As the CannTrust (CTST) ordeal drags on, investors are becoming impatient as to what’s going to happen to the company and if they will recoup any of their losses. The stock currently sits around C$3.00 down from its peak of over $13.00. Some may wonder what CannTrust has done to mediate the situation and we are going to talk about what has transpired so far.

On Wednesday, July 31, CannTrust announced that they would retain a financial advisor to assist in reviewing the possible options for the company, including a potential sale. CannTrust has been through a lot recently announcing last week that their CEO knew about the unlicensed growing. He was fired and the Chair of the Board Eric Paul’s resignation was demanded. Despite the shakeup in management, CannTrust’s stock rallied on this news for the simple fact that this whole ordeal might be coming to ahead.

BMO analyst Tamy Chen recently highlighted some key information about the possibility of a sale that could be very important to many investors currently holding CannTrust or contemplating buying or trading the stock. The first and most important piece of information is the fact that Health Canada has not given their final verdict as to whether their grow facility and extraction facility will be allowed to keep their license. This is extremely important information because if Health Canada revokes their license, these assets will most likely be sold at a steep discount. (To watch Chen’s track record, click here)

Chen does, however, believe that these assets will provide a strategic advantage to a licensed producer that is behind on their production targets and would rapidly increase earnings especially if obtained at a steep discount. There has been a recent trend of LP’s acquiring companies for their extraction capacity and CannTrust definitely has some quality assets when it comes to extraction. The company has a 60,000 sq. ft extraction facility in Vaughan Ontario that would provide extremely valuable for any LP that outsources extraction or whats to add capacity to their current setup.

While the analyst remains sidelined on CannTrust stock with a Market Perform, her $6.00 price target suggests an impressive upside of 164% from where the stock is currently trading.

All in all, CannTrust’s outcome remains extremely unclear with basically the fate of the company sitting in the hands of health Canada. They were very unclear as to when they will announce the final verdict for the licenses on both facilities but it’s pretty obvious that if the company is allowed to keep their licenses then the stock will more than likely rebound and if their licenses get revoked then it has more room to fall. Investing in Canntrust at this current time is essentially like flipping a coin, so if you are considering it, tread with caution.

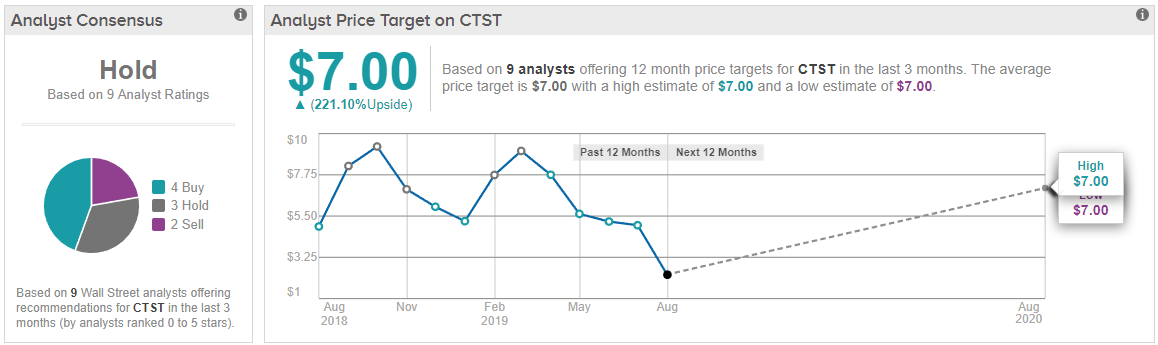

Wall Street has mixed reviews on CannTrust. Of nine analyst ratings tracked by TipRanks, four recommend Buy, three recommend Hold, and two Sell. The average price target is $7.00, which represents a 221% upside. (See CTST price targets and analyst ratings on TipRanks)

Disclosure: The author is long Canntrust.