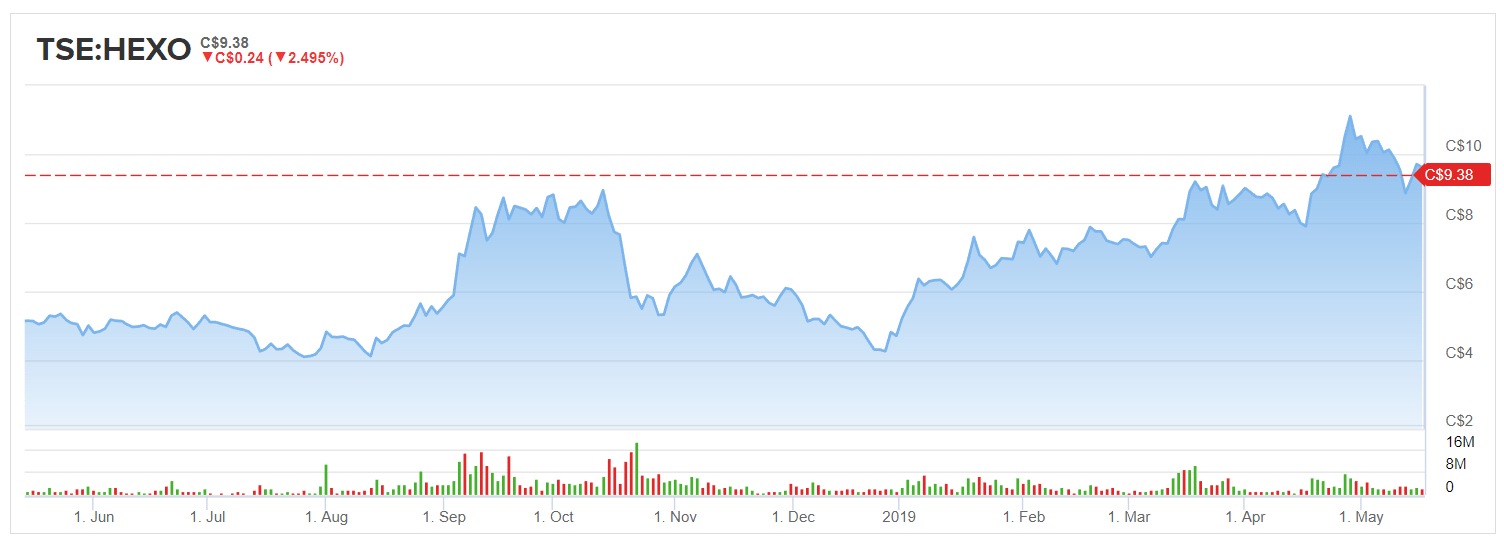

With many cannabis companies now having reported earnings from the first full quarter of sales following the legalization of recreational cannabis in Canada, a reconsideration of the best names to be holding is prudent. Among the mid-sized names we can find some interesting companies that appear to be punching above their weight in terms of revenues, guidance and market share. HEXO Corp (HEXO) is one such name which is still worth consideration even with the stock up about 100% year-to-date (on the Toronto exchange).

Solid revenues and revenue growth ahead

With earnings for the quarter ending January 31, 2019, HEXO impressed the market by reporting C$16.2M in gross revenues (C$13.4M in net revenues) up from C$6.7M (C$5.7M in net revenues) in the prior quarter. However, it should be noted the prior quarter included only two weeks of sales from the post-legalization period, although the increase quarter-over-quarter at least confirms HEXO is not a one-trick pony. HEXO envisages greatly increased revenues in its future with the announcement of the Newstrike Brands Ltd acquisition coming with a net revenue target of C$400M for FY2020. That being said, C$400M is an aggressive target in such a short time frame and the reaction of the stock suggests the market has not yet priced this in, perhaps being skeptical of these claims. In any case, HEXO seems to be making the right moves to ensure revenue growth (HEXO and Newstrike, combined, have distribution agreements in eight provinces, including the five provinces with the highest retail sales of cannabis).

Proven management

One factor that should increase confidence that HEXO can achieve revenue guidance is the competent management team steering the ship. Recent examples of management delivering on promises include the completion of the expansion of the Gatineau facility to one million square feet (which was completed within a year of announcement of the planned expansion). March 2019 saw the first harvest at the facility, which has an expected annual capacity of 108,000 kg of dried flower.

Additionally, HEXO’s management team got the deal done on a joint venture with Molson Coors Brewing (TAP) which aims to develop and market cannabis-infused beverages in Canada. Other producers which have attracted interest from a beverage maker have generally been much larger, such as Canopy Growth Corporation, which received an investment from Constellation Brands, or Tilray which has partnered with AB InBev. Much like with its revenues, HEXO again punched above its weight in landing such a deal. The hype around these beverage deals including the HEXO-TAP joint venture has subsided slightly in recent months, but the deal may come back into focus when cannabis-infused beverages become legal in Canada, an event anticipated by October 17, 2019.

Wrapping up

HEXO has kept up with the big players in the pot stock space, inking high impact deals and reporting encouraging revenues. Even with its stock having jumped almost 100% since the beginning of the year, HEXO has more room to run higher. The combination of an effective management team and potential revenue growth make HEXO a name worth considering for those keen on getting exposure to the pot stock space.

To read more on the nitty gritty of what’s going on in the rising cannabis industry, click here.

Disclosure: The author has no positions in HEXO stock.

Read more on HEXO: