Zenabis Global (ZBISF) remains one of the biggest under the radar stocks in the cannabis sector. Despite having massive ambitions and capacity growth lined up, the stock still trades at $1.20 with a meager market cap providing the great opportunity.

Big Q1

For Q1, Zenabis reported net revenues that jumped to C$11.6 million with C$4.1 million from cannabis that only started harvests last October at a minimal 237 kg. The company just completed an RTO back in January, so the market naturally doesn’t know much about the cannabis company that is the combination of Bevo Argo and Sun Pharm Investments.

Due to substantial growth, Zenabis is guiding to Q2 revenues reaching C$26 to C$30 million. In the matter of months, the company is going to reach substantial revenues via both the historical vegetable propagation business and up to C$12 million from the cannabis business for sequential growth of 200%.

Since the start, Zenabis has seen cannabis production vastly exceed cultivation forecasts and designs. The May harvests exceeded design capacity by an incredible 28% as signs exist that the farming expertise from Bevo Argo is paying off in ramping up the cannabis business.

Toronto Stock Exchange

Due to the rapid corporate development, the listing on the TSX was expected to offer a major catalyst for the stock. The company graduated to the TSX effective May 27 suggesting the only exchange catalyst would occur on a move to the NYSE or Nasdaq.

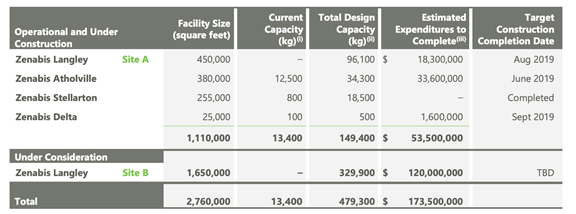

Either way, an American investor should have more faith in the credibility of the new company based on the ability of the cannabis company to graduate to a major stock exchange. The credibility of a major stock exchange reinforces the ability of Zenabis to reach the stated goal of producing up to 479,000 kg of cannabis.

(Source: Zenabis Global)

Cannabis production approaching 500,000 kg would quickly place Zenabis into a top 5 global producer and rival an industry giant like Canopy Growth (CGC). Not to mention, the company continues to exceed design capacities by a substantial amount such that the 479,000 kg goal could reach 600,000 kg of actual production.

Zenabis is quickly moving towards having the facilities completed for design capacity of ~150,000 kgs. The company will need to raise additional funds for the Langley Site B facility to add the additional 323,000 kg that will cost C$120 million.

In addition, two other facilities exist that are used for vegetable propagation and a floral business that could be converted to cannabis or hemp production at a future date. The company plans to grow industrial hemp on these facilities on surplus land and in the greenhouses off-cycle from other crops.

Takeaway

The key investor takeaway is that Zenabis Global is a major cannabis player in the making still relatively unknown. The company has major catalysts ahead including the graduation to a major U.S. stock exchange and the license approval of several new facilities coming online that will make the company a major cannabis producer on top of an existing business still generating ~C$17 million in Q2 revenues.

Investors get all this potential for a meager market valuation of about $250 million. As the market catches onto the growth story here, Zenabis is likely to gather steam and the recent graduation to the TSX and the projections that Q2 revenues reach C$28 million should provide enough details for the market to shortly catch on to the bargain story here.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: No position