What’s going on with Aurora Cannabis (ACB)? The second largest cannabis company by market cap is dealing with a wild combination of headwinds and tailwinds, from the current supply crunch in the Canadian recreational market to anticipated high production ramping up in the next 18 months.

And to add a another twist to the company’s story, Aurora has just concluded an agreement with a lenders’ syndicate led by Bank of Montreal to increase its available credit by C$160 million. The new credit facility, a combination of short-term loans and revolving credit, will increase Aurora’s credit access to C$360 million and is set to mature in two years.

CFO Glen Ibbott said that the credit increase recognizes Aurora’s position as the industry leader in production, and adds, “Access to this non-dilutive capital is a core funding source the Company intends to utilize as it further executes on its strategic growth initiatives.

Conflicting Market Forces at Work

Aurora is contending with a variety of contradictory market forces, putting opposite price pressures on the stock. On the negative side, Canada is facing a serious supply crunch in the adult recreational marijuana market, as Health Canada tries to work through the backlog of dispensary license applications. At first glance, Aurora may seem immune to supply-side problems, as the company produces 150,000 kilograms annually and plans to increase that production to more than 600,000 kilos by the end of next year. Such a fast ramp-up in supply, however, will put a sharp downward pressure on prices, and consequently on future earnings.

On the positive side, Aurora has plenty of other potential markets for its product and does not have to depend solely on the Canadian market. The company has built a presence in the German cannabis market and is expanding into Latin America. Between European and South American operations, Aurora has access to nearly a billion potential customers. That will go far toward relieving price pressures and overstock when the company’s production reaches full capacity.

Finally, and also on the positive side, Aurora’s product markets with a high gross margin, on the order of 50%. Along with the company’s $150 million cash-on-hand, this puts Aurora in a strong position to deal with market headwinds.

Top Analysts React to the Market Forces

From the sidelines, 4-star BMO analyst Tamy Chen says, “We raised our rec average selling price, incorporated revenues from wholesaling to other producers and modestly raised international sales… We have lowered our target price to $11 (from $12), which is based on a projected enterprise value that is 17x (from 20x) our calendarized 2020 sales estimate.”

Chen rates ACB as a Hold, but it’s worth pointing out that her new target price, $11, suggests an upside of 92% from the current share price. (To watch Chen’s track record, click here)

The bulls, on the other hand, see ACB ready for something special. Cowen’s Vivien Azer and 5-star analyst and expert on the legal cannabis industry, sums up Aurora’s situation: “We believe that as one of the largest manufacturers, ACB is well positioned to benefit from the growing medical and adult use cannabis industry in Canada… With the largest physical presence outside of Canada among the LPs, ACB is also well positioned to capture share in the $31 bn international medical market. Further, efficiencies from its large-scale production network and near-term operating leverage will allow ACB to be among the first Canadian cannabis companies to reach profitability.”

Azer gives her bottom line with admirable clarity: “ACB remains our ‘Top Pick’ in cannabis.” Her price target on the stock, $15, implies an upside of 160%. (To watch Azer’s track record, click here)

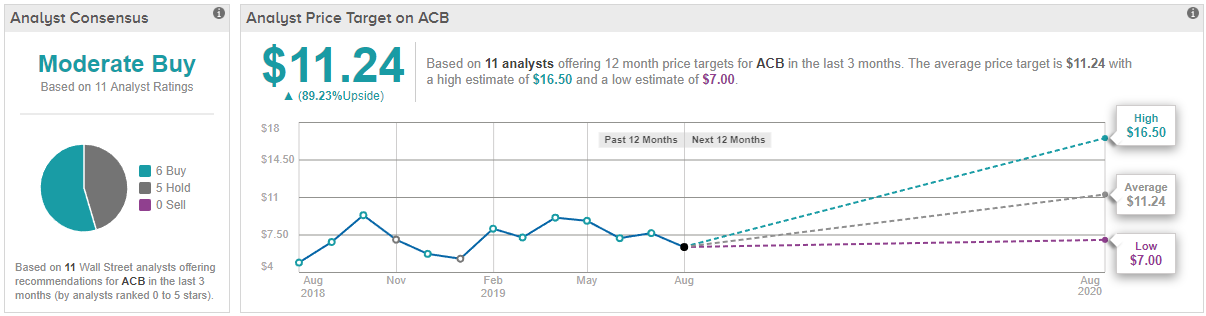

Overall, Aurora’s ratings reflect the conflicted market forces. The stock gets a Moderate Buy from the analyst consensus, based on 6 buys and 5 holds set in the past three months. The average price target of $11.24 suggests an upside of 96% from the current share price of $5.72.