Planet 13 Holdings (PLNHF) hopes to gain a foothold in an entirely new market — marijuana tourism. The company launched the first phase of its cannabis Superstore near the Las Vegas strip in November, 2018. This first phase of the entertainment complex offers 40,000 square feet of multi-faceted entertainment space, including interactive attractions and more than 16,500 square feet of cannabis retail space. The Superstore will total 112,000 square feet when all phases are completed. Unlike most dispensaries that rely on repeat, loyal customers, Planet 13’s Superstore will primarily lean on tourists.

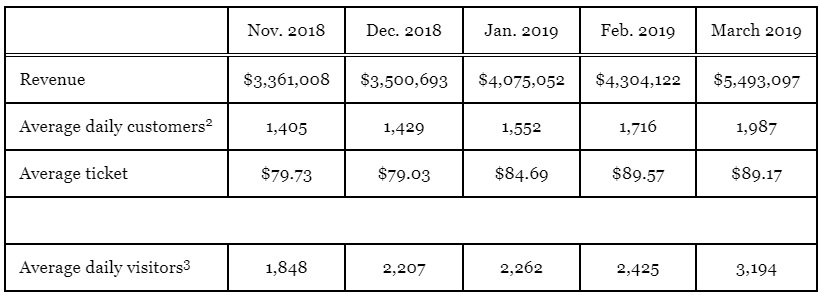

Today, the cannabis company surprised investors with stronger than expected metrics at its Superstore location in the month of March:

Specifically, Planet 13 reported average daily customers of 1,987 and an average ticket size of $89.17. The Company also reached its highest monthly revenue of $5.5 million in March. With average daily visitors count of 3,194, Superstore is one of the most visited dispensaries in the country.

As investors continue to digest the encouraging March numbers, shares of Planet 13 skyrocketed nearly 18% in Wednesday’s trading session.

With a “pole position” location and a tourist centric retail experience, Northland analyst Paul Penney believes Planet 13 is “ideally positioned to be one of the leading legalized/retail cannabis companies in the ever important Las Vegas marketplace.”

Penney reiterates an Outperform rating on PLNHF stock, with a price target of $3.75, which implies over 80% upside from current levels.

“PLTH’s most recent (March) SuperStore metrics continued to handily outperform our average store visitation and $ spend expectations. Further, we’re enthused with PLTH’s proactive efforts to launch / sell their own branded suite of products, which will equate to incrementally higher / sustained profitability levels. All in all, we believe PLTH is “hitting on all cylinders” which gives us added confidence in our YE 19’ and 20’ estimates,” Penney commented.

Overall, the analyst believes Planet 13 represents “an attractive/long term opportunity to invest in an under-known/small cap growth/cannabis company that is on the cusp of a near term Rev/profitability inflection point and creating a hard to replicate/strategic asset on a longer term basis.” The analyst continued, “On a valuation basis, we believe PLTH is attractive on both an absolute and relative valuation basis, as the shares trade at ~3.0X and ~9.9X our ’20 Rev and EBITDA estimates, respectively, which are both sizable discounts to the US centric cannabis players.”

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.