In the course of a few months, Cresco Labs (CRLBF) (TSE:CL) has gone from obscure market player, not even listed on the CSE, to a leading cannabis company with the acquisition of Origin House (ORHOF). The company has the projected revenues to match the large Canadian companies, but the projected market valuation of a smaller stock fitting of its obscure standing.

No Longer Obscure

The multistate cannabis operator in the U.S. was listed on the CSE under the symbol “CL” back in December. Shortly after, Cresco Labs released Q3 results with revenues of $12.2 million, up 51% sequentially. The pro-forma numbers that include results of less than majority owned affiliates were up at $16.3 million.

Like a lot of companies in the industry, Cresco Labs was in the midst of substantial growth into new markets. The company has just recently entered both the Florida and Michigan markets and is doubling cultivation and production in key states like Illinois and Pennsylvania. To further that expansion, the MSO announced the merger with Origin House to suddenly create one of the most valuable cannabis companies in the North American industry.

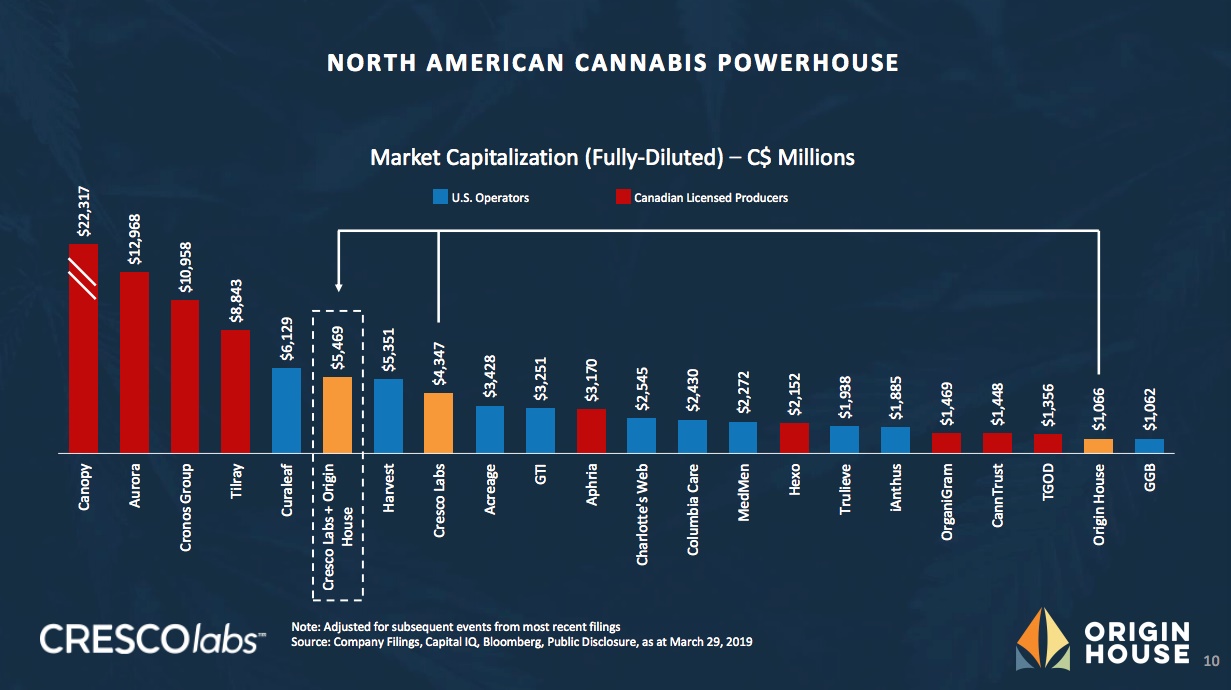

The deal values Origin House at C$1.1 billion based on an offering of C12.68 per share for the company that focuses on cannabis distribution throughout the large California market. According to internal estimates, the new Cresco Labs will have a fully diluted market valuation of ~C$5.5 billion (or ~$4.1 billion based on exchange rates).

