Aurora Cannabis (ACB) seems to be a very well-rounded stock with a bright future ahead. Calling it “well-positioned from a brand, distribution and international perspective,” you could say Laurentian Bank’s John Chu is a bull. The analyst anticipates ACB to have the potential to be a leader in the medical, wellness, nutraceutical and non-prescription drug markets and as a result initiates coverage for the stock with a Buy rating and a price target of $8.50, showing a potential of nearly 20% upside. (To watch Chu’s track record, click here)

In 2017 the company walked away with 16 awards from the 2017 Canadian Cannabis Awards and took the gold for Indica flower, Top High CBD and THC Flower. The analyst weighs in, explaining that being an award-winning brand sets Aurora apart from other cannabis companies of the like. “While this helps establish a brand early on, we believe the company needs to demonstrate success in value-added products over the long-term in order to be successful in building a stronger brand.”

“Two transformational acquisitions involving leaders on the medical side (CanniMed in May/18 and MedReleaf in July/18) put the company in a market leader position. We also believe the patient and market data intelligence that comes with these companies should prove to be invaluable, particularly as it relates to the wellness, nutraceutical and medical/non-prescription drug arenas going forward,” the analyst explains.

Chu is also encouraged by Aurora’s supply agreements with Shoppers Drug Mart and Pharmasave as well as having a strategic investment in former liquor store retail giant Alcanna, which will add to ACB’s expansion strategy. The company already has nine provincial supply agreements.

Moving to the international stage — Aurora has one of the widest reaches when it comes to the global market of major LPs: “We believe direct exposure (vs. simply exporting and/or employing a hub model) is the best approach to penetrate the international market at this time. Given the international market opportunity is strictly on the medical side, for now, we anticipate Aurora can leverage its CanniMed, MedReleaf, and Pedanios acquisitions to better penetrate the international markets compared to peers,” the analyst concludes.

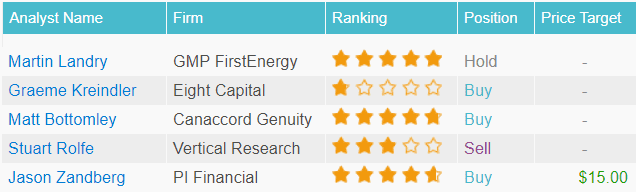

Other analysts are betting on this rising star company as well. According to TipRanks, out of six analysts including Chu, four are bullish, one is sidelined and one is bearish. (See ACB’s price targets and analyst ratings on TipRanks)