Canopy Growth (CGC) has recently enjoyed the rebound in the cannabis market, as sentiment, at least temporarily, has grown more optimistic for the overall sector.

In this article we’ll look at why the company has a good chance of under performing in the infused beverage market, and what that could mean over the long term for Canopy Growth. We’ll also look at the positive impact an increase in same-store sales could have on the company going forward.

Product returns

One of the major concerns I have for Canopy Growth is its inability to accurately identify demand trends, which in the last quarter came back to bite them, as it had product returns of just under $27 million, much of that coming from a lack of demand for its oil products.

I don’t think that’s only from misreading demand, but from misreading the trend itself. It remains to be seen if oils will be the positive catalyst some following the industry, and some in the industry itself, have believed it would be. Canopy Growth was definitely wrong in its assumptions concerning demand for oils.

As a result of primarily excessive inventory, the company noted in its latest earnings report that it had identified $15.9 million in product inventory that exceeded demand, or had become obsolete.

The key issue here to me is that the company was not only overly optimistic concerning oils in particular, but may have went after the wrong market segment altogether.

I draw that conclusion from the fact that its major competitor Aurora Cannabis had stated in the past it wasn’t convinced oils were going to be as popular as some companies believed.

Infused beverages

As this relates to infused beverages, I’m concerned the same thing could happen. So far, much of the outlook for infused beverages is related to theory rather than reality.

Obviously, with large brewers like Constellation Brands (STZ) and other industries looking at the cannabis sector for growth opportunities, the assumption is they will be able to generate significant sales in the infused beverages segment. The level of demand for infused beverages has yet to be proven.

If it doesn’t meet expectations in any significant way, Canopy Growth could face some strong headwinds beyond what they already do. Why this would have a major negative impact on the company is because the market is looking for its partnership with Constellation Brands and infused beverages to drive a lot of future growth.

Some good news

One positive thing Canopy Growth has going for it is its same-store sales performance. Last quarter same-store sales from retail outlets it owned were up 17 percent in gross revenue. When including new store openings, that number jumped to 24 percent.

This is important because Ontario is going to start opening up approximately 20 stores a quarter, starting in April 2020. If it is able to perform well in those stores, it could go a long way toward consistent growth. The significance of that is it’s doing it without the sales of derivatives.

If the company is able to figure out derivatives, it could add nicely to the top and bottom lines. So far the company hasn’t shown it can project demand in specific segments with accuracy, so it remains to be seen if it can improve in that area in the months and years ahead.

Consensus Verdict

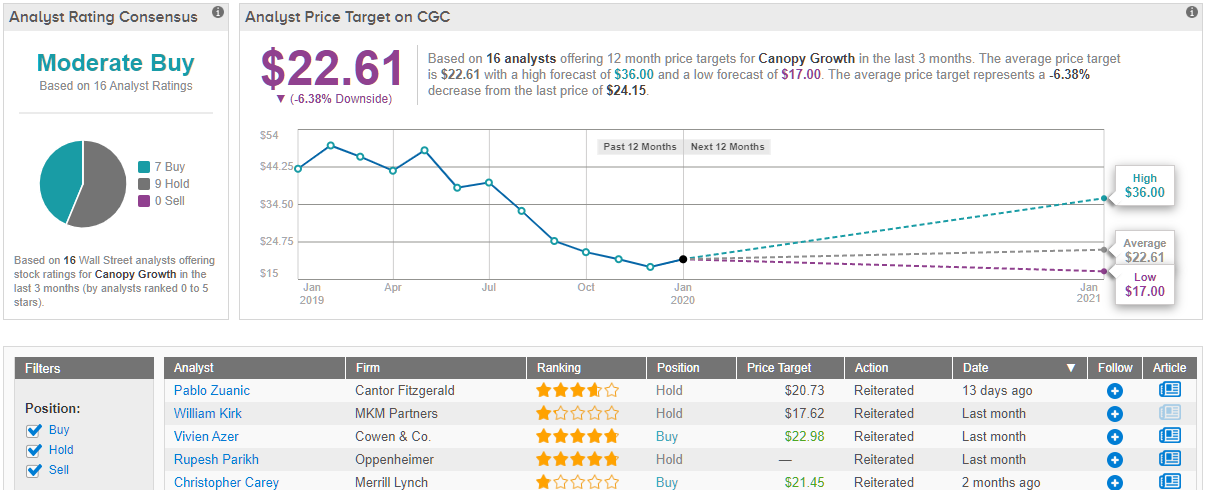

Wall Street is unsure Canopy Growth is worth the gamble, with 7 out of 16 analysts in the last 3 months rating a Buy on the stock, and the majority maintaining a Hold. With a downside potential of nearly 6%, the stock’s consensus target price stands at $22.61. (See Canopy Growth stock analysis on TipRanks)

Conclusion

Since Canopy Growth received the $4 billion cash infusion from Constellation Brands, it has been touted by many as the cream of the crop in the cannabis sector. For some time I’ve been one of the few that have went against the grain with that conclusion, for the reasons of its poor track record of identifying legitimate trends in the industry, along with providing the right products to meet what demand is there.

From what I’ve seen so far, the infused beverage market could be a negative catalyst for Canopy Growth. That has in part been confirmed by the recent decision of the company to push back the release of infused beverages. I think that’s not necessarily a bad decision, because it needs to get this right.

If it were to bottle up a lot of products that once again have to be returned, it would underscore the fact it has difficulty in accurately identifying demand in certain segments, which if isn’t able to break out of that weakness, it would crush the share price of the company, even with over $2 billion in cash remaining from Constellation’s investment in Canopy.

If Canopy can’t overcome these things, its bottom line will take further hits, and questions on the sustainability of any meaningful growth trajectory would increase.

I, for one, am not convinced it will be able to do so. If it fails with infused beverages, there’s not a lot of tailwinds left to drive it. On the other hand, if it does succeed at some level with infused beverages, the combination of the increase in stores in Ontario, and secondarily, in Quebec, could be enough in the way of catalysts to help the company turn around.

To find good ideas for cannabis stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.