New Age Beverages Corporation (NBEV) closed a deal in December acquiring marketing company, Morinda Holdings for $85 million with $75 million of it being paid in cash and the rest in stock. This news paired with the lightening of federal regulations against the sale of marijuana has made the cannabis stock more desirable to Northland’s top analyst Michael Grondahl. The analyst reiterates an Outperform rating and raises his price target from $6 to $8, which shows a potential upside of about 29% from where the stock is currently trading.

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, 5-star analyst Michael Grondahl has a yearly average return of 30.5% and a 72% success rate. Grondahl has a 36% average return when recommending NBEV, and is ranked #51 out of 5,140 analysts.

Grondahl commented, “Of Morinda’s ~$240M in revenue, we believe ~40% is from Japan, ~35% from China, ~6% from the U.S., with the remainder in other countries. We believe the important point of the acquisition is how well NBEV can utilize the 160K DTC distribution points to sell other brands in the portfolio and especially NBEV’s CBD products. From management comments on the M&A call, it sounds like ~50% of Morinda’s revenue is subscription based at ~$100 per month in orders. Management also went on a worldwide tour to promote NBEV’s products and get integration started. With this acquisition on a pro forma basis, NBEV shares are trading at ~1.3x EV/TTM revenue and even cheaper on a forward basis.”

The legislation, which is now colloquially called the Farm Bill, has removed the red tape for businesses distributing CBD products, but not if the product is labeled with claims it has healing/medicinal benefits. While some analysts have suggested this provision will threaten the company’s business, Grondahl doesn’t see it as an issue. “We believe NBEV CBD products could ship in the near-term. Note that even with a Hemp Farming Act approved federally, CBD falls under FDA regulation if a product is claiming to have medical benefits. While we believe this does not impact NBEV’s initial CBD rollout (no claims of medicinal benefit), it is something to keep in mind for the CBD space as a whole.”

Looking ahead, there are multiple retailers and even a large convenience store that have shown interest in the NBEV products and brands. While management didn’t make it clear during the third quarter call in 2018, the analyst guesses the retailer could be Walmart and the convenience store 7-Eleven. NBEV also anticipates 2 pharmacies and 3 big box retailers to reach out about potential business deals in the near future.

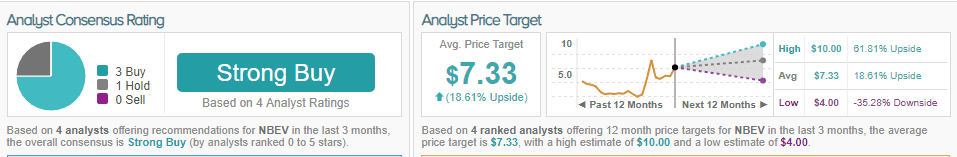

Grondahl is not the only fan of the cannabis company on Wall Street, as TipRanks analytics exhibit NBEV as a Strong Buy. Based on 4 analysts polled in the last 3 months, 3 rate a Buy on NBEV stock while 1 maintains a Hold. The 12-month average price target stands at $7.33, marking a 19% upside from where the stock is currently trading. (See NBEV’s price targets and analyst ratings on TipRanks)