Upscale dispensary chain MedMen (MMNFF) reported its fiscal third-quarter operating results yesterday afternoon, and they were not pretty. Even with sales growth of close to 20% from the previous year, MedMen lost $63.1 million on an operating basis. This included a more-than-threefold increase in general and administrative expenses tied to construction and new store openings, and a substantial jump in sales and marketing expenses.

However, Seaport analyst Brett Hundley believes huge upside remains in a long term window, as he reiterates a Buy rating on MedMen stock with a $7.00 price target. (To watch Hundley’s track record, click here)

With a market cap of $1.1 billion, MedMen is the leading cannabis retailer in the U.S. and continues to expand (its losses?). The most important market for MedMen is in California, equating to roughly $25 million during the quarter. The company now operates 10 stores in the state, and it continues to expect average store revenue of $20 million/year.

Hundley noted, “Without a doubt, most investors around MMNFF want to see the company better manage cash burn and the overall capital structure. If management can better execute against such metrics, we think that company valuation will improve against what we deem is another widely held investor view: the strength of MedMen’s brand, footprint and asset base. In addition to simple cost cutting efforts, we think that MedMen is garnering meaningful efficiencies as it widens its footprint inside CA. The company continues to generate cash ($70MM+) from property sales to the Treehouse REIT. Additionally, it has thus far secured $100MM of funding from Gotham Green as a part of its $250MM convertible financing. So long as the company maintains growing responsibility in the middle of the P&L, alongside continued top-line growth in key markets like AZ, NV, FL and MA, we think that capital structure concerns could ease, as well, making for renewed shareholder value creation.”

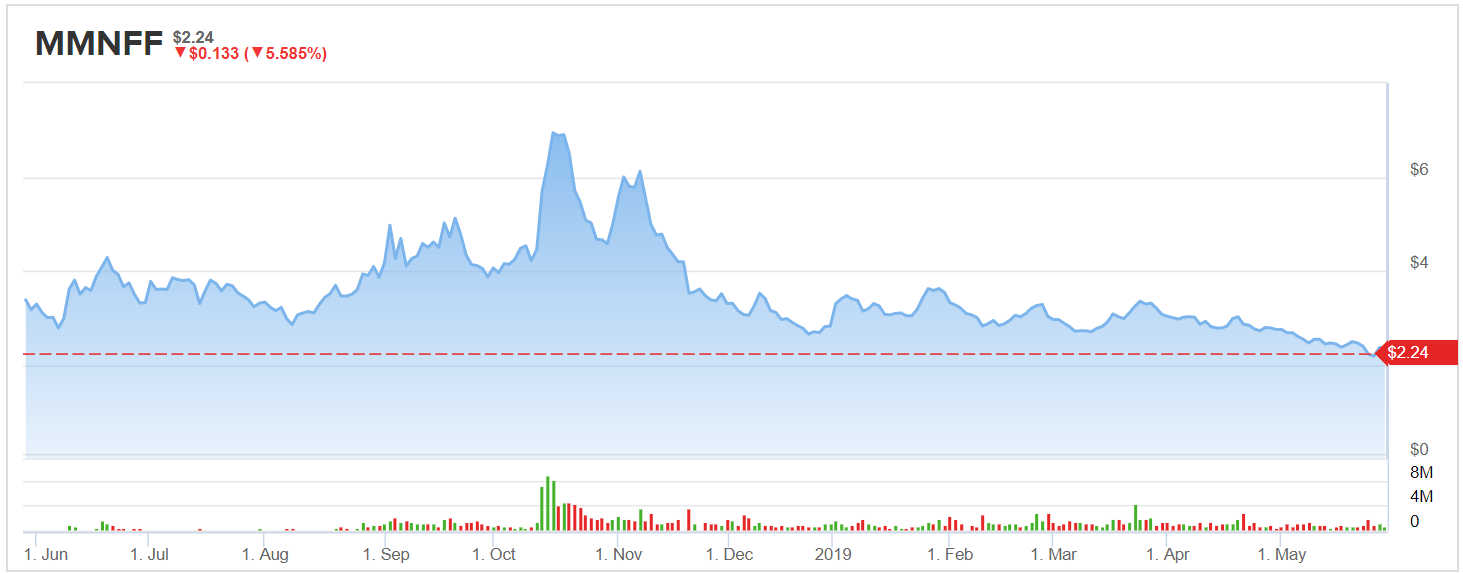

The rest of Wall Street echoes Hundley’s bullish play, as TipRanks analytics exhibit MedMen stock as a Strong Buy. Out of 4 analysts polled in the last 3 months, all 4 are bullish on the stock stock. But despite analysts’ bullish view, MedMen shares fell nearly 6% to $2.24 in Thursday’s trading session.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.