Alone among the “Big 4” Canadian cannabis companies, Edmonton, Alberta-based Aurora Cannabis (ACB) lacks a deep-pocketed “brand name” partnership in the world of consumer goods, to provide the funds it might need to broaden its business as the legal marijuana industry gains credibility, and expands into the consumer market. As a result, Aurora — arguably more than any other Canadian cannabis stock — has a real need to raise cash, and as brokerage Jefferies reports, this is a big reason why this week, Aurora raised some cash by cashing out its final block of shares in peer company The Green Organic Dutchman (TGOD).

As Jefferies analyst Owen Bennett explained in a note yesterday, Aurora began investing in TGOD back in January 2018 with a 33.3 million-share purchase made at the bargain price of $1.65 a share. It doubled down on that bet when TGOD IPO’ed in May 2018, buying a further 6.3 million shares at $3.65 per share, raising its stake in TGOD to about 18%. But it soon became apparent that these were opportunistic — not strategic — investments on Aurora’s part.

In fact, by October of last year, Aurora had already begun unwinding its position in TGOD, selling off shares from October 2018 through January 2019 at prices ranging from $5 to $6 a share — and even allowing warrants it had acquired to expire unexercised. This selling spree culminated Tuesday in Aurora’s announcement that it would liquidate its remaining 10% stake in TGOD in a “block trade” at $3 per share — about 15% below TGOD’s market price at the time of the announcement.

Why sell out, and more precisely, while sell out at a share price below what it had paid for much of its TGOD stake as recently as May of last year?

For one thing, Bennett notes that at the same time as it was selling off its TGOD stake, Aurora was also casting acquisitive eyes at TGOD rival Whistler, which like TGOD, specializes in the production of “organic” cannabis, finally confirming its intention to buy Whistler outright in January 2019 in a $175 million deal. Unless Aurora intended to corner the market on organic weed, therefore (and perhaps invite antimonopoly scrutiny from Canadian regulators), it only made sense to sell TGOD in order to buy Whistler.

But a second reason for liquidating its stake in TGOD, as Bennett also points out, was to raise cash. “The $86.5m” received for its TGOD shares “is a welcome cash boost for Aurora given a lack of financial backing vs larger peers,” commented the analyst. And raising this cash helps to address “one of the main bear points we see around Aurora.” It also, not incidentally, helps to avoid (or at least delay) the necessity of Aurora making further dilutive share issuances to raise the cash it needs to expand.

What does it mean for TGOD?

Of course, TGOD is itself a publicly-traded company, and investors in it may wonder what Aurora’s selling-out means for them? In Bennett’s opinion, it doesn’t necessarily mean anything bad. For one thing, the reasons for Aurora selling out of TGOD are logical on their face, and don’t necessarily imply that Aurora saw anything wrong with TGOD’s business from which it wished to extricate itself. For another, with Aurora’s ties to the company now severed, the way could be clear for another, more strategic buyer to make a bid for TGOD, and thus “get exposure to an attractive organic segment, given other players here are scarce.”

With Aurora out, there’s now an opportunity for someone else to get in — and should an acquirer emerge, this should only mean good things for TGOD’s stock price.

All in all, Bennett rates both ACB and TGOD a ‘buy’, with respective price targets of C$14.00 and C$6.50. (To watch Bennett’s track record, click here)

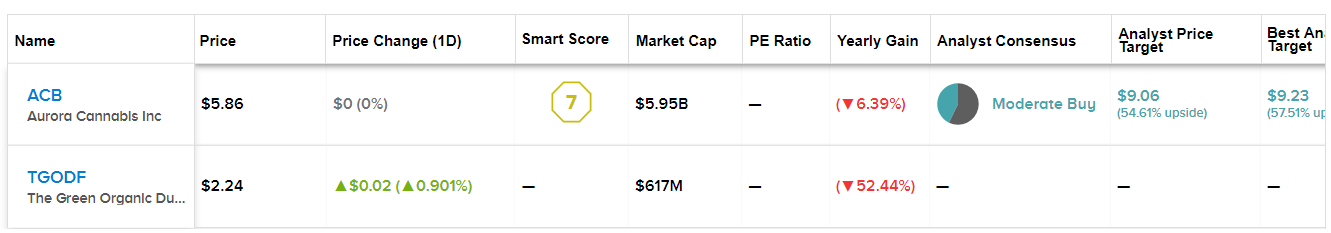

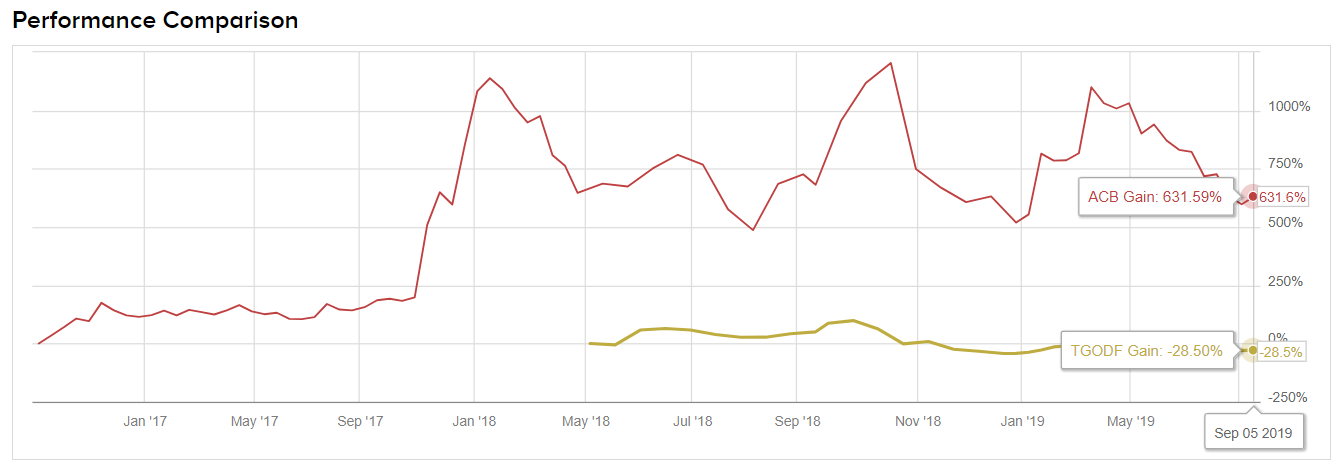

See Comparison results for ACB and TGOD: