As the early numbers start flowing in for Cannabis 2.0 sales, analysts are starting to slash 2020 sales estimates for the category. Cannabis 2.0 refers to Canada’s legalization of cannabis products including vapes, edibles and beverages. Canopy Growth (CGC) was expected to be a leading player in this market launch, but the company still hasn’t been able to scale THC beverages, and the new CEO just took over a couple of weeks ago. The new CEO must now reorganize the business when announcing December results in early February to turn around the never-ending cash burn.

Cannabis 2.0 Failure

The Canadian cannabis market has seen major weakness since the legalization of recreational cannabis back in October 2018. The failures have been a combination of restrictive government regulations as well as the lack of products available in the right categories and price points.

The initial Cannabis 2.0 product rollout has followed the same path of recreational cannabis. Governments in Alberta and Quebec have banned vape sales and Ontario still lacks the retail stores necessary to attract consumers.

On top of these regulatory issues, Canopy Growth announced on December 17 that the company wasn’t able to scale cannabis-infused beverages. Investors already had concerns about the weak beverage sales in the U.S. market, but hoped the backing of Constellation Brands (STZ) would be the key ingredient to conquer the Canadian market.

Combined with questions related to edible product pricing, analysts such as Douglas Miehm from RBC Capital Markets and John Chu of Desjardins Securities have severely cut revenue estimates for the year. Miehm now forecasts 2020 revenues of only $250 million, while Chu is slightly more bullish at $300 million.

Miehm forecasts vape sales of close to $4.0 million, with cannabis-infused edibles and drinks at $8.0 million. The major problem, according to RBC, is that consumers prefer prices for edibles and vapes that are far below the initial prices found in B.C. and Ontario where both products are legal.

No Margin Help

The major appeal of selling Cannabis 2.0 products was the higher margin opportunity. The companies with major greenhouse capacity could grow cannabis for $1 per gram and sell CPG products for multiples of the commodity’s cost.

Well, the forecasted sales levels will only leave a company like Canopy Growth with a sales boost of $5 to $10 million per quarter. With the beverage facility not scaling and the weak sales in general, one has to wonder if the 2.0 products are a margin drag rather than a profit boost.

For FQ2, the company reported adjusted operating expenses of C$160 million. One has to foresee this number growing with the launch of 2.0 products in Canada and CBD in the U.S. Even ignoring the weak September quarter due to product returns, Canopy Growth should have a difficult time recovering from the C$92 million EBITDA loss from June.

The new CEO has to rationalize expenses and potentially exit certain markets. Both moves could lead to lower revenues and impact investor sentiment.

Consensus Verdict

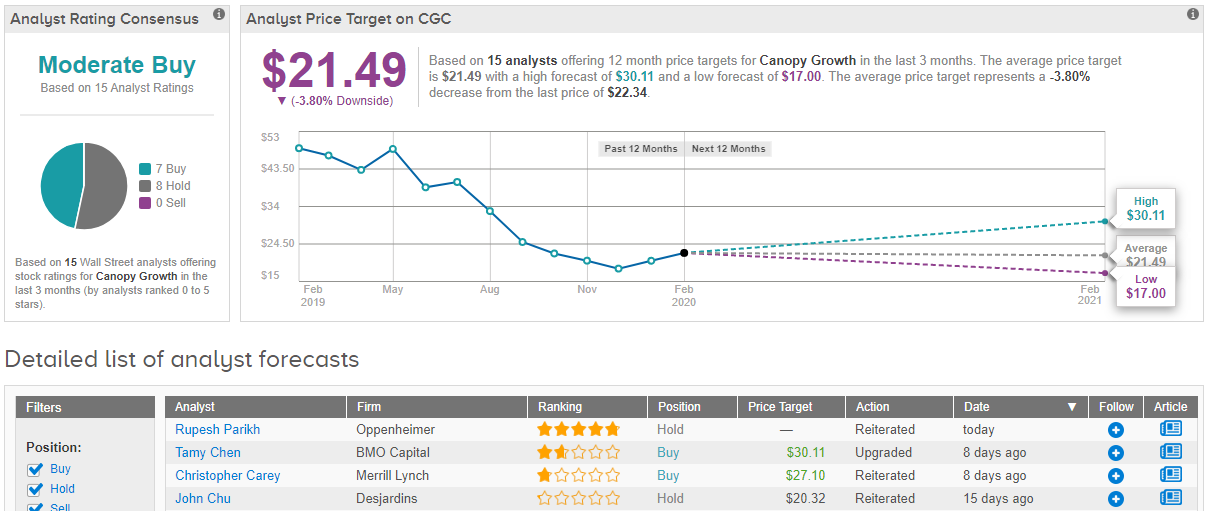

Turning now to the rest of the Street, it’s a mixed bag when it comes to takes on this cannabis stock. 7 Buys and 8 Holds assigned in the last three months add up to a Moderate Buy consensus rating. At $21.49, the average price target puts the potential downside at 4%. (See Canopy Growth price targets and analyst ratings on TipRanks)

Takeaway

The key investor takeaway is that Canopy Growth keeps running into hurdles in terms of meeting financial targets. The stock is far too expensive with a valuation of over $8 billion, while revenue estimates for FY21 ending March are slipping below $500 million. The company has yet to exit a major spend mode, which is the first step to rationalize given the current weak market.

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.