HEXO (HEXO) traded down 20% on Boxing Day after the company had a surprise equity raise. Considering the company recently completed a sizable convertible debt offering, the move on an inopportune day to raise equity doesn’t offer a promising outlook for the stock of the struggling Canadian cannabis company.

Boxing Day Equity Offering

On December 26 or Boxing Day in Canada, HEXO announced a definitive agreement to sell 14,970,062 shares to institutional investors at an offering price of $1.67. The deal was an ~14% discount to market prices and raised gross proceeds of $25 million. In addition, the offering includes warrants to purchase 7,485,032 shares at an exercise price of $2.45 per share.

Back in October, HEXO raised $70 million via a direct placement of 8.0% unsecured convertible debt. Those investors included the CEO Sebastien St-Louis and other board members.

In addition, the company had an at-the-market offering that would seem more appealing than a substantially discounted offering and the issuance of warrants not typical in equity offerings of strong growth companies. The company will have a lot of questions about this surprise offering on the next earnings call.

Liquidity Problems

The stock is down to $1.48 in trading that day in a signal the market has problems with the signs from this surprise equity offering. HEXO ended the October quarter with a cash position of $73.5 million and the company raised the additional $70 million from the convertible debt for a total pro-forma cash position of $143.5 million.

In the last quarter, HEXO reduced operating expenses sequentially, yet the Canadian cannabis company still produced a substantial EBITDA loss of $24.6 million. The company has an operating expense base of $35.1 million with net sales of only $14.5 million.

The gap between sales and expenses is concerning considering the company has 70% of revenues from Quebec where Cannabis 2.0 products are essentially blocked. HEXO plans to slowly rollout beverages, vapes and edibles during 1H’20, but the prospects appear sparse due to the initial regulations in Quebec.

The company had forecasted HEXO being EBITDA positive in 2020, yet a surprise equity raise at such a discount has the merits of suggesting the company isn’t progressing towards EBITDA positive as forecast. Analysts forecast FQ1’21 (October) revenues jumping to $23.8 million, but the amount is both problematic as a target and questionable as to how HEXO turns such revenues into positive EBITDA even with higher Cannabis 2.0 margins.

The company still has the attractive joint venture with Molson Coors (TAP). The numbers from this Truss Beverages JV won’t be consolidated in the quarterly results, but the ability of this beverage business to generate value to shareholders is based in part on the company cutting the bleeding from their main operations.

After this equity offering of nearly 15 million shares, HEXO will have 336 million shares outstanding for a stock value of over $500 million.

Analyst Consensus

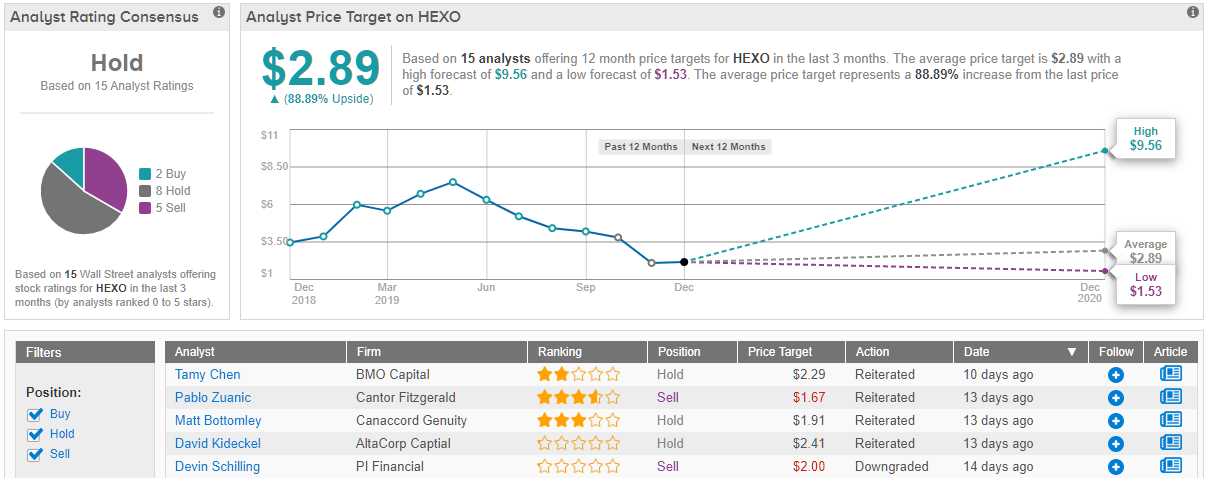

According to TipRanks, a company that tracks and measures the performance of analysts, the consensus on Wall Street is that HEXO stock is a “hold” for investors. Out of 15 analysts polled in the last 3 months, 2 are bullish on HEXO, while 8 remain sidelined and 5 are bearish. But TipRanks might as well have said “buy” — because analysts, on average, think the stock, currently at $1.53, could zoom ahead to $2.89 within a year, delivering 89% profits to new investors. (See HEXO’s stock analysis)

Takeaway

The key investor takeaway is that the projected revenue ramp in CY20 appears unlikely considering all of the negatives for Cannabis 2.0 products. One has to wonder how HEXO reaches EBITDA positive based on realistic financial projections for next year. The surprised equity offering will place investors on the sideline until the company can generate results that better reduce future liquidity concerns.

Check out these 5 ‘Strong Buy’ stocks that top Wall Street analysts recommend.