Cronos (CRON) stock spent most of last year underwater from its IPO price. Of course, after Altria announced a $1.8 billion investment in the Canadian pot producer in December, it was off to the races. That news is three months old, however — so why is Cronos still going up? Let’s take a closer look.

It’s been less than a year since Canadian medical marijuana producer Cronos made its debut on America’s Nasdaq — the first such “pot stock” to do so — but what a year it’s been!

Since its opening trade at $8.24 a share, Cronos stock has skyrocketed nearly 150% in value, closing Wednesday trading at $20.45. Such strong price movement hasn’t gone unnoticed at Toronto boutique investment banker GMP Securities — but neither is it much appreciated.

In a note last week, GMP’s Martin Landry lamented that Cronos’ run-up in share price has forced GMP “to the sidelines.” But here’s the thing: It’s not just the fact that Cronos has more than doubled over the past year that has the analyst worried — it’s the fact that Cronos stock is up nearly 74% since 2018 began, less than a month-and-a-half ago. (To watch Landry’s track record, click here)

Worse, argues Landry, this run-up in share price has been on no material news. Altria’s announcement of a $1.8 billion investment in Cronos happened way back in December, and it’s been basically crickets ever since. Despite this lack of new news, Cronos stock has left the rest of the “HMMJ cannabis index” far behind, beating the index’s returns by a factor of two over the last six weeks, making Cronos far and away the most richly-valued cannabis stock out there.

The price is the thing

None of this is to say that Landry doesn’t like Cronos. The contrary would be more accurate. The analyst says it sees no problems with the company’s operations, with its expansion plans, or its management team, for example. And the analyst sees Altria’s investment in Cronos, as a potential game changer for the Canadian company.

Problem is, even with Altria’s support, Landry sees the correct value for Cronos stock today as “$CAD 24” — which would be about $US 18.10. At today’s prices, that makes Cronos stock about 13% overpriced, and deserving of a downgrade to “hold.”

Price isn’t the only thing

And yet, while Landry says it’s valuation and valuation alone behind this downgrade, if you read between the lines, the analyst does appear to have other reservations about the stock. Indeed, there’s a whole laundry list of concerns:

- Cronos’s need to make more progress deploying capital in the US market — which could be complicated by a lack of opportunities to legally deploy such capital in the U.S.

- Cronos’s failure to penetrate further into the Canadian recreational market — its home turf.

- Cronos’s apparent lack of sufficient inventory to supply the Canadian recreational market.

- And of course, Cronos’s “limited revenues in relation to its sizeable market cap.”

When the best Yahoo! Finance can say about Cronos’s financials is that its trailing-12-month revenue is “N/A,” pretty much any valuation seems expensive relative to that.

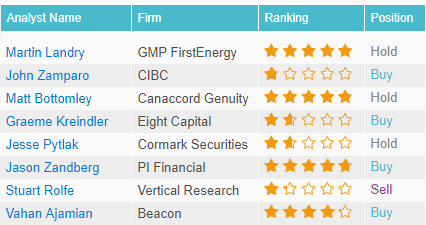

Overall, Wall Street is not convinced just yet on this cannabis player, but cautious optimism is circling, as TipRanks analytics demonstrate CRON as a Buy. Based on 8 analysts polled in the last 3 months, 4 rate a Buy on Cronos stock while 3 maintain a Hold, and only one recommends a Sell. (See CRON’s price targets and analyst ratings on TipRanks)