Apart from spooking the markets to an alarming degree, the coronavirus is having a profound impact on all global industries; from travel to energy to tech, the fallout is being felt across the board.

The cannabis industry will most likely be added to the list of those counting the effect of the outbreak, too; much of the cheap cannabis hardware is manufactured in China, including vapes, product packaging and specialty equipment.

This begs the question: Is the bottom in yet for the beleaguered cannabis industry or can it actually drop any further? This is a question that has come up repeatedly over the last few months. Following several years of dramatic expansion, the sector’s upward curve came to a grinding halt last year. In 2019, previous high-flying cannabis stocks came crashing down as supply shortages and regulatory issues hampered Cannabis 2.0’s progress.

In a recent report, investment firm Jefferies’ published its latest thoughts on how it sees the sector developing over the next year and beyond.

“We increasingly expect to see a strong divergence between those that can deliver financially near term and those that can’t. With the industry showing signs of share price support in recent months, there is an opportunity for significant re rating in the names that impress in this sense,” said Jefferies’ analyst Owen Bennett.

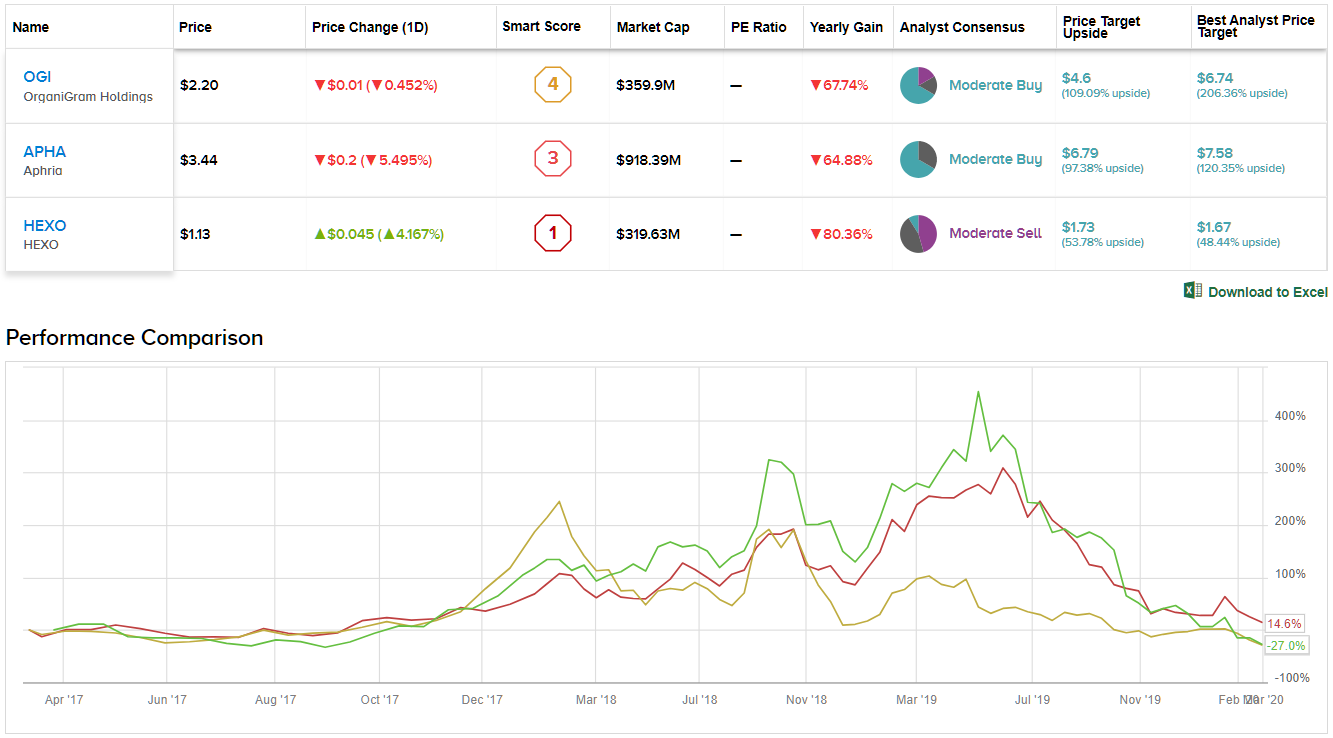

With this in mind, we decided to cut a trail through the smoke and look deeper into 3 cannabis stocks under Jefferies’ coverage: 2 of which the investment firm is bullish on, and another posting bearish sentiment. Using TipRanks’ Stock Comparison tool, we lined the 3 side by side to get the lowdown. Let’s check them out.

OrganiGram Holdings (OGI)

In an industry where concern over long term cash flow is prevalent, OrganiGram is holding up nicely. Keeping operations tight and staying relatively small without the burden of debt whilst focusing on steady growth and controlling costs has meant that compared to other players in the sector, the company has no short-term cash worries. As like most of its peers, though, OrganiGram endured a torrid time in the market during 2019, shedding 32% of its value during the year.

