The cannabis market is buzzing right now. But the recent rally in cannabis stocks has left some of the bigger names looking overvalued. For example Aurora Cannabis (ACB) – which has doubled year-to-date, is now facing a downside risk of 8% according to the Street. So with that in mind we focused in on stocks that still have massive upside potential ahead. We used TipRanks to focus in on the latest ratings from analysts with the strongest stock picking track record. Without further ado, here are three of the best cannabis stocks to be looking at right now:

Aphria Has More Room to Run

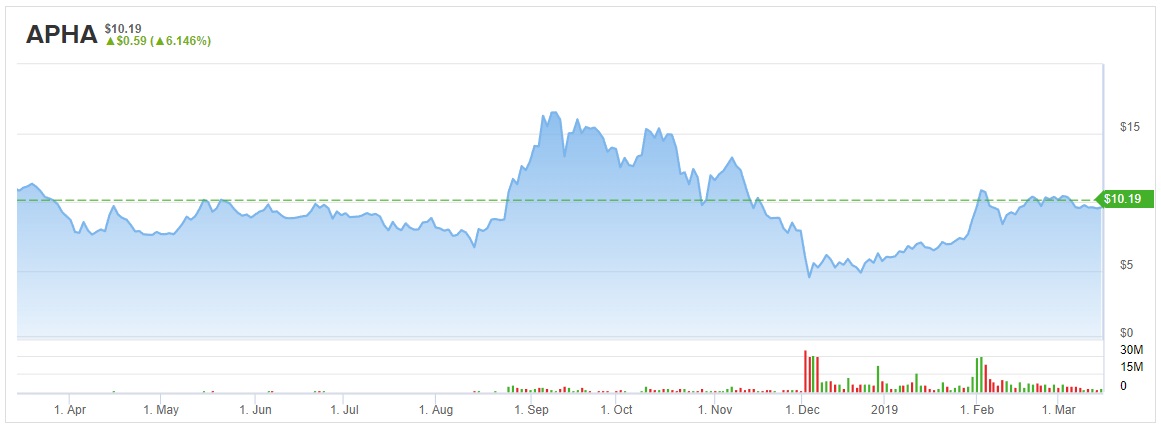

Over the last three years, Aphria (APHA) shares have exploded by over 850%, and according to the Street significant further upside potential lies ahead.

That’s despite a horrendous 2018, which featured a hostile takeover attempt, the exit of its CEO and allegations from a short-seller that insiders profited from acquiring international businesses at highly inflated prices. This was the central accusation of a short report that roiled the stock price, and renewed concerns about the company’s corporate governance.

Luckily the most serious allegations have now been refuted. A special board committee found that the price paid for businesses in Latin America was acceptable and that these assets are now progressing according to plan. And with newly-appointed chairman Irwin Simon now acting as CEO, short-seller Quintessential is appeased, tweeting: “With a new management team the company has a chance to a brighter future and we are accordingly moving on to new projects.” Simon is the founder, and former CEO of multi-billion company Hain Celestial Group.

In short, this low-cost cannabis producer is ready to rebound. This is reflected by recent ratings from the Street. Most notably, top-rated Clarus analyst Noel Atkinson has just reiterated his buy rating on APHA with a price target of $19.25. This translates into sizeable upside potential of over 85% from the stock’s current share price of $9.63. (To watch Atkinson’s track record, click here)

According to Atkinson the company needs to stop looking back and start executing to move the ball forward. He believes Aphria’s list of near-term operational milestones is significant, and successful execution could transform the company both in terms of financial results and investor sentiment. “If management can execute, there is the potential for a very substantial re-rating of the stock price from current levels” the analyst tells investors.

Overall, Wall Street’s confidence backing this cannabis stock is strong, with TipRanks analytics showcasing APHA as a Strong Buy. Based on 6 analysts polled in the last 3 months, 5 are bullish on Aphria stock, while only 1 remains sidelined. The 12-month average price target stands at $15.33, marking over 50% upside from where the stock is currently trading. (See APHA’s price targets and analyst ratings on TipRanks)

Zynerba Stock Looks Less Fragile

Zynerba (ZYNE) focuses on transdermal cannabinoid therapeutics. Its goal is to improve the lives of patients affected by rare neuropsychiatric conditions including Fragile X syndrome and autism spectrum disorder. Currently the company is trialing a groundbreaking cannabinoid (CBD) gel. This is the first and only patented permeation-enhanced CBD gel for delivery through the skin and into the circulatory system.

According to ZYNE, the gel offers multiple advantages when compared to the more traditional oral delivery. By skipping the digestive process, ZYNE can minimize psychoactive effects, limit drug-drug interaction, and avoid digestion of the drug by the liver.

And for investors, now’s the time to start taking a closer look at Zynerba’s investing potential. That’s because this cannabis biotech is gearing up for a transformational 2019 according to five-star HC Wainwright analyst Oren Livnat. Today, Livnat reiterated his buy rating on ZYNE with a $23 price target, which indicates jaw-dropping upside of over 350%. (To watch Livnat’s track record, click here)

The key data to look out for comes from Zynerba’s lead Fragile X (FXS) program. ZYNE continues to enroll patients for the pivotal Phase 3 study (CONNECT-FX), and the all-important data is expected in 2H19. Livnat is optimistic for positive data, although he admits that this is a risky call given other companies’ failure in this indication.

Livnat noted, “We reiterate our Buy, rating and see the current $105M market cap ($27M EV) leaving remarkable upside potential on positive data; as our $23 price target still reflects only a 35% probability of success in FXS.”

Overall, this cannabis-related player stands as a ‘Strong Buy’ name among Wall Street analysts. In the last 12 months, ZYNE stock has won four ‘buy’ ratings vs. only one ‘hold’ rating. With a return potential of over 300%, the stock’s consensus price target lands at $20. (See ZYNE’s price targets and analyst ratings on TipRanks)

Arena Stock Falls Under the Radar

Here we have a promising biotech that is currently under-the-radar for most investors. Unlike Zynerba, Arena (ARNA) devotes some of its pipeline to CBD therapeutics, while also devoting some of its pipeline to non-cannabinoid medicine.

This means that even though its most advanced drug currently in trial is Etrasimod (for colitis, Crohn’s and atopic dermatitis), for cannabis investors Olorinab is the key focus. Also known as APD371, Olorinab is an oral agonist of cannabinoid receptor 2 (CB2), which is part of the natural cannabinoid receptor system found in our bodies. The drug is designed to treat pain associated with gastrointestinal diseases like IBS and Crohn’s- a large and growing market.

And the best part is that these drugs could ultimately reduce the need for highly addictive opioid medications. As Bruce Yacyshyn, medical director at UC Health University Hospital, says: “There is a strong clinical need for non-opiate treatments for the management of chronic abdominal pain in patients with gastrointestinal disorders, including Crohn’s disease, ulcerative colitis and irritable bowel syndrome.”

As for the timeline, Olorinab Phase 2 trial in IBS pain is expected to begin in 2H19. Cantor Fitzgerald’s Alethia Young is keeping a close eye on these developments, writing “Over the next 12-18 months, we see opportunities like olorinab and etrasimod expansion as underappreciated at current levels. With many Ph2 and 3 trials reading out in 2020, we expect investors to take note, and we see little downside risk in the interim.”

She reiterates her buy rating on Arena with a $62 price target- indicating 33% upside potential from current levels. Alongside Young, Needham’s Alan Carr is the only other top analyst who has published a recent rating on Arena. He also rates the stock a Buy, writing “we think olorinab remains an unappreciated potential opportunity with commercial synergies with etrasimod.”

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.