While Aurora Cannabis (ACB) isn’t expected to release its fiscal fourth-quarter results until late September, the second-largest Canadian cannabis company provided investors with a sneak peek at selected metrics from the just-completed quarter, and by all accounts, it appears to have been a blowout. In reaction, shares of Aurora climbed nearly 10% on Tuesday to close just above $6.80.

Specifically, Aurora estimates that its total production for the fourth quarter will be above analyst forecasts of 25,000 kilograms, in a range of 25,000 to 30,000 kilograms. The company also expects to report net fourth-quarter sales (excluding excise tax paid) between CA$100 million and CA$107 million, with year-end revenue of between CA$249 million and CA$256 million.

This comes at a time where many cannabis investors are growing concerned about the future of the sector and whether these companies are going to deliver solid numbers this quarter. Many of the stocks within the sector have taken a beating over the past few months and investors are looking closely for any signs of a turnaround.

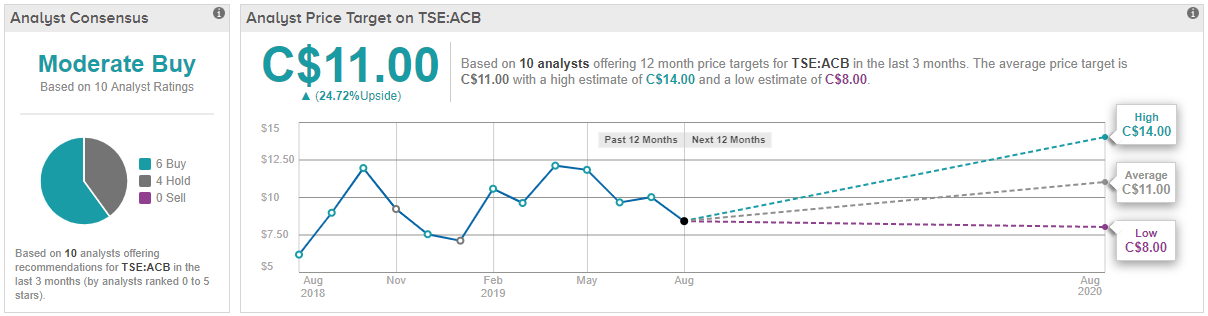

The strong earnings guidance from Aurora enjoyed Wall Street’s collective attention. 4-star BMO analyst Tamy Chen reiterated a Market Perform rating on Aurora stock, but slightly lowered her price target to CA$11.00 (from CA$12.00), which implies about 25% from current levels. (To watch Chen’s track record, click here)

Chen noted that although the company expects to generate CA$100 million to CA$107 million in revenues, this is in-line with her CA$107 million estimate and well below the prior mean of CA$113 million. While the analyst has revised her estimates on a positive note for the most part, she has lowered her recreational cannabis sales volumes from her prior forecast of 33% market share to 24.4% (up from 18.5% last quarter). Chen has also revised their EBITDA forecast to 8 million from 10 million.

In a long-term bullish scenario, the analyst sees the stock reaching CA$13.00, which could stem from future strategic partnerships as well as faster than expected international growth. The analyst also presents a more bearish scenario, which could lead the stock price ~8% down and based on a possible delay in positive EBITDA.

All in all, with the stock price still well off 52-week highs, it’s going to be very exciting to see if Aurora Cannabis can keep its growth.

What do other analysts say about the cannabis maker? TipRanks analytics show that out of 10 analysts, 6 are bullish on Aurora stock, while 4 remain sidelined. The consensus price target of CA$11.00 shows a potential upside of about 25% from current levels. (See ACB’s price targets and analyst ratings on TipRanks)