoholic beverage brands. The 2nd item in the plan to restore momentum can be translated to say that acquisitions will focus on buying non-carbonated brands, which have proven to be profitable.

It’s difficult to imagine that all these 500+ brands are profitable, or dominate their markets, or are getting adequate resources for growth. From an 80/20 perspective, they have 400 excess brands.

Procter and Gamble (NYSE:PG) confronted a similar problem, and came up with the strategy of culling from among their 90+ brands. The Coca-Cola Company should take a hard look at their 500+ brands, and narrow their focus.

Valuation

A P/E5 analysis, after taking out the large capital gain booked in 2010, and adjusted for share count, arrives at a five year average EPS of $1.89. An iconic consumer stock typically trades at a P/E5 of 20, suggesting a fair market value of $38, not too far from recent share prices in the $42 area.

However, this brand is not receiving full advertising and incentive support, and the owner’s focus is distracted by over 500 competing brands. The obesity issue is tarnishing the iconic stature, and GAAP accounting may not reflect the true cost of stock based compensation.

With that in mind, the target P/E5 multiple might be more realistic at 17.5, reflecting the need to reinvest in the brand. That would reduce FMV to $33. The current price reflects a successful resolution of the outstanding problems, which has yet to occur, and may not be evident until three years hence.

Buybacks

The company actively repurchases its shares. Consulting the 2013 Consolidated Statement of Shareholder Equity, for that year they bought back 121 million shares at a cost of $4,827 million, or $39.89 per share. This is in excess of a generous estimate of FMV, and well in excess of a more realistic appraisal, as developed above. As such, buyback activity flunks the most basic test: the company overpaid.

For all the money spent, share counts weren’t reduced that much. The reason: 54 million shares were issued to employees, for receipts of $745 million, or $13.79 per share. Since 2007, the company has used treasury shares to fulfill employee option exercises, and the average cost of these shares is less than the average strike of the options. As such, the GAAP accounting is murky.

It should be noted that buybacks are in theory a return of excess capital to shareholders. However, the information presented above suggests that the company has been skimping on advertising and sales incentives. Also, if growth requires the acquisition of still brands then capital should be deployed in that direction. Again, recent buyback activity flunks a basic test: it wasn’t excess capital. The money should have been spent elsewhere.

Investment Implications

I made a respectable profit controlling shares of KO by means of deep in the money LEAPS, against which I sold covered calls at the $43 level. After completing the review I closed the position, and plan to reinvest the funds into something where I am more confident of the value.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Tom Armistead has a total average return of 14.2% and a 68.4% success rate. He is ranked #309 out of 3906 bloggers.