Tilray (TLRY) is a mover and shaker out on the Street today, with investors sparking the stock on an almost 22% upturn. Why the excitement? Privateer Holdings, a top shareholder of the Canadian medical cannabis maker, issued a statement, emphasizing that it does not have plans to register, sell or distribute the 75 million shares that Privateer owns in Tilray when the lock-up expires next week.

A lock-up period is a period typically ranging from between three months and a year during which insider and institutional investors are restricted from dumping potentially millions of dollars worth of shares into the market. As the lock-up expiration date nears, traders often anticipate a stock price drop due to the additional supply hitting the market.

Michael Blue, Managing Partner of Privateer Holdings, wrote, “Privateer Holdings strongly believes in Tilray’s long-term global growth strategy and pioneering role in shaping the future of the legal cannabis industry. Given this, we do not have plans to register, sell or distribute the shares Privateer holds in Tilray during the first half of 2019. When we decide to distribute shares, we will do so in an orderly and deliberate manner to maximize tax-efficiency considerations for Privateer investors, while also taking into consideration potential impacts on Tilray’s public float. And we will do it in a way that reflects our long-term confidence in Tilray’s business model and management team.”

The statement was issued in reaction to concerns raised by short-seller InsideTech:

“[…] we expect Privateer to sell at a moderate level where Tilray valuations fall in line with its peers. It seems reasonable that Privateer would want to sell enough shares to profit from Tilray’s currently inflated values, but not so much that they would have to give up control of the company if they ever want to sell more later. That means they’ll want to hold well over their minimum 10% of shares. The importance of Tilray to Privateer also makes it seem unlikely they would damage investor trust by willfully tanking the price. That said, Tilray’s valuations right now are already just about as high its customers. At the time of writing, it boasts a Price/Book ratio over 35, and a Price/Sales on its last quarter over 160. There’s plenty of room to come down even if Privateer doesn’t sell much.”

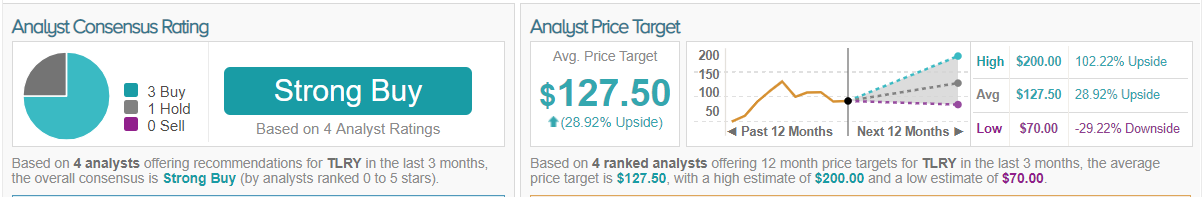

Overall, the word on the Street rings largely bullish on this medical marijuana producer, backing Privateer Holdings’s confident move, with TipRanks analytics demonstrating TLRY as a Strong Buy. Out of 4 analysts polled in the last 3 months, 3 are bullish on Tilray stock, while 1 remains sidelined. With a return potential of nearly 29%, the stock’s consensus target price stands at $127.50. (See TLRY’s price targets and analyst ratings on TipRanks)