As the Canadian cannabis market undergoes growing pains, the industry stocks have taken a beating. The majority of the stocks in the sector are down over 50% as industry demand remains weak due to a lack of retail stores and a mounting flood of supply pressuring prices.

Seaport Global analyst Brett Hundley recently reset expectations for the cannabis sector. Hundley is generally neutral on all of the Canadian stocks due to expectations of substantial revenue cuts with a more bullish view of the U.S. multi-state operator market.

A major sign of his bearish view was the maintaining of a Buy rating on Aphria while lowering the price target from $13 to only $8. All of the other stocks in his coverage have Neutral ratings including updated numbers on Aurora Cannabis and HEXO after the later company recently slashed estimates and pulled guidance for FY20.

We’ve delved into these three cannabis companies poised to struggle from low demand in Canada primarily due to a lack of retail stores all the way into 2021:

Aurora Cannabis (ACB)

Hundley makes big hits to the expectations for Aurora Cannabis in FY20 and FY21. The major basis for holding these large cannabis stocks was a concept of revenues reaching C$1 billion in the next year or so, but the analyst no longer thinks that is the case.

In fact, Hundley is now far below consensus. The analyst reduced FY20 revenue estimates from C$589 million to only C$391 million. The new FY21 target was slashed by more than 50% with revenues dipping from C$992 million to only C$410 million. The forecast is that revenues only grow 5% during FY21.

The resulting impact is that Aurora Cannabis doesn’t even reach profitability in FY21 despite the original guidance from the company of reaching that target in FQ4’19. Hundley now has the company producing an adjusted EBITDA loss of C$35 million in FY21.

The stock still has a market valuation approaching $4 billion which is relatively expensive for a company with revenue estimates from Hundley of only $311 million in an out year. Stocks don’t usually maintain +10x sales valuations while losing money in a slow growth environment. Based on these estimates, Aurora Cannabis should have a Sell rating.

TipRanks indicates Wall Street is evenly split between the bulls and the fence sitters on this cannabis stock. Out of 15 analysts polled in the last 3 months, 6 are bullish on Aurora stock, 6 remain sidelined, while 3 are bearish on the stock. Yet, consider that the 12-month average price target of $6.83 reflects healthy upside potential of nearly 90% from where the stock is currently trading; in other words, optimism circulates among analyst sentiment even amid apprehension. (See Aurora stock analysis on TipRanks)

HEXO Corp. (HEXO)

HEXO was a clear-cut case for estimate reductions after the company slashed last quarter estimates and pulled full year guidance. Hundley slashed revenue estimates for the next couple of years to factor in near zero growth.

The analyst has HEXO only generating FY21 revenues of C$122 million, down from previous estimates of C$613 million. The company is now forecast to have breakeven adjusted EBITDA next fiscal year.

The lack of guidance from HEXO and the quick departure of the CFO leave the numbers near impossible to model. Based on a market valuation of $660 million, the stock is far too expensive for the numbers outlined by Hundley.

My expectations would be for the company to exceed these lowered estimates, but the stock isn’t touchable until more confidence exists in the ability of HEXO to operate in the current competitive market in Canada.

The company needs to double or triple these revenue estimates from Hundley to make the stock a buy here. Investors have no reason to touch the stock here.

