The best companies make tough moves in difficult times. With the CBD market struggling and the U.S. economy heading into a recession, Charlotte’s Web Holdings (CWBHF) made the aggressive move to snap up CBD competitor Abacus Health (ABAHF) for a fraction of their previous valuation. The move makes the new company a clear leader in the fractioned CBD space and a survivor when the economy and stock market rebounds.

Acquisition Details

CWH is paying 0.85 shares for each share of Abacus Health. The deal has the company issuing ~19.2 million shares for around 15% of the company.

The new entity had a December 31 cash balance of $90.4 million with combined Q3 sales of $29.1 million. Abacus Health distributes 50 SKUs through ~12,000 unique retail doors and 16,500 healthcare providers for a combined entity with access to 15,000 unique doors. The move helps eliminate competition in around 9,000 of those existing stores.

Abacus Health provides the company with more access to the topicals market and healthcare providers to expand their market reach in the promising CBD space. The new CWH has a 34.7% market share in the FDM market and 43.5% in the drug retail space.

The company promises the deal is accretive to adjusted EBITDA targets in 2020 and should help the new entity fend of increased competition in the market. The one benefit of the coronavirus shutdown of the economy is the likely elimination of weaker funder competitors in the sector.

Deep Value

Analyst estimates have the new entity generating $190 million in 2020 sales with $144 million coming from CWH and $46 million from Abacus Health. The new entity will have around 67 million shares outstanding for a market cap of ~$450 million.

The stock is very attractive here with an enterprise value of only $360 million and a current year revenue target of $190 million. The possibility exists for some revenue cuts with the weak economy and the tough competitive environment in the CBD space.

Any positive signals from the FDA actually removing restrictions from food and dietary products will lead to sales taking off. Analysts originally pegged combined 2020 sales at close to $400 million before the FDA muddled the regulatory environment for food and dietary products. The moves caused the mass retailers signed up by CWH to retract plans to offer a full range of CBD products until regulatory clarity returns.

The stock only trades at an EV of ~2.0x 2020 sales targets and less than 0.9x normalized sales targets, if the FDA ever eliminates regulatory scrutiny in the sector. The company had 75% gross margins and strong EBITDA margins before sales growth took a hit.

Takeaway

The key investor takeaway is that CWH becomes a powerhouse in the CBD market. The Abacus Health deal makes the company better positioned for the topicals market and the healthcare segment. Once the economy picks back up, the stock will rebound as CWH traded up above $6 for most of February. The company continues to build for the future similar to how strong companies operate in difficult times.

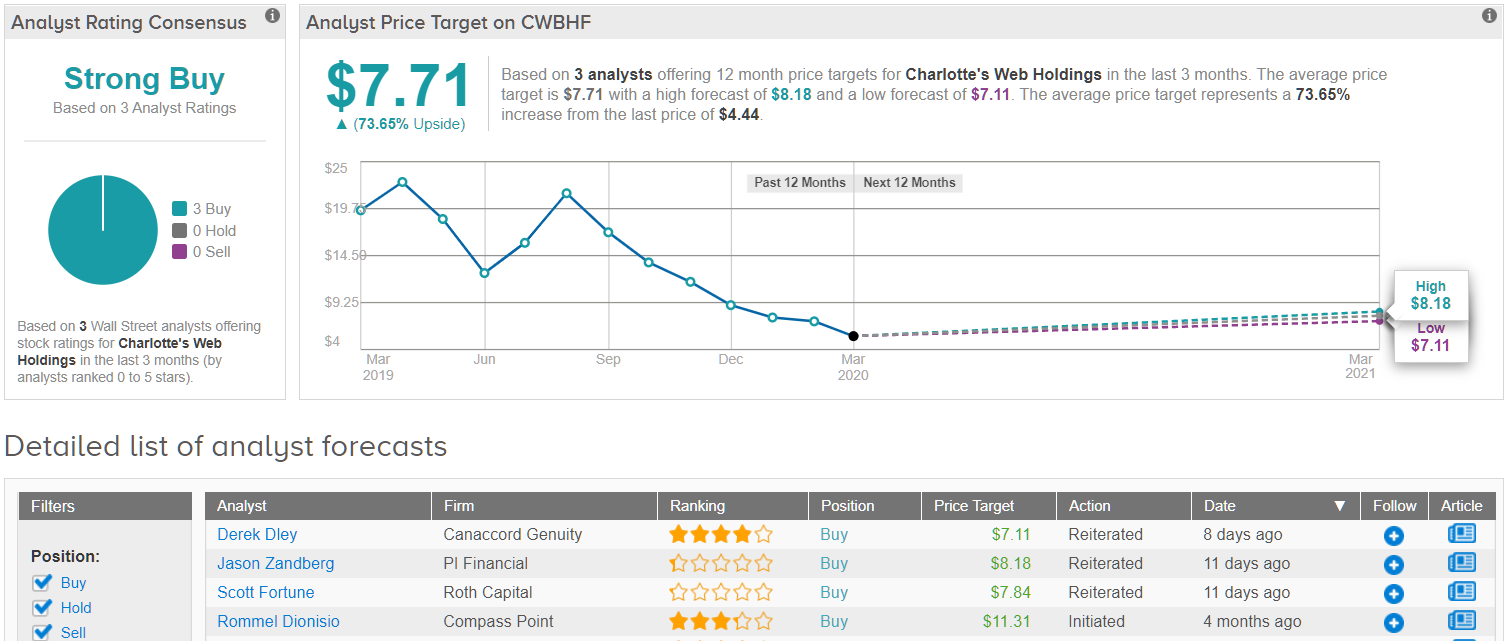

Judging from the consensus breakdown, it has been relatively quiet when it comes to analyst activity. Over the last three months, only 3 analysts have reviewed CWH. Both of which, however, were bullish, making the consensus a Strong Buy. On top of this, the $7.71 average price target puts the upside potential at nearly 74%. (See CWH stock analysis on TipRanks)