On the heels of poor revenue growth and two resignations from top Aphria (APHA) leadership members, cannabis research team Cornerstone Investments (CI) says there’s another situation that might present itself in the future: a company sale. (To watch CI’s track record, click here)

In early December, a short report came out with photos alleging the company had spent much less money on assets like farms and office spaces in Latin America than was reported to investors. In addition, a private marijuana company called Green Growths Brands made a hostile bid for the company. All these events together have made it very difficult for the company to clean up its act.

CI believes the removal of Chief Executive Officer Vic Neufeld and Co-Founder/Vice President Cole Cacciavillani is a big positive for the company’s image: “The two executives announced their resignation in the quarterly release citing personal reasons including age. However, investors might be relieved to see Vic out of the company due to a series of insider dealing allegations made by the short sellers – Vic being one of the main players being accused. We also view the change as favorable for the company and in fact, we have said many times in the past that a complete reshuffle of management is required for Aphria to enter a new page,” the blogger explains.

Is Aphria really a buyout candidate? “Aphria has an attractive portfolio of Canadian assets and we see potential buyers interested in Aphria as a platform acquisition to enter the Canadian cannabis market. The Canadian market has entered a relatively mature stage of development where barriers to entry for new entrants consist of long licensing timelines and existing supply agreements with provinces. For any large international player looking at the Canadian market, Aphria would be a sizable platform to launch into the new market. On the other hand, other Canadian LPs could be looking at Aphria as a way to gain market share in order to compete with juggernauts like Canopy and Aurora,” CI opined.

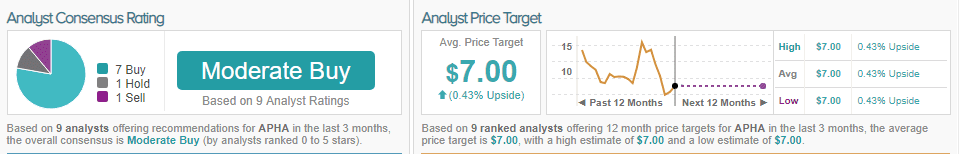

Even though investors have been tough on Aphria, analysts are still seemingly bullish. Out of 9 analysts, 7 are bullish, 1 is sidelined and 1 is bearish. The consensus price target of $7 is almost comparable to the price of a current share price. (See APHA’s price targets and analyst ratings on TipRanks)