It’s safe to say that Aphria (APHA) totally shocked the market and many of its investors after blowing its fiscal fourth-quarter earnings out of the water.

The stock surged 40% this past Friday as the company recorded over 100% increased sales quarter-over-quarter for recreational marijuana and topped analyst estimates on revenue of C$128.6 million. A huge portion of the company’s sales was driven by CC Pharma which distributed pharmaceutical products and medical cannabis to thousands of pharmacies across Germany.

Given the encouraging earnings results we just saw, Seaport analyst Brett Hundley maintains a ‘buy’ rating on APHA stock with a $13.00 USD price target. (To watch Hundley’s track record, click here)

Q4 revenue of 128.6MM compared to Hundley’s estimate of 77.3MM represents a huge surprise. Furthermore, the analyst likes the fact that Aphria is making great progress on its facilities and noted that Aphria 1 is now fully planted with 200 thousand plants which bring its total count to 500 thousand. Also, the Aphria diamond facility has been completed and awaits Health Canada’s licensing. The company expects to produce around 255 thousand kilograms of cannabis annually. Once the company is operating at full production capacity, management expects to achieve annualized revenues of 1 Billion by the end of 2020.

“We believe that early execution against its 2020 goals will be paramount for Aphria being able to further rebuild its share price and valuation. As we have discussed in recent research, store counts in Canada are lacking in highly populated provinces like Ontario and Quebec, however, we do believe that the launch of the 2.0 market will help to bring more consumers into the system,” Hundley noted.

This all seems like great news but what’s next for Aphria?

The company is focused on building its brands across Canada including its specialty brand Broken Coast. Aside from Canada, management sees a massive opportunity in the German cannabis market after winning three lots in the German tender process. The company anticipates that it will see revenue from those three lots in Germany by 2021 and until then it will export its products from its EU-GMP certified facilities which should receive their certification in FY2020. Aphria has mentioned the US cannabis market including CBD and HEMP but it does not seem to be on the top list of priorities.

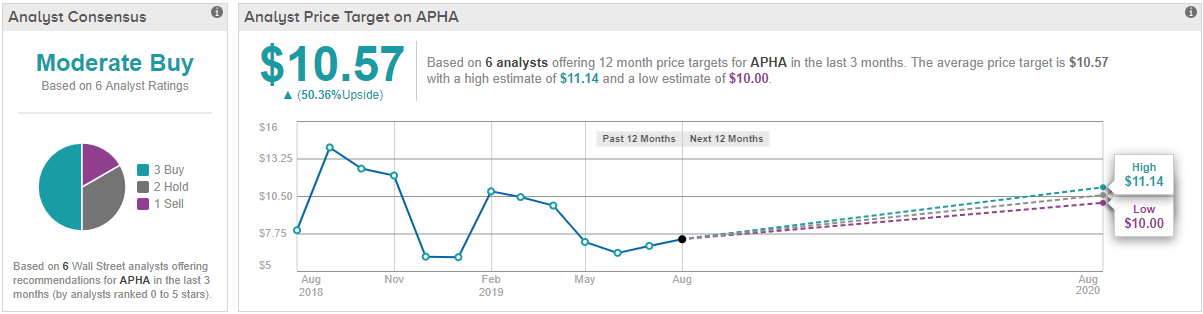

All in all, Aphria has proven a lot in a short period of time, but let’s see if the company can continue to deliver for the quarters to come. When looking at Wall Street’s stance, Hundley is not the only bull, as TipRanks analytics showcase APHA as a Moderate Buy. Out of 6 analysts polled in the last 3 months, 3 rate Buy on Aphria stock, 2 suggest Hold, while only 1 recommends Sell. The 12-month average price target stands at $10.57, marking about 50% upside from where the stock is currently trading. (See APHA’s price targets and analyst ratings on TipRanks)