Jim Simons is a numbers man who has built a Wall Street fortune on back of his analytical prowess. In 2018, the man earned a monster $1.6 billion- the best in the hedge-fund arena. Keep in mind, this is considering without working each day, having retired 8 years ago from the fiercely lucrative Renaissance Technologies firm he founded in the early 1980s. Yet, Simons still plays a key role and reaps the rewards of a firm that takes Ph.D. math geniuses to task; all to figure out understated patterns in Wall Street data that can be anticipated in advance.

The guru got his start running later in life, in his 40s when he founded the firm that has won him his life’s fortune. Simons is not one to hedge his bets, guiding Renaissance Technologies to bite into holdings in thousands of stock picks. Though the statistics might indicate it a pipe’s dream to realize 30% in yearly returns, this firm crunches numbers and now manages $60 billion. The hedge funds Renaissance manages for outside investors performed well in 2018. For example, the Renaissance Institutional Equities fund last year returned 8.5% and the Renaissance Institutional Diversified Global Equities fund returned 10.3%. Simons’ earnings were further driven by Renaissance’s Medallion fund, a $10 billion black-box strategy that only invests money belonging to Simons and his Renaissance partners and employees. For this reason, Wall Street pays attention to Simons’ portfolio moves.

Notably, the guru of profit-making algorithms has made a strong bullish leap toward one of Wall Street’s leading cannabis giants. Simons led Renaissance Technologies to jump right into Aurora Cannabis (ACB) stock with a new position of 788,595 shares worth $6.3 million.

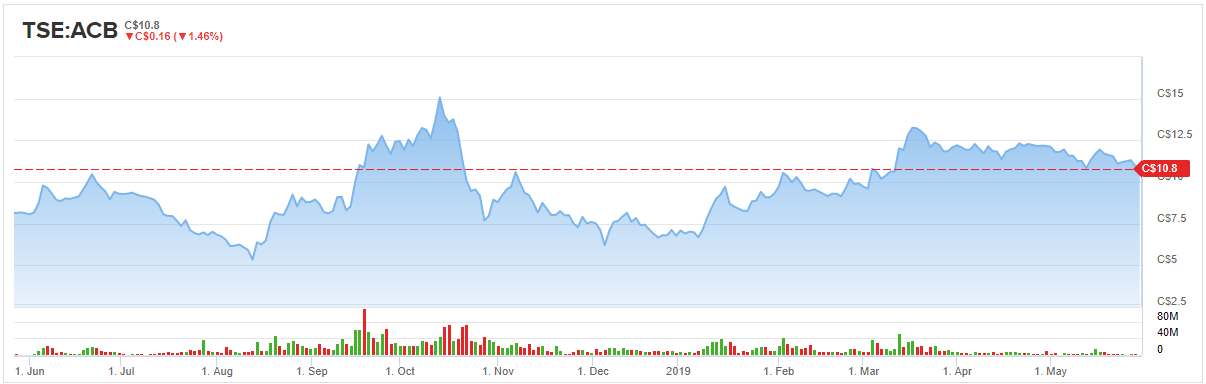

Desjardins analyst John Chu echoes the numbers wizard’s upbeat first quarter play with enthusiasm of his own. Chu rates ACB stock a Buy and sees over 50% upside with a C$16.50 price target. (To watch Chu’s track record, click here)

Chu noted, “The ramp of Aurora Sky and the overall economies of scale from its Sky and Bradford facilities should help drive margins higher. In addition, with extraction capacity improving, we should see a shift toward higher margin products (oils, soft gels etc). Lastly, with fewer supply constraints, the company should be able to service the Canadian medical market (it appeared to hold back on growing this market given supply constraints) as well as the international market— both of which generate higher margins than the recreational market.”

“We continue to see Aurora making meaningful progress. Specifically, production capacity (flower and extraction) continues to ramp up and sales continue to move higher, especially recreational sales, despite weak industry sales,” the analyst concluded.

Canaccord’s Matt Bottomley added, “We believe Aurora continues to hold the #2 rec market position in Canada (after Canopy) and is further distancing itself from its most immediate peers in the space with a strong showing out of the gate […] Although improved, FQ3/19 was still a ways away from profitable; however, management once again reiterated its expectation of achieving positive EBITDA in FQ4/18 as a result of its favourable market position and increased production capacity afforded by the recent completion of its Aurora Sky and MedReleaf Bradford facilities.”

Bullish on ACB’s bigger picture, Bottomley rates a Speculative Buy rating on ACB stock with a price target of C$13.50, which suggests a 25% upside potential from current levels.

All in all, TipRanks exhibits a largely confident analyst consensus surveying the cannabis giant’s market opportunity. Out of 8 analysts polled in the last 3 months, 7 are bullish on ACB stock, while only one remains sidelined. With a return potential of 33%, the stock’s consensus target price stands at C$14.33.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.