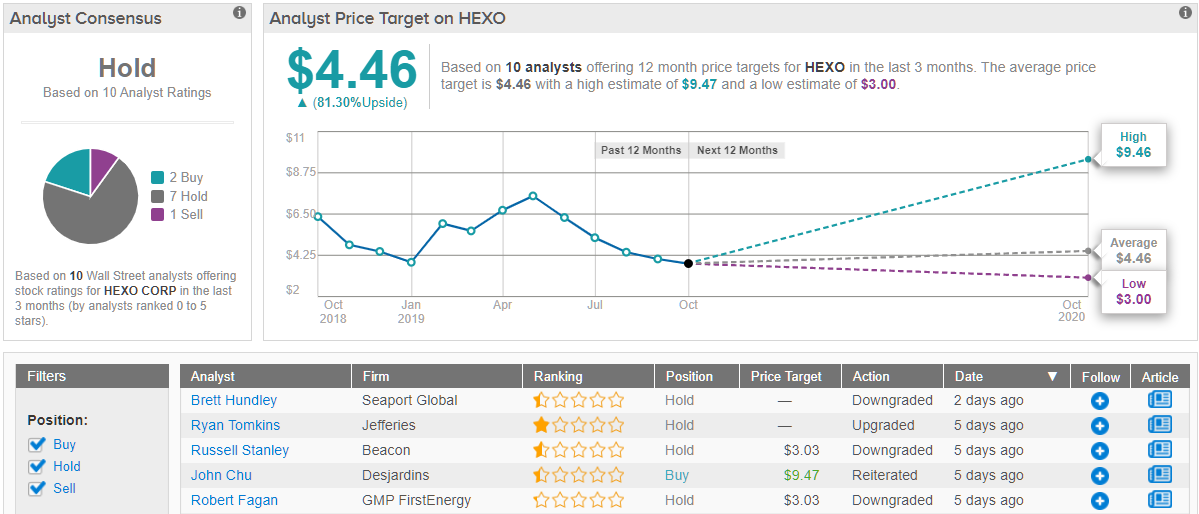

Wall Street believes Hundley is smart to play it safe when it comes to the HEXO’s prospects ahead, as TipRanks analytics reveal the stock as a Hold. Out of 10 analysts polled in the last 3 months, 7 remain cautious on HEXO stock, 2 are bullish, and one is bearish on the stock. However, the $4.46 price target suggests a potential of over 80% from the current share price. Most likely a result of the sudden tumble and analysts’ inability to turnaround new price targets so quickly. (See HEXO stock analysis on TipRanks)

Aphria (APHA)

Hundley was most bullish on Aphria in the Canadian cannabis sector despite a massive cut to the price target. The analyst had actually modeled revenues to C$131 million in the FQ1 just reported and the company didn’t even reach this target reporting C$126 million.

A lot of the revenue miss came from a switch in the German operations to improve profitability, so the overall analyst estimates weren’t cut in an update. The other estimates by analyst Brett Hundley appear far too bearish as acknowledged by the analyst, yet the one comparison already in the market was too high.

The new number already had Aphria seeing FY21 revenues dip to C$593 million, down from C$973 million. The analysts now has revenues estimates for FY21 at C$596 million so he has slightly more confidence in Aphria after the FQ1’20 report.

Possibly most interesting was the company maintaining FY20 revenue guidance of at least C$650 million while Hundley reduced targets to only C$546 million. A wide gap now exists between where the analyst maintained estimates and the updated guidance from the company.

The biggest positive for Aphria is the expectation of generating positive EBITDA as liquidity could become a major problem in the sector. The ability to generate cash from operations and over C$400 million on the balance sheet will help Aphria survive any further market pressure.

The stock soared on the basis of maintaining revenue estimates for the year while Seaport is predicting limited growth despite the company having over 5 months of Cannabis 2.0 to contribute to the FY20 results. Aphria is only trading up to $5.50 on the market perception of positive results so Hundley still sees plenty of upside on the stock.

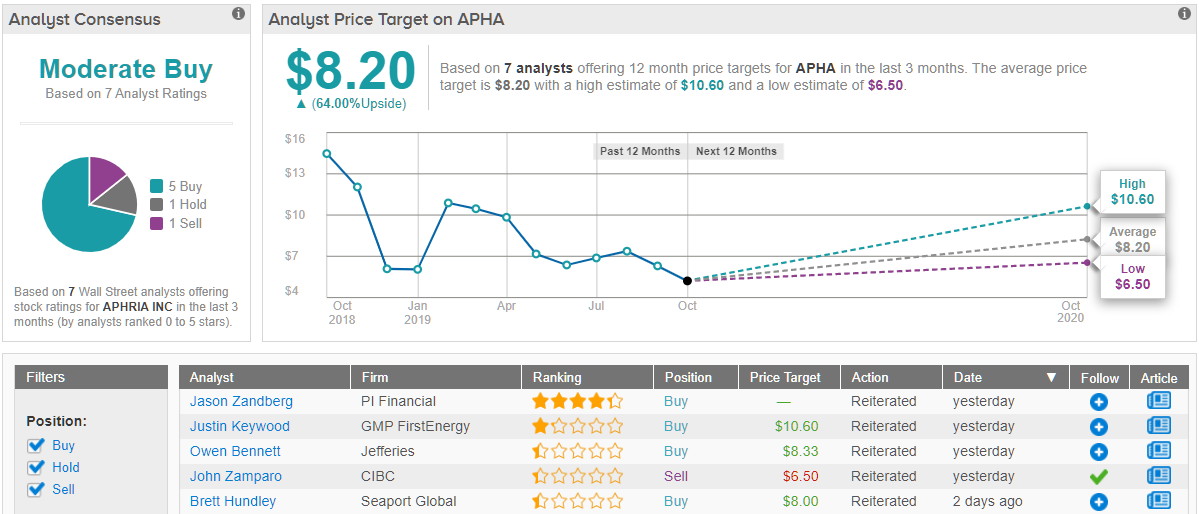

If we step back and look at the bigger picture, we can see that overall the stock has a ‘Moderate Buy’ analyst consensus rating. In the last three months, the stock has received 5 “buy” ratings and just one “hold” and one “Sell” ratings. With an average analyst price target of $8.20, analysts are projecting upside potential of 64% from the current share price. (See Aphria stock analysis on TipRanks)