Aphria (APHA), the Canadian cannabis company, has been under the heat lamps after a new scandal seems to be arising every which way we turn. First was a lengthy short report detailing shady business operations that seemed to have non-functional set-ups in Latin America in addition to documentation that seemed to show leadership paid a lot less money for those farms and offices than was documented and shown to investors. Now, the company is dealing with a hostile takeover offer from Green Growth Brands (GGB). The company is private in the U.S., but in November became listed on the Canadian Securities Exchange. The bid, according to Hindenburg Investment Research (HIR) is a “highly irregular deal” and is also a “desperate attempt to manufacture the appearance of demand.” (To watch HIR’s track record, click here)

HIR suggests that since nearly all of APHA management has been “caught with their hands in the cookie jar,” the ideal solution would be a buyout with a change of control, which would help leadership exit with their reputations intact. However, HIR suggests if a company would have no organization to save it, staging such an event would be a good way to create demand, while hoping a more credible option rolls in. The blogger even refers to the bid as a “fakeover.”

“We find it to be a remarkable coincidence that Aphria holds a major stake in its own ‘hostile’ bidder through a fund that is advised by its own CEO. A further review of Green Growth Brands’ SEDAR filings show other remarkable coincidences. A filing from just 1 month prior to the reverse takeover transaction shows the directors at the time. Two stand out in particular. Let’s start with Shawn Dym. If the name sounds familiar, that is because he is a current Aphria director,” HIR explains.

HIR continues to spot relations between the two companies, which is supposed to be a hostile bid, meaning the bidder goes straight to shareholders instead of confronting management first. GGB’s main backer had a recent joint venture with Aphria and its key insiders. Additionally, the blogger connects that recent GGB board members concurrently served on the board of Aphria or had numerous historical dealings with those who held essential positions in Aphria. HIR concludes with “We think Aphria is making a mockery of the capital markets […] With so much attention on Aphria and its irregular dealings we simply find it to be brazen that this deal has even been put on the table.”

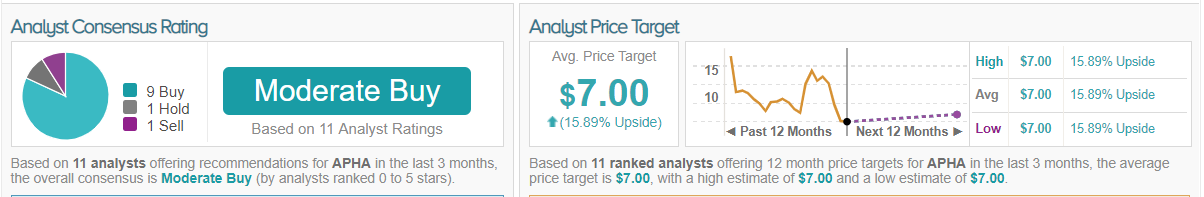

As if making a business out of the first emergence of legalized marijuana as an industry wasn’t shaking it up enough, APHA has continued to make it interesting. What’s next? TipRanks analytics shows that out of 11 analysts who are focused on the stock, 9 are bullish, 1 sidelined and 1 bearish. The consensus price target of $10.50 shows a near 68% upside. (See APHA’s price targets and analyst ratings on TipRanks)