Source: Cresco Labs/Origin House merger presentation

Origin House delivers over 50 cannabis brands to more than 500 dispensaries in California, a market estimated to reach cannabis sales of $7.7 billion by 2022 according to Arcview Market Research. The new company becomes a powerhouse in the U.S. market with operations in 11 states, 23 facilities, more than 1.5 million square feet of cultivation, and licenses to operate up to 51 retail dispensaries and sold in over 725 dispensaries in the U.S.

Impressive Size

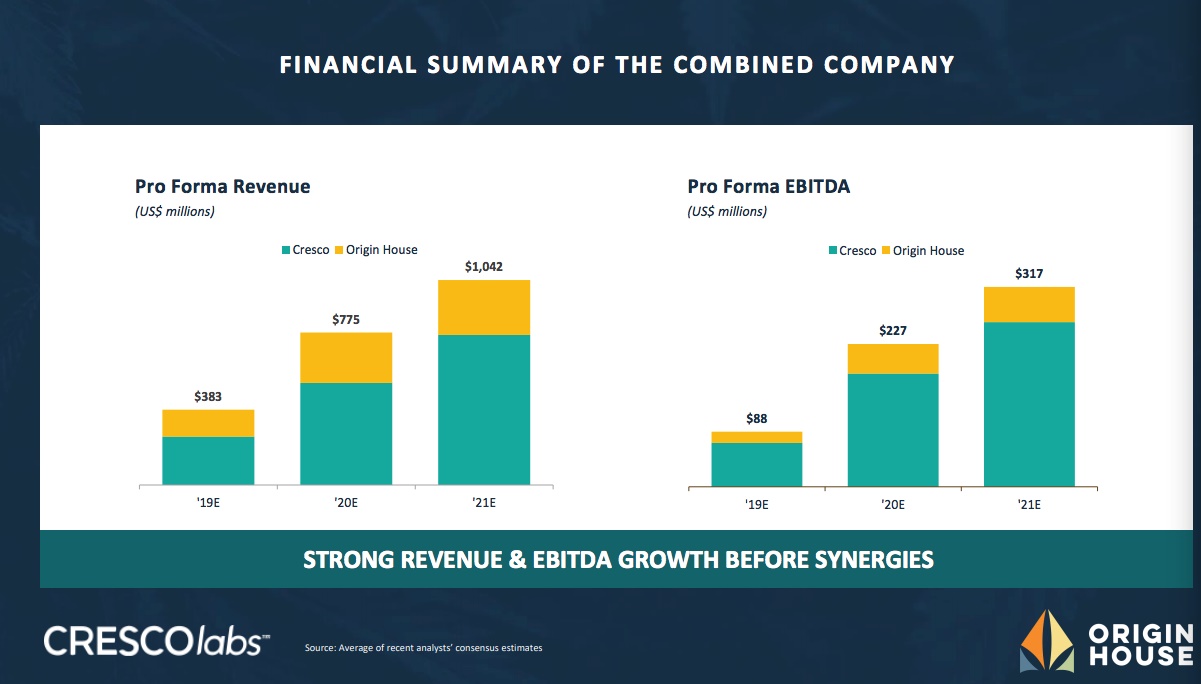

Despite being under the radar, Cresco Labs was already progressing towards a large business by 2020. The addition of Origin House pushes 2020 sales estimates up to $775 million and 2021 numbers top $1 billion. The EBITDA goal tops $200 million and $300 million, respectively.

Source: Cresco Labs/Origin House merger presentation

These revenue targets place Cresco Labs on pace to match the revenue goals of the largest Canadian industry leaders that have market valuations of 2-5x the level of this stock. The focus on domestic markets versus the global expansion plans of the Canadian companies should lead to higher margins for domestic players allowing for those 30% EBITDA targets.

Takeaway

The key investor takeaway is that Cresco Labs is a suddenly large domestic cannabis company without the massive stock valuation. Per revenue estimates of management, the stock only trades at ~4x ’21 revenue targets.

For anybody interested in the industry, Cresco Labs is the far better deal, but a lot of risk still exists in getting from quarterly revenues of $12 million to a target of $250 million per quarter in just two years. A lot still has to go right to reach these targets as the company enters new markets, expands cultivation and production while closing on the Origin House acquisition.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no position in CRLBF/CL. The information contained herein is for informational purposes only.