While Zenabis Global (ZBISF) continues to trade around $1, the cannabis company continues to quickly expand output. Zenabis remains a sleeping giant with substantial plans for cannabis cultivation increases while the stock is still valued as a sleepy cannabis company.

Production Exceeding Estimates

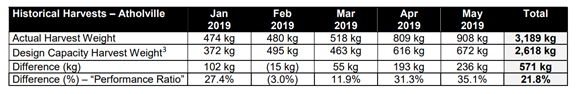

Zenabis Global remains in a quick ramp up plan with the original forecast for monthly cannabis production to not top 1,000 kg until August. For May, the company reached 908 kg to top the forecast by an incredible 35%.

Over the course of 2019 for a corporate history that only started at the end of 2018, Zenabis has exceeded harvest forecasts by an average of 22%. The scale remains very small, but the ramp from here is very quick.

(Source: Zenabis Global news)

Zenabis just got approval for an additional 9,800 kg of dried cannabis pushing the total approved capacity to 23,100. The company remains on target to increase cultivation capacity to 131,200 by Q3.

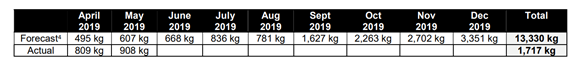

Zenabis forecasts December capacity to reach 3,351 kg, up from the forecast of only 607 kg in May. The average cultivation out performance would push the December monthly total to over 4,200 kg.

(Source: Zenabis Global news)

The story for the sleeping giant doesn’t stop with output that would still approximately triple from the December levels. In addition, Zenabis has facility plans that when fully built would increase cannabis design capacity to 479,300 kg. The company could easily top 500,000 kg with the ability to consistent exceed designs.

Big Revenue Boost

Zenabis Global could see monthly cannabis revenues reach C$21 million based on obtaining C$5 per gram from the December output. The company would be on a path to C$250 million in annual cannabis revenues.

The market is probably already overlooking that Zenabis has a propagation business that already generates C$16 to C$18 million in forecasted revenues for Q2. The company already has a total business with C$26 to C$28 million in quarterly revenues with cannabis monthly capacity forecast at only ~600 kg.

The one analyst covering the stock has the 2020 revenue target at C$240 million, but the company appears to have substantial upside to these estimates. The ability to start 2020 with the full 131,200 kg cultivation capacity reaching market would push the revenue targets far, far higher.

The biggest challenges in 2020 will be pricing. The company would need to maintain the C$5 per gram sales target in order to hit these revenue forecasts while a ton of industry capacity will reach market.

Zenabis has a listed market valuation of ~$250 million. The biggest headwind is the likely need to raise capital to fund expansion. The company had C$25.6 million in cash on hand as of March 31.

With the stock price slightly above $1, any additional funding could lead to substantial share dilution. The ideal solution would be a quick jump in the stock price to reflect the progress being made by the cannabis company followed by a quick equity raise.

Takeaway

The key investor takeaway is that Zenabis Global remains an emerging sleeping giant. The cannabis company has substantial growth plans right under the surface of investor view. Investors should view a fundraising as a benefit for the stock, but Zenabis would probably dip on any initial announcement. Use any weakness to build up a position in the sleeping cannabis giant.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position.