Only two months ago, Seaport Global was taking a cautious stance on Canadian cannabis company Aphria (APHA), cutting estimates for both sales and earnings in part on worries about oversupply in the Canadian market. Two months later, and with Aphria stock down 8%, Seaport is changing its tune on Aphria — for the better.

In a note published Thursday, Seaport analyst Brett Hundley reiterated his “buy” rating and $13 price target (which he had lowered in June) on Aphria stock. For perspective, Aphria’s stock closed at $6.51 yesterday, so this implies upside of nearly 100%. (To watch Hundley’s track record, click here)

The analyst described two possible, positive outcomes of the marijuana supply debate in Canada, gleaned from conversations with Aphria management earlier in the week.

In one scenario, the analyst expressed doubt that “Canadian oversupply will develop, as many pundits expect.” Investment capital has been harder to come by for Canadian cannabis companies of late, you see. And with less capital, there’s less money available for expanding production capacity. Less capacity, less cannabis — and as a result, less (or no) oversupply!

Similarly, consolidation within the industry could give rise to more rational actions among the remaining players, who might limit supply in order to support prices.

The second scenario seems similarly benign. Assume supply does surge, driving down prices for dried marijuana flower. That won’t necessarily hurt sales or profits for Aphria (or other cannabis players) however, if they are able to pivot to focus on production of higher value-added products such as vapes and edibles. As Hundley explains: Aphria “management believes that more than enough extraction capacity is coming into place … to handle the new 2.0 market, and it believes that pricing will find an equilibrium across the market, as declines in flower are offset by benefits from higher value-added product prices.”

Result: Despite broad concerns of oversupply in the industry, Aphria management “seemed confident on reaching its $1B revenue run-rate by December, 2020.”

Now, it’s important to make a distinction here between “revenue run-rate” and “revenue,” period. By Hundley’s estimation, Aphria will only actually do about C$662 million in revenue in 2020, although if it does even that, it will equate to 256% growth from 2019 revenues. The $1 billion “run-rate” target refers to Aphria’s intention to accelerate production throughout the year, finally reaching a point at the end of 2020 at which it will be churning out roughly C$1 billion in sales per year. Hundley, by the way, is taking Aphria at its word on this — the analyst’s projection is for sales to get within a whisker of C$1 billion in 2021 — C$972.6 million.

Also worth pointing out: Both of these sales estimates, for 2020 and 2021, are up significantly from what Hundley was projecting just two months ago — further evidence that the analyst sees worries of marijuana oversupply abating.

Final point, regarding profits. As far as profits go, Hundley predicts none of those this year, but positive “adjusted earnings before interest, taxes, depreciation, and amortization” of C$68.2 million in 2020, growing 116% to C$147.2 million in 2021.

No word on net profits of course. Then again, that’s par for the course in marijuana-land. In the immediate future at least, there will be none.

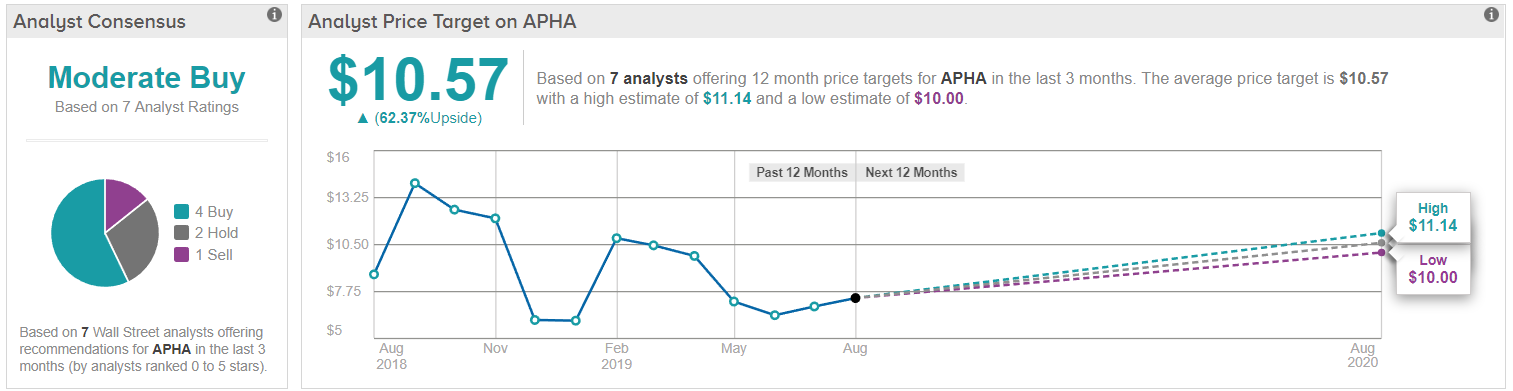

All in all, Wall Street sizes up APHA as a ‘Moderate Buy’ stock, as the bulls edge out the cautious on the cannabis maker. In the last 3 months, Aphria stock has received 4 bullish ratings versus 2 analysts hedging their bets, and 2 bearish ratings. Importantly, the consensus price target of $10.57 hints there could be over 60% upside for investors from current levels. (See APHA’s price targets and analyst ratings on TipRanks)