HEXO’s (HEXO) latest earnings report did nothing to assuage concerns over the near term growth prospects of the company, as losses continue to pile up and future growth prospects are weak.

In this article we’ll look at its recent earnings report, and specifically at its heavy exposure to Quebec and why that doesn’t bode well for HEXO.

Latest Earnings

Net revenue in the reporting period reached $14.5 million, up from $5.7 million year-over-year. Most of that increase came as a result of the legalization in October of last year.

The company lost $62.4 million in the quarter, up from the loss of $12.8 million in the same reporting period last year.

Revenue per gram for recreational cannabis dropped sequentially from $4.74 per gram to $4.35 per gram. Net revenue per gram for recreational pot fell from $3.51 to $3.24 from the prior quarter. Both were attributed primarily from sales returns and price adjustments in the reporting period.

Operating expenses in the quarter were down 25 percent, dropping from $46.9 million to $35.1 million. That was attributed to a cut in G&A, marketing and stock-based compensation expenses.

In a healthy market, cuts in marketing expenses could be a concern, but with Canadian retail cannabis outlet growth being so slow, it makes sense to cut back because no amount of marketing can result in more cannabis stores opening. I expect this to change as a significant amount of cannabis stores open, but that’s going to take time.

The company held cash, cash equivalents and short-term investments of $73.5 at the end of the quarter. It has a $65 million credit facility with a syndicate of chartered Canadian banks. That includes $50 million term credit and $15 million revolving credit. The company also closed a $70 million private placement of unsecured convertible debentures at 8 percent, maturing on December 5, 2022.

The major challenge HEXO has going forward on the revenue side of the business is its heavy exposure to Quebec and its monopoly cannabis retailer Société québécoise du cannabis (SQDC).

Approximately 75 percent of the adult-use cannabis shipped in the quarter was to the Quebec market.

Quebec and Société québécoise du cannabis

In a recent note to clients, analyst Greg Mcleish of Mackie Research estimates the Quebec cannabis market to needs about 800 cannabis stores to meet demand. According to the SQDC website, it only has 24 retail outlets at this time. Another 20 are projected to be operational by March 2020, but that is far below the number needed to move HEXO’s sales needle in Quebec.

The reason for the disastrous retail situation, McLeish says, is from the “heavily government-controlled” network failing “to rise to the occasion.” He said the same about the retail cannabis fiasco in Ontario.

Here’s the breakdown of sales per region for HEXO:

“The SQDC contributed 3,080 kg, ALGC contributed 474 kg, OCS contributed 518 kg, other provinces and private retailers contributed 124 kg.”

Another issue in Quebec is its raising the legal age of cannabis consumption to 21, starting on January 1, 2020.

Quebec is also severely limiting the potential for derivatives, saying edibles “may not be sweets, confectionary, dessert, chocolate or any other product attractive to persons under 21 years of age.”

Also limiting the impact of derivatives is the fact SQDC isn’t going to offer vapes or related products for sale. The only derivatives allowed to be sold in Quebec will be “non-alcoholic, cannabis-infused beers, teas and other drinks…”.

As it relates to HEXO, it means it’s going to struggle to find more ways to boost revenue if it remains so heavily exposed to Quebec. The company needs to find distribution outlets outside the province in order to reverse its downward trajectory.

Consensus Verdict

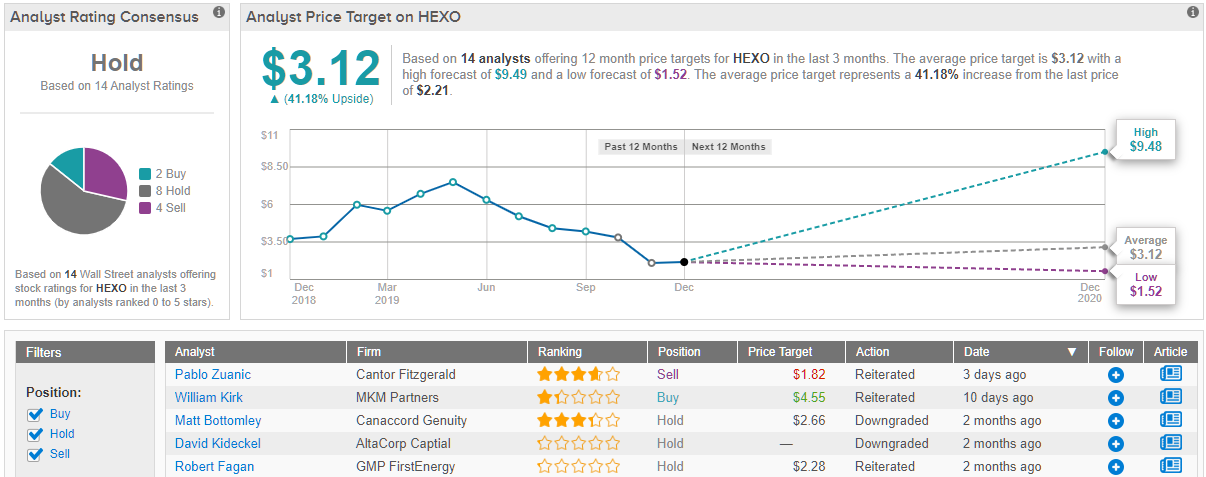

TipRanks reveals HEXO as a stock that has not drawn a vote of confidence among Wall Street opinion. Out of 14 analysts polled in the last 3 months, 8 are sidelined, 4 are bearish, while only 2 are bullish on the stock. However, the 12-month average price target stands at $3.12, which implies about 41% upside potential from current levels. (See HEXO price targets and analyst ratings on TipRanks)

Conclusion

HEXO has more headwinds than tailwinds impacting its performance, and much of that comes from forces outside of its control.

The problem for HEXO, as with all cannabis companies competing in Canada, is the more government-controlled provinces of Quebec and Ontario have terrible on execution concerning the licensing process for retail cannabis stores, and that has caused the sector to vastly underperform, and leave a lot more black market operators as low-cost competitors.

Taking into account the fact HEXO has about 75 percent of its sales exposed to Quebec, which not only has far too few stores, but is also limiting the potential of derivatives sales more than any other province in Canada, it’s imperative that it starts to spread its risk across other provinces. If it doesn’t, it’s going to come under immense pressure when considering the provinces aren’t showing much in the way of urgency in rolling out more retail stores. That’s especially true in Quebec.

As with Canopy Growth, HEXO has also overestimated demand for cannabis oils, which has also hampered its revenue growth, margins and earnings.

The bottom line is there are no legitimate catalysts that suggest any progress in the near term. Anyone interested in going long in the cannabis sector should stay away from HEXO.

Check out these 5 ‘Strong Buy’ stocks that top Wall Street analysts recommend.