Charlotte’s Web (CWBHF) is one of the most recognizable brands in the cannabis sector anywhere in the world, and it has garnered a lot of positive press and attention from its focus on what is expected to be a fast-growing CBD market.

Even so, the company has taken a hit along with the rest of the cannabis sector over the last year.

In this article we’ll look at why it has slowed down in growth, and what to expect over the next couple of years.

Third quarter earnings

Charlotte’s Web generated revenue of $25.1 million in the third quarter, basically the same as the prior quarter. During the reporting period it also had gross profit of $17.9 million, with gross margin of 71.3 percent. Both of those numbers were slightly lower sequentially.

Consequently, it suffered a net loss of $1.3 million in the reporting period, down from the $2.2 million in net income from the second quarter.

With expectations high, primarily from the projections from Brightfield Group that CBD sales would soar to $22 billion in 2022, so far it looks like sales will struggle to reach that level in the overall CBD market.

It also doesn’t help that the FDA hasn’t been positive on the CBD market in general, as it has pointed out the fact that many claims about the healing properties of CBD haven’t been proven, and worse, it stated that it also could cause health issues such as liver damage from usage.

The lack of clarity on the regulatory side remains one of the major hurdles for U.S.-based cannabis companies, and with CBD probably being impacted the most by that lack of visibility, it could disproportionately have a negative effect on Charlotte’s Web.

One piece of good news on this front was the filing of a bill by some members of Congress that would change the Federal Food, Drug and Cosmetic Act to list CBD as one of a number of supplements that are allowable for sale to the market. Essentially, this is an end-run around the FDA, if it passes. That would be a positive catalyst for Charlotte’s Web.

Ramping up production

In 2018 the company started somewhat modestly on the production side, planting approximately 300 acres of hemp. It increased that to 862 acres in 2019, and is working on major expansion at this time.

Charlotte’s Web now operates from a 40,000 square-foot facility, but is constructing a new facility of 137,000 square feet. It is expected to take about two years to finish.

While it’s doing that, it has also managed to rapidly increase the number of retail stores it sells through from 3,680 as of the end of 2018, to a little under 10,000 stores today.

All of this will be great if the CBD market grows at the pace the market is looking for, but the big snag will be how the negative comments from the FDA will have on potential new customers.

The way to view it is there is going to be a customer base that will use CBD no matter what the FDA says, outside of some new extraordinary proof of a significant health threat. But even there is needs to be considered that many prescription drugs have harsh side effects as a result of usage. The question yet to be answered is how potential new customers will respond to the risk/reward part of consuming CBD. Uncertainty could keep a lot of people from trying CBD until more information comes out about its benefits versus the downside.

Since Charlotte’s Web is the market leader with CBD, any negative market conditions that result with lower sales will have more impact on its performance and investor sentiment toward the company.

Wall Street’s Verdict

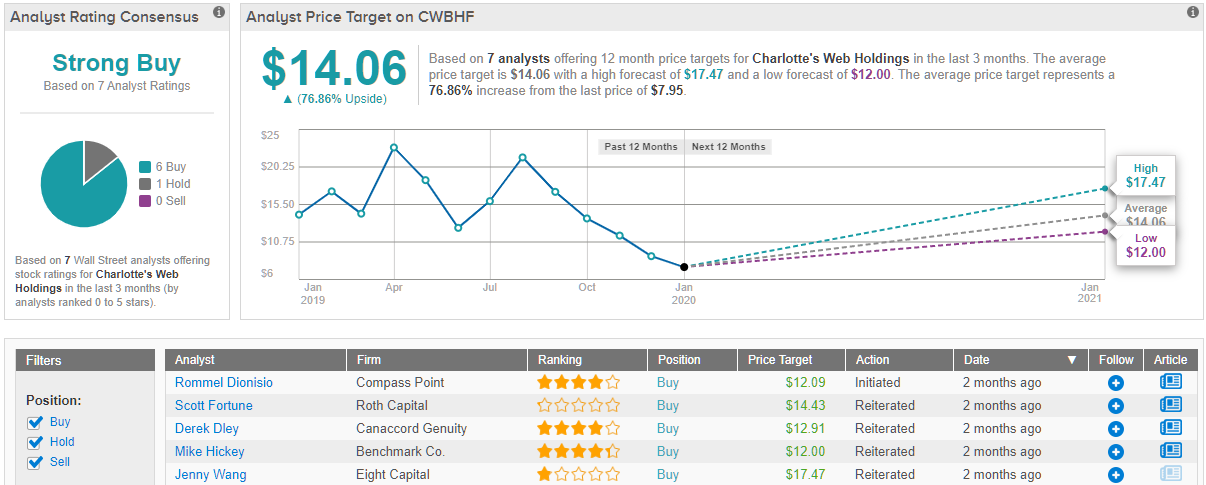

Wall Street has high hopes for Charlotte’s Web. As 6 “buy” ratings were assigned in the last three months compared to only 1 “hold,” the consensus is unanimous: ‘Strong Buy.’ To top it all off, its $14.06 average price target puts the potential twelve-month gain at a whopping 77%. (See Charlotte’s Web’s price targets and analyst ratings on TipRanks)

Conclusion

There is no doubt there is a lot of potential upside for Charlotte’s Web if CBD becomes the hit the market expects. I’ve mentioned for some time that Brightfield Group’s projected CBD sales of $22 billion in 2022 is probably too optimistic.

Taking into account the outlook by the FDA concerning CBD, it appears it could slow down the trajectory of growth for the segment until people feel okay with using it.

I think the best way to look at CBD is to view it in the same way the dietary and health supplement market is viewed. There has been a lot of pros and cons concerning that market over the years, yet many consumers still believe they have a lot of benefit for their health. I tend to think, over time, that’s likely to be the case with CBD as well, with the caveat people with some health issues may have to refrain from using it, such as those with liver disease or damage.

If the market does take off in the near future, Charlotte’s Web should be ready to meet market demand. I think it’s going to take longer to reach current expectations than many investors have thought in the recent past, but it’s also positioned to benefit the most once the CBD cannabis segment starts to take off

A negative would be when it finishes construction on the current facility, it has far too much product than the market can absorb at that time.

Either way, Charlottes Web, in my opinion, is going to take longer to achieve its full potential. But again, about the only thing I see being a strong headwind would be if some news comes out from the FDA that it has the potential to cause damage to the health of consumers in different ways.

For that reason, research is going to play a big part in the potential in the CBD market, and that too is going to take time to play out. Eventually I believe there will be positives and negatives coming out of research, but the positives will far outweigh the negatives in the years ahead, and Charlotte’s Web will be a big winner in the CBD market.

Patient investors will have to be patient with Charlotte’s Web to get the full potential inherent in its business model.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.