OrganiGram boasts its own proprietary three-level indoor growing system and is one of a number of cannabis companies with supply agreements with every Canadian province. The company has also taken advantage of Canada’s Cannabis 2.0 market, in which edibles and derivatives have been introduced to consumers. OriganiGram has just released a new line of vapes and edibles; The Edison line includes Edison vape pens and Edison Bytes, a line of premium cannabis products targeted at the high end of the market.

Bennet remains bullish on OrganiGram. The analyst notes that despite a temporary blip in FQ4, the company returned to positive EBITDA in the last quarter, marking five positive quarters out of the last six.

Bennett said, “We continue to believe OGI are set up well to succeed, sales and market share still being very respectable vs many peers, and profitability industry leading. On wider sector read-across, we think fears of oversupply/ price compression are likely overdone, and much more relevant for the low quality/value end of the market… We see no reason why Organigram cannot continue to deliver on its impressive metrics in the months ahead. There is opportunity for material upside if it is able to do so, its valuation (surprisingly for us) still relatively depressed.”

Accordingly, Bennett reiterated a Buy on Organigram. The analyst’s price target stays at US$6.14 and implies possible upside of 178%. (To watch Bennett’s track record, click here)

What does the Street make of OrganiGram’s prospects, then? A Moderate Buy consensus rating breaks down into 6 Buys, 2 Holds and a single Sell. The average price target is US$4.60 and suggests potential gains of 107%. (See OrganiGram price targets and analyst ratings on TipRanks)

Aphria Inc (APHA)

With a market cap of $1.07 billion Aphria is one of the cannabis industry’s bigger players. Compared to the rest of the sector’s bloodbath in 2019, the company was one of those left relatively unscathed, with the share price only losing 7% throughout the year. In 2020, though,the stock is down by 34%, so far.

Bennett, though, is undaunted by Aphria’s current low valuation. In fact, Aphria remains the top pick across the firm’s Canadian coverage. Bennett argues that as consumer preferences come into the fold over the next 12 months, a key metric which is set to become increasingly important is that of brand positioning. “Our proprietary brand positioning matrix takes into account average rating, potency (THC) levels, number of SKUs available and product pricing. On this analysis Aphria is a standout, holding the top two positions with Good Supply and Riff,” the analyst said.

On top of an attractive valuation, Aphria also has a strong international presence. Last year, Aphria bought German company CC Pharma and is only one of only three companies in possession of a German cannabis license. Germany remains at the core of its business; in the company’s latest earnings report, CC Pharma distribution revenue came in at C$86.4, representing almost 72% of the company’s total net sales.

Bennett concluded, “Aphria has a strong balance sheet, is EBITDA positive, and is taking share. Despite recent updates also being supportive (not the case at many peers), and while also a good likelihood of positive catalysts in the months ahead (consensus beat and US move), its valuation remains one of the most compelling.”

Bennett, therefore, kept his Buy rating on Aphria intact. The price target, though, comes down a notch, from $8 to $7.5. Still, the revised figure presents possible upside of a plentiful 124%.

Surveying the consensus breakdown, 4 Buys and 2 Holds published by the analysts over the last 3 months, add up to a Moderate Buy consensus rating. With an average price target of $6.79, the Street projects upside of 97% in the year ahead. (See Aphria stock analysis on TipRanks)

HEXO (HEXO)

Hexo reflected the problems the cannabis industry faced in 2019. Once viewed as Quebec’s leading cannabis company, the stock took a hammering last year, with the share price declining by a depressing 72%. 2020 is not off to a much better start either; Hexo is down by a further 30% year-to-date. In contrast to both previous tickers, though, Bennett doesn’t foresee a turnaround for Hexo on the horizon.

Bennett notes that following Hexo cutting FY20 expectations by a substantial amount, he became more constructive on the company’s prospects. Since then, though, the analyst has been alarmed by a number of data points that suggest “fundamental headwinds are perhaps worse than we had originally assumed.”

Bennett explained, “The company announced the launch of a deep value brand which is now facing increasing competition, a series of capital raises would suggest very difficult times ahead, and inventory levels are rising to nervous levels (even after a number of write downs at Q1). Perhaps more significantly for Hexo, and validation of its business model, against the above backdrop, and with the company losing money and overall industry commentary less helpful, we see very little chance of Hexo adding another FMCG partner as part of its hub-and-spoke model any time soon.”

Analyzing Hexo’s brands, Bennett concludes that none currently stand out, while the possibility of Hexo turning a profit over the next two years is increasingly unlikely: “With C$100m of CapEx already guided for FY20, there is a good chance funds could run out,” the analyst concluded.

Bennett, therefore, downgraded Hexo from Hold to Underperform. The price target comes down, too from $1.50 to $0.75, and implies potential downside of 34%.

All in all, HEXO gets a Moderate Sell rating from the analyst consensus, with 5 Holds, 5 Sells, and single Buy rating given in recent months. (See Hexo price targets and analyst ratings on TipRanks)