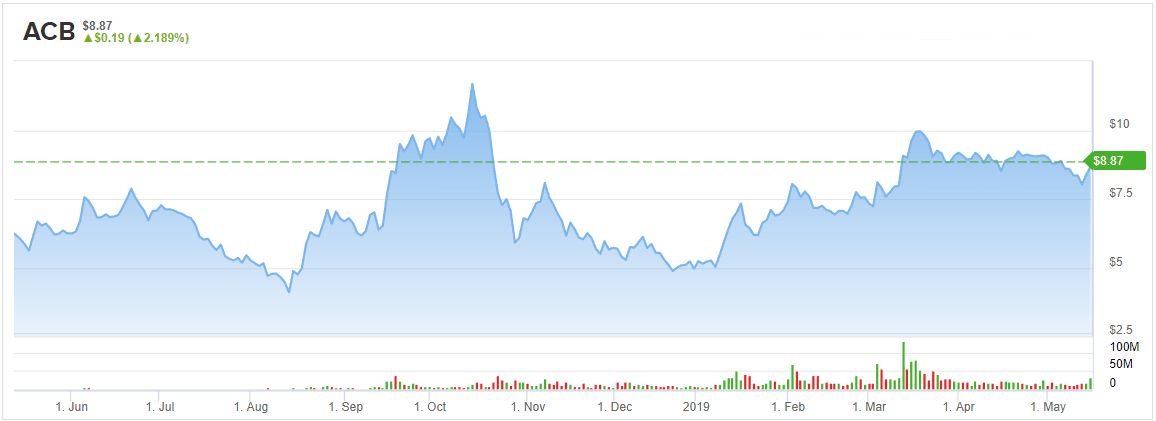

Cannabis giant Aurora Cannabis (ACB) reported its fiscal third-quarter results after market close on Tuesday. With shares skyrocketing nearly 40% over the last five months, investors were undoubtedly watching the medical marijuana maker closely.

By the looks of the stock’s 6% move higher over the past two days, Aurora slightly managed to lift investors’ confidence in the stock. The company posted Q3 revenue of C$65.1 million, which came in below expectations at C$68 million. Furthermore, the company’s EBITDA came out to a loss of C$36.6 million — significantly worse than the C$25.5 million loss analysts were expecting.

Clearly, the numbers came out weaker than what the Street had expected, so why the stock price went up? “The likely outcome is that Aurora stock still spins a bullish market thesis due to global expansion and the further opening up of the domestic Canadian cannabis market. The market likely gives the stock a pass on weak results.” Stone Fox Capital predicted.

BMO analyst Tamy Chen says she remains cautious on the path to profitability, as she reiterates a Market Perform (i.e ‘hold’) rating on ACB stock, while raising her price target to C$12.00 (from C$10.00).

Chen commented, “We are forecasting total volume sold of 17k kg in FQ4/19, implying an 80% q/q increase. While the Canadian market remains undersupplied due to industry production-ramp challenges, the potential for material growth in industry recreational sales beyond existing distribution channels remains unclear over the near term given the limited roll-out of retail stores. Aurora management indicated the opportunity to sell into the existing distribution infrastructure is due to inconsistent supply by other licensed producers of in-demand products (i.e., higher THC and higher CBD) […] We have reset our forecasts based on our revised outlook for a more gradual ramp of industry production, bricks-and-mortar retail store openings, and value-added products.”

Most of the Street is more confident than Chen’s sidelined stance, with TipRanks analytics showcasing ACB as a Strong Buy. Based on 9 Wall Street analysts polled in the last 3 months, 7 rate Aurora stock a Buy, while 2 (including Chen) suggest Hold. The average price target among these analysts stand at C$14.33, which implies 20% upside from current levels.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Read more on ACB: