Today is kind of good news, bad news day for investors in Canadian cannabis company Aurora Cannabis (ACB). On the good news side, Piper Jaffray just initiated coverage of the stock. But here’s the bad news: Piper isn’t particularly impressed with it.

Aurora Cannabis boasts “industry-leading capacity,” earns “a higher gross margin than most Canadian peers” (on the order of about 50%), and is on track to “report positive EBITDA in its F4Q19,” notes Piper analyst Michael Lavery. Despite all these positives, however, when Lavery runs Aurora through his “stoplight” checklist — evaluating how the company looks from the perspective of its balance sheet, its valuation, and its progress at penetrating marijuana markets in Canada, the U.S., and Europe, it turns out that Aurora’s “premium” valuation relative to other publicly-traded marijuana stocks may not actually be justified. As a result, Lavery initiates coverage on ACB stock with a Neutral rating (i.e. ‘hold’) and a US$7.00 price target. (To watch Lavery’s track record, click here)

Lavery begins by awarding Aurora (and its rivals) either 0, 1, or two “points” in each of five categories, emerging with a total “matrix score” at the end. He then compares this score to the company’s enterprise value-to-sales ratio, based on anticipated sales in fiscal year 2020, and compares this valuation to the “matrix score.”

In Aurora’s case, the likelihood of cannabis being in oversupply in Canada next year gives Aurora a score of zero there. A lack of “visibility” into how Aurora plans to enter the U.S. market for CBD oil, and for THC (legal marijuana), meanwhile, generate nil scores for the company in those categories as well.

Aurora does get a point in the category of EU market positioning (where the company is currently awaiting “Good Manufacturing Practices” certification. Finally, Lavery gives Aurora a point for balance sheet strength. Albeit Aurora has the second-to-worst net cash position among the cannabis companies Piper covers, its position is at least positive in that it has $150 million in net cash.

In total, therefore, Lavery gives Aurora Cannabis a “matrix score” of two points out of a possible 10 — which is precisely as bad as it sounds. He then divides this number into his estimate of a 10.4x enterprise value-to-FY2020 sales valuation to end up with a “valuation vs. score” ratio of 5.2, which is by far the highest (i.e. worst) score out of the four companies surveyed.

If you’re interested, Cronos Group (CRON) was next-worst-ranked at 1.8x, then Canopy (CGC) Growth at 1.3x. Of the four firms surveyed, Tilray (TLRY) came out looking cheapest of all at just an EV/sales ratio only 1.1 times its matrix score of 5).

At an enterprise value of 10.4 times Lavery’s best guess at its fiscal 2020 sales, Aurora Cannabis is both the most expensive of the four marijuana stocks reviewed — and also the worst risk when that valuation is compared to the company’s proprietary (and convoluted) “matrix score.”

Conversely, Tilray has both the cheapest EV/sales ratio (5.7x) and the best risk score, while Cronos and Canopy both score somewhere in the middle — just as their valuations, 9.1x EV/sales each — fall between the valuations of Aurora and Tilray.

When you look at it that way, Lavery’s recommendation to avoid buying Aurora Cannabis stock makes sense. To paraphrase the old real estate investing rule of thumb: Don’t buy the most expensive grow-house on the block.

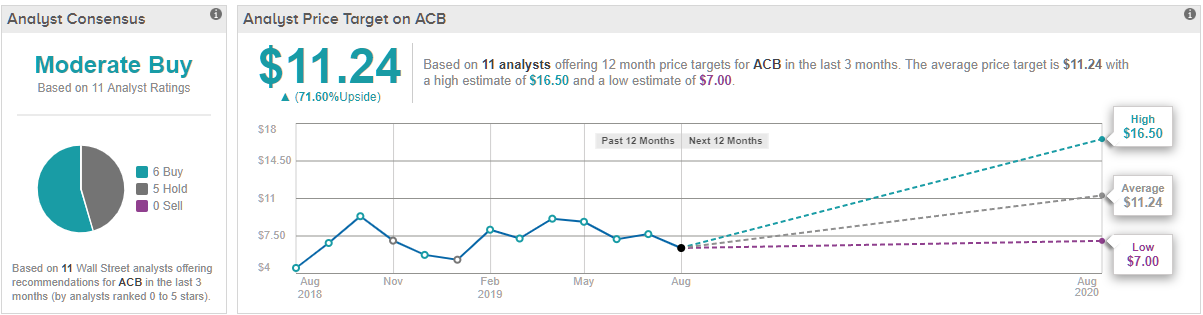

All in all, Wall Street almost evenly split between the bulls and those choosing to play it safe. Based on 11 analysts polled in the last 3 months, 6 recommend a Buy on Aurora stock, while 5 suggest Hold. Notably, the 12-month average price target stands at $11.24, marking a nearly 72% in return potential for the stock.

To discover Wall Street’s best-rated trending stocks on TipRanks, click here.