Like the majority of cannabis stocks, Canopy Growth (CGC) has taken a big hit in 2019, as sentiment in the industry continues to weaken, and being based in Canada, has the additional headwind associated with the slow rollout of retail outlets.

Add to that its heavy exposure to Canadian recreational pot, the lack of a permanent CEO, and less than robust growth prospects at this time, and it’s clear that Canopy, once considered the standard of the cannabis sector, will struggle to break out of its downward spiral, and at least in the short term, is unlikely to have any meaningful increase in its share price; the catalysts simply aren’t there.

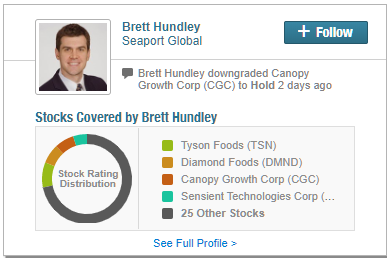

Sentiment from analysts has also started to turn, with the latest downgrade coming from Seaport Global analyst Brett Hundley, who downgraded the stock from Buy to Neutral. (To watch Hundley’s track record, click here)

Unsurprisingly, investor sentiment is also very negative, with individual portfolios in the TipRanks database showing a net pullback from CGC.

Exposure to Recreational Pot

In the past Canopy Growth management has clearly stated it’s primarily a recreational pot company. That has strengths and weaknesses inherent in that business model. The primary strength is the potential for rapid revenue growth, and the major weakness is recreational pot generates lower margins, which requires more sales to boost earnings.

As for the weakness related directly to the Canadian recreational market, the low number of retail outlets to sell through has hindered Canopy Growth and others based in Canada.

It would seem that the lack of retail stores would give cannabis prices a boost because of the lack of supply as measured against demand, but because Canada is transitioning from a black market to a legal market, there is still a strong cannabis black market that is able to fill in the lack of supply because of the low number of legal outlets. That means that the usual response to under supply isn’t in play, and rather than prices climbing and margins widening, the opposite is happening.

Until more retail outlets are operational and the black market influence is reduced, Canopy Growth will continue to struggle in regard to recreational pot.

The CEO Situation

I’ve been saying for some time that it’s better for Canopy Growth to hire a permenant CEO sooner rather than later, but that isn’t how it’s being played out.

While understanding the need to get the right person in place, the company will remain under pressure until the new CEO is hired and investors get a visible look at where the direction of the company is headed.

That’s important because at the time of the firing of Bruce Linton, Constellation Brands was very clear that the major reason was because it felt it needed new type of leadership for the next growth cycle of the company.

Presumably a permanent CEO will provide clarity in that regard, and investors will understand what the growth strategy in the near and long term is going to be. Until that time, a cloud will remain hanging over the company.

Finally in relationship to a new CEO, Constellation Brands is almost certainly not going to exercise any of its stock warrants to provide additional funding to Canopy Growth until that person is put in place.

As Hundley asserted, the inclusion of “this added cash assumption had been a core tenet of our Buy rating under our valuation analysis.”

With Constellation Brands under fire from its own shareholders concerning the position it took in Canopy Growth, it’s highly unlikely it’ll expose itself to further pressure until it puts in a CEO, and even under that scenario, I think it’ll be slow to provide more funding.

Conclusion

The growth prospects for Canopy Growth look anemic in the short term, and even further out it has significant headwinds it must overcome in order to return to sustainable growth.

For now, the risk connected to Canopy Growth doesn’t offer enough reward to justify taking a position in the company. Even though it has sold off in a big way, the upside simply isn’t there yet.

With its heavy exposure to Canadian recreational pot, lack of a permanent CEO, along with the slow licensing process related to Canadian retail stores, it’s going to take some time for Canopy Growth to right itself and start to realize its full potential.

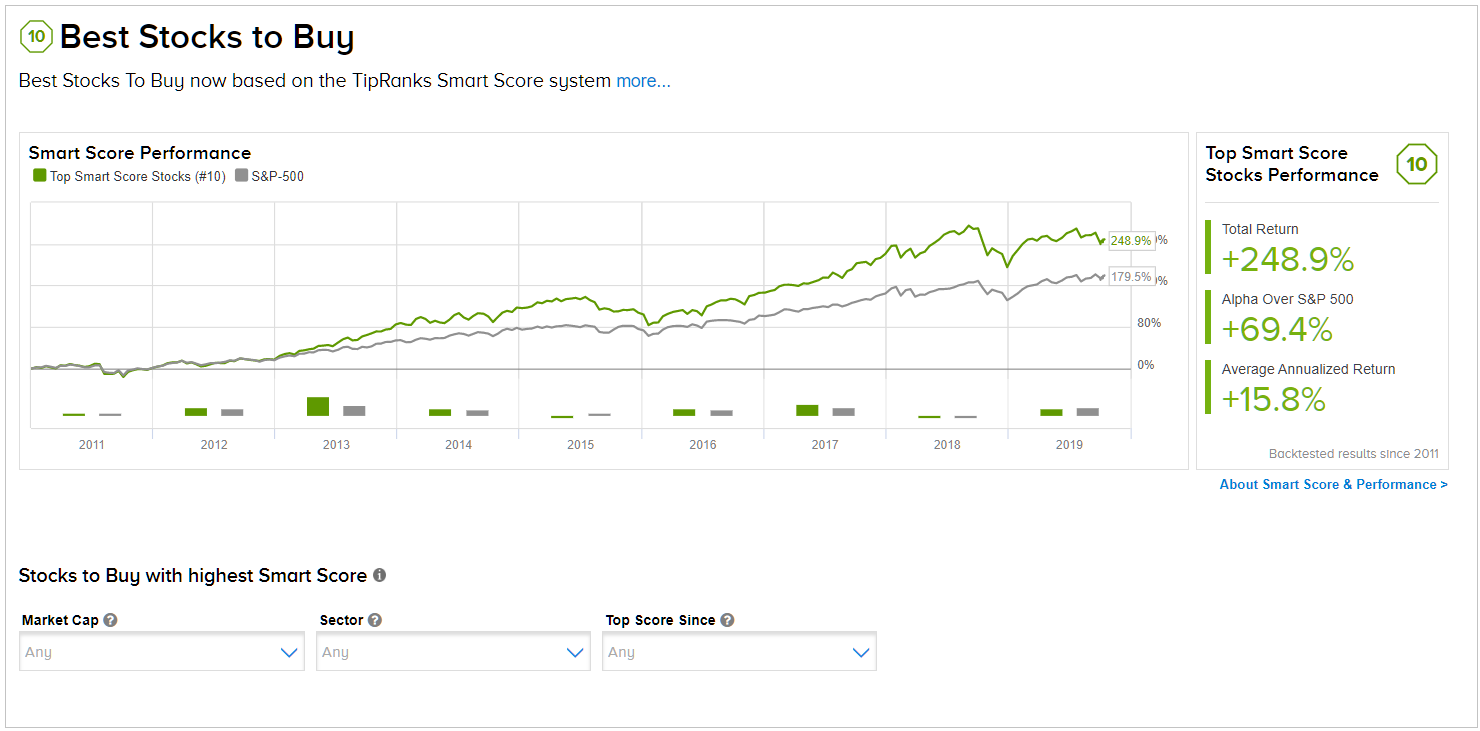

To find good ideas for cannabis stocks trading at better value, visit TipRanks’ Best Stocks to Buy, a newly launched feature that unites all of TipRanks’ equity insights.