Despite an attractive position and brand in the CBD space, Charlotte’s Web Holdings (CWBHF) has succumbed to a competitive market where regulatory questions have stalled growth opportunities. The stock is trading towards the lows below $11, but the bullish case on CWB is now difficult to make in the current market climate for CBD products.

Margin Compression

During 2019, CWB has made great progress entering new retail doors. Unfortunately, a lot of the larger FDM outlets have only sold topical CBD products due to the lack of legal clarity from the U.S. Food and Drug Administration. Independent retail stores that also carry ingestible products see topicals account for only 15% of sales.

Despite the FDM channel adding 787 retail stores during Q3, sales only grew about ~$0.1 million in the quarter. Similar to other companies in the CBD and cannabis space, the company has greatly expanded production capabilities to handle substantial growth that hasn’t occurred. In fact, the company just built a new facility that increases current capacity 10x while sales aren’t expected to meet those lofty growth totals.

CWB generated impressive 71.3% gross margins, up slightly from 70.8% last Q3. Sales grew a solid 41.8% to $25.1 million, but analysts were expecting a large jump in sales with a goal of topping $31.5 million in the quarter.

The end result is that previous impressive EBITDA margins in the 30% range dipped to only 3% in Q3.

Reduced Growth Targets

The company now forecasts 2019 revenues coming in below $100 million after previous guidance targeting $120 million to $170 million. The guidance for 2020 only predicts revenues growing in the 40% to 50% range for a $150 million maximum target.

Analysts were predicting sales reaching $280 million next year so CWB cut estimates by up to 50% here. The big caveat is that the company does predict that eventual regulatory clarity will provide for a substantial lift in sales, but the timing of any FDA move on edibles is highly unknown.

The company has a long-term EBITDA margin target of 35%, but the updated guidance provided no indication of where margins head in 2020 with the current market climate. In addition, the company was less clear on the impacts of additional competition other than this statement from the CEO.

“In an increasingly crowded, noisy and confusing CBD market, brands matter, and Charlotte’s Web is the most trusted hemp extract in the world.”

The stock still has a valuation of $1 billion so the market has extreme confidence that regulatory clarity will reinvigorate growth. At maximum EBITDA margins on the original forecasts of $280 million in 2020 revenues, CWB would generate about $98 million in 2020 EBITDA. The stock would be appealing at a market valuation of 10x EBITDA targets.

Unfortunately, the U.S. CBD sector is far too competitive and unclear to justify an investment at the current valuation. CWB won’t achieve these original goals.

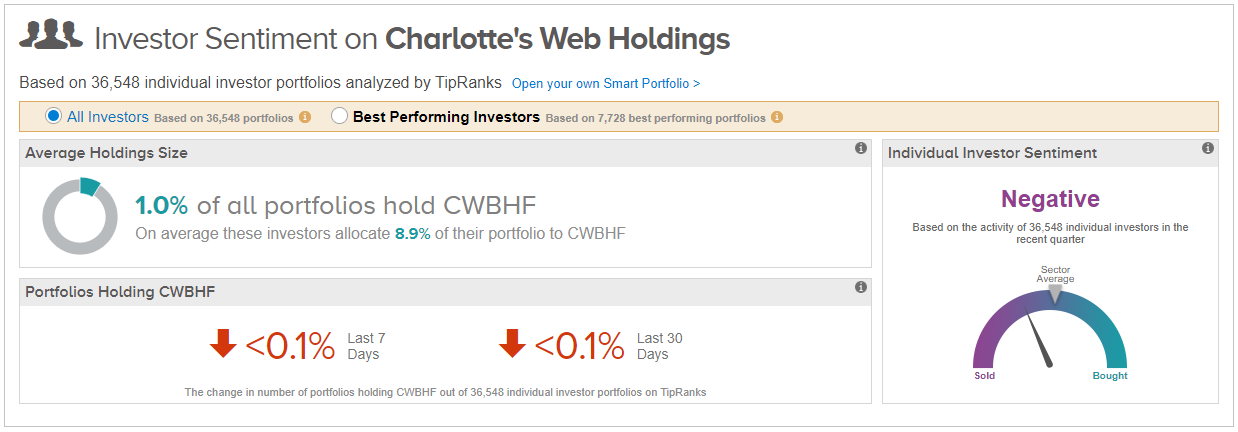

Investor Sentiment

Unsurprisingly, investor sentiment is negative, with individual portfolios in the TipRanks database showing a net pullback from CWB. Since shining to its July high, the stock has come way off, down over 50%.

Takeaway

The key investor takeaway is that CWB is another stock caught up in the turbulence of the current CBD market. The company likely has a bright future, but the cloudy present market climate makes the stock difficult to load up at the lows with a market valuation still approaching $1 billion. A better entry point is likely to occur in the next few quarters.

To find better